Weekly global protein digest—June 24, 2021

Market analyst Jim Wyckoff shares news and information from US and around the globe.U.S. pork export sales slip a bit, but beef sales up in latest week

USDA Thursday reported U.S. pork net sales of 28,600 MT for 2021 were down 2 percent from the previous week and 4 percent from the prior 4-week average. Increases were primarily for Mexico (11,500 MT, including decreases of 900 MT), Canada (5,200 MT, including decreases of 400 MT), Japan (3,200 MT, including decreases of 500 MT), China (2,000 MT, including decreases of 800 MT), and South Korea (1,800 MT, including decreases of 500 MT). Exports of 33,600 MT were down 12 percent from the previous week and 10 percent from the prior 4-week average. The destinations were primarily to Mexico (15,700 MT), China (7,400 MT), Japan (3,700 MT), South Korea (1,700 MT), and Canada (1,500 MT).

U.S. beef net sales of 16,900 MT reported for 2021 were up 31 percent from the previous week, but down 3 percent from the prior 4-week average. Increases primarily for South Korea (6,700 MT, including decreases of 400 MT), Japan (4,000 MT, including decreases of 500 MT), China (1,600 MT, including decreases of 100 MT), Taiwan (1,400 MT, including decreases of 200 MT), and Hong Kong (900 MT, including decreases 100 MT), were offset by reductions for the Philippines (100 MT). For 2022, total net sales of 400 MT were for Japan. Exports of 18,200 MT were up 2 percent from the previous week and 3 percent from the prior 4-week average. The destinations were primarily to Japan (4,700 MT), South Korea (4,700 MT), China (4,100 MT), Mexico (1,100 MT), and Taiwan (1,100 MT).

Argentina to restricted beef exports

Argentina has announced it will cap beef exports at half of last year’s average level through August, an effort to curb domestic food inflation. In a joint statement, the Rural Societies of Tucuman and Salta provinces said the new policy will hurt production and the discourse regarding the measure “is loaded with lies.”

Argentina is the world’s fifth largest beef exporter and a key supplier to China. The country completely banned beef exports mid-May, prompting farmers to respond with sales strikes of their own. In announcing the new restrictions, the Argentine government said its medium-term objective is to increase meat production from 3.2 million metric tons (MMT) currently to 5.0 MMT each year, but it offered no details on how it planned to do so.

Consumer group sues Smithfield Foods for misleading consumers during pandemic

Consumer group Food & Water Watch filed suit against Smithfield Foods, charging the company with “fearmongering” about a meat shortage during the Covid-19 pandemic and misrepresenting worker safety measures. The group took issue with Smithfield stating that the country was “perilously close to the edge in terms of our meat supply” while the company’s meat exports were rising.

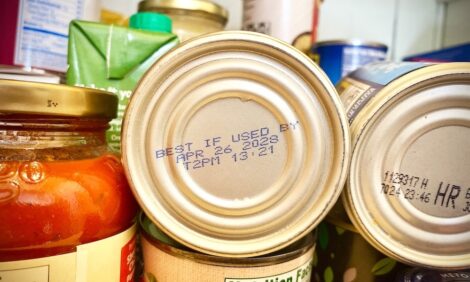

“Government data further refute Smithfield’s doom-and-gloom warnings, showing that pork inventory held in cold storage warehouses was well into the hundreds of millions of pounds, which analysts have estimated could have kept grocery stores stocked with pork for months, even absent any additional production,” the suit stated.

The group said that Smithfield’s warnings on supply prompted consumers to stock up on meat. Smithfield said the allegations of price manipulation are “wrong,” and it stressed its worker safety measures were comprehensive and guided by medical and worker safety experts.

US meatpacking industry faces stricter oversight

The Wall Street Journal reported new rules and legislation would revamp markets for livestock and poultry. USDA is crafting new rules that would change how companies pay chicken farmers, while making it easier for farmers to pursue disputes against meatpackers, the agency said this month.

On Capitol Hill, Republican and Democratic lawmakers have proposed legislation that would require beef processors to buy more cattle on open markets and set minimum regional prices. Senators this month rolled out a separate bill that would appoint a special investigator to enforce meatpacking regulations and probe potential anticompetitive conduct.

The Senate Agriculture Committee will hold a hearing Wednesday to examine meatpackers’ cattle purchasing—and how that affects livestock markets and burger prices for consumers. Witnesses at tomorrow’s hearings:

Andy Green, USDA’s senior adviser for fair and competitive markets, said some of farmers’ troubles stem from a handful of companies controlling the bulk of U.S. meat processing. “America’s food industry has a monopoly problem,” said Green, a former senior fellow for economic policy at the think tank Center for American Progress who joined USDA earlier this year. “There’s a lot that we want to do to bring competition back to the market.”

The North American Meat Institute, which represents meat companies, is pushing back against tighter regulations for the industry. Mark Dopp, the group’s head of regulatory affairs, said USDA’s planned rules would narrow farmers’ options to sell livestock, enable frivolous lawsuits and potentially boost supermarket prices for burgers and chicken breasts. USDA under the Obama administration proposed similar rules that were later blocked by Congress and court challenges, he said: “They were a bad idea then, and they’re still a bad idea.”

The big four beef processors’ share of the cattle market has held roughly steady for 25 years, according to data compiled by the meat institute, while some cattle producers were earning record profits as recently as 2014. Recent low prices for cattle ranchers showed fundamental market forces at work, Dopp said, as the disruptions that closed meat plants left a greater supply of cattle on the market, pushing down livestock prices.

USDA recently announced grants and loans to support new and smaller meat-processing plants as part of a $4 billion program to strengthen the U.S. food system. Calls for the government to make the food system more resilient by ensuring there is more packing capacity “ignore important considerations,” Dopp said. “First, in the hog industry more capacity has been added over the last several years in response to market forces. Significant harvest facilities have been opened in the last few years in Michigan, Missouri, and Iowa, with smaller plants also opening -- before the pandemic and in response to market forces. And just last week Wholestone Farms announced plans to build a packing facility in South Dakota.5 In cattle, a plant recently opened, and expansions and new facilities have been announced, all in response to market forces.”

Organic Trade Association wants to return to Obama-era organic livestock, poultry rules

The Organic Trade Association is asking the US District Court for the District of Columbia to immediately vacate the USDA withdrawal of the Organic Livestock and Poultry Practices (OLPP) final rule and order USDA to reinstate the regs put in place near the end of the Obama administration.

“Organic egg farmers who are doing the right thing to give their poultry real outdoor access and raise their animals according to the highest standards are continuing to be exposed to economic harm from unfair competition every day that the Trump administration’s rescission of the organic animal welfare rule is allowed to stay in place,” said Laura Batcha, CEO and Executive Director of the Organic Trade Association.

The group said that while they welcome assurances from USDA Secretary Tom Vilsack they are re-evaluating the situation, “the policy statement alone won’t guarantee a swift end to this harm,” Batcha said. The motion filed June 18 argues USDA dismissed congressional intent and failed to follow the Administrative Procedures Act and buried economic benefits from OLPP and inflated costs associated with the rule. The also argued that USDA based its action on flawed economic analysis.

USDA announces meat inspection grant program

USDA announced that $55.2 million in competitive grant funding is being made available through the new Meat and Poultry Inspection Readiness Grant (MPIRG) program. The effort uses funds set aside under the Fiscal Year 2021 omnibus spending and Covid-19 relief package enacted in December. “We are building capacity and increasing economic opportunity for small and midsized meat and poultry processors and producers across the country.”

USDA Secretary Tom Vilsack said. USDA said it encourages MPIRG applications that focus on “improving meat and poultry slaughter and processing capacity and efficiency; developing new and expanding existing markets; increasing capacity and better meeting consumer and producer demand; maintaining strong inspection and food safety standards; obtaining a larger commercial presence,” and those that aim to increase access to slaughter or processing facilities “for smaller farms and ranches, new and beginning farmers and ranchers, socially disadvantaged producers, and veteran producers.”

Eligible facilities include commercial businesses, cooperatives, and tribal enterprises. MPIRG’s Planning for a Federal Grant of Inspection (PFGI) project is available to facilities currently in operation and are working toward federal inspection, while the Cooperative Interstate Shipment (CIS) Compliance project is for plants working towards compliance with their state’s a Food Safety and Inspection Service (FSIS) CIS program. Currently, Indiana, Iowa, Maine, Missouri, North Dakota, Ohio, South Dakota, Vermont and Wisconsin have CIS programs.

Applications for MPIRG grants must be submitted by August 2, 2021. USDA’s Agricultural Marketing Service (AMS) will hold webinars to walk applicants through the application process.

USDA’s latest weekly US milk market report

FLUID MILK: Milk production is level to declining in the East, strong in the Central region, and steady to decreasing in the West. Abundant supply is exceeding immediate demand, sparking spot milk load offers priced below class in the Central and West regions. The. The high temperatures baking parts of the country feel like a light at the end of the tunnel to some stressed handlers. While yield has already begun to notably taper in some areas, including Florida and Arizona, cooler nighttime temperatures in the Midwest are keeping production declines slow and steady. Class I demand is mixed but generally trending flat to lower. Balancing operations are running at, or close to, capacity. Class III demand is strong, and some cheesemakers are receiving additional scheduled milk loads. Cream supplies are available for dairy manufacturing needs. Butter churning is seasonally active. Ice cream production is mixed. Cream cheese plants are increasingly active this week. Some contacts report a softening tone for condensed skim markets, although contract sales are steady. Cream multiples this week are 1.28-1.39 in the East, 1.23-1.35 in the Midwest, and 1.05-1.27 in the West.

DRY PRODUCTS: Low/medium heat nonfat dry milk (NDM) price ranges narrowed, and the Central/East mostly series held steady while the top of the West mostly series increased. Domestic demand is steady to sluggish, while international demand is reportedly strengthening. High heat NDM prices are unchanged in the West, but the bottom of the Central/East range dropped a few pennies. High heat NDM trading was limited this week as production is sparse and supplies are said to be tight. Dry buttermilk prices are unchanged in the Central and East, but the price range and mostly narrowed in the West. Production is limited, and regional dry buttermilk inventories are tight. Ice cream makers are clearing much of the available condensed buttermilk supply. The dry whole milk price range expanded this week, and trading was relatively busy. Availability is tight, but demand is picking up. Dry whey prices are higher. Production and inventory levels vary across regions. Whey protein concentrate 34% prices are unchanged this week. Production is steady, and demand is somewhat variable. The lactose price range is unchanged. Steady production is meeting supply demands, and contacts say that many Q3 business arrangements are set. Shipping delays have created some backups, and a few manufacturers have offered spot loads to relieve warehouse congestion. Acid casein prices are steady while rennet casein prices increased on both ends of the range.

NATIONAL RETAIL REPORT (DMN): The most advertised dairy item this week is conventional 48 to 64-ounce ice cream. Conventional half gallons of milk saw the biggest increase in ads, jumping 372 percent. Total conventional dairy advertisements are down 16 percent this week, while total organic dairy ads increased 7 percent. The most advertised cheese item is conventional 8-ounce shred cheese, with a weighted average advertised price of $2.45. Greek yogurt in 4 to 6-ounce containers, the most advertised conventional yogurt item, has a weighted average advertised price of $0.96, down $0.02 from last week. The national weighted average price for conventional half gallon milk is $1.99, unchanged from last week. For organic half gallons, the national weighted average advertised price is $3.78, which results in an organic price premium of $1.79.

TheCattleSite News Desk

IMPORTANT NOTE: I am not a futures broker and do not manage any trading accounts other than my own personal account. It is my goal to point out to you potential trading opportunities. However, it is up to you to: (1) decide when and if you want to initiate any traders and (2) determine the size of any trades you may initiate. Any trades I discuss are hypothetical in nature.

Here is what the Commodity Futures Trading Commission (CFTC) has said about futures trading (and I agree 100%): 1. Trading commodity futures and options is not for everyone. IT IS A VOLATILE, COMPLEX AND RISKY BUSINESS. Before you invest any money in futures or options contracts, you should consider your financial experience, goals and financial resources, and know how much you can afford to lose above and beyond your initial payment to a broker. You should understand commodity futures and options contracts and your obligations in entering into those contracts. You should understand your exposure to risk and other aspects of trading by thoroughly reviewing the risk disclosure documents your broker is required to give you.