Weekly global protein digest: Good week for cattle futures bulls, NWS threat delays US border reopening

Livestock analyst Jim Wyckoff reports on global protein news

Cattle futures bulls having a good week

February live cattle on Wednesday rose $1.10 to $221.90 and closed at a three-week high close. January feeder cattle gained $1.975 to $331.85 and hit a four-week high. The cattle futures markets rallied again Wednesday on short covering and perceived bargain hunting. The much-improved near-term technical postures for live and feeder cattle futures markets are also likely inviting the chart-based speculators to more actively play the long sides. USDA reported very light cash cattle taking place so far this week at solidly higher money, with steers and heifers averaging $215.00--also supported buying interest in cattle futures. USDA reported last week’s average cash cattle trading price was $211.53, which was down $5.88 from the week prior.

China’s pork prices continue to decline, suggesting sagging consumer confidence

China’s pork prices have been declining all year are likely set to drop even lower, with government efforts to cull the breeding herd and a seasonal demand boost not enough to arrest the slide, Bloomberg reported. “Wholesale prices have dropped 18% so far in 2025 and are at the lowest level in more than three years. Consumption of China’s most popular protein normally picks up as temperatures cool, but the declines highlight how fragile consumer sentiment is at the moment.

A trade truce with the U.S. has restored a semblance of economic calm, but the property-market slump and a weak jobs market mean consumers aren’t splashing out just yet. With the 5% GDP growth target for 2025 in sight, Beijing also appears likely to hold back on stimulus, although that leaves room for support early next year,” Bloomberg Economics said.

China’s restaurants and retailers should be starting to stock up on supplies for winter and the upcoming holidays, when Chinese people go out for meals more and also entertain at home. But the external environment as well as an oversupply of hogs means pork prices will likely keep dropping this month, according to commodities consultancy Mysteel.

Beijing has been pushing this year for major hog producers to cut their breeding herds, along with other measures to tackle oversupply. Sow numbers were down 2.1% at the end of October from a year earlier, according to government data, but the drop hasn’t been big enough to have a meaningful impact on pork prices.

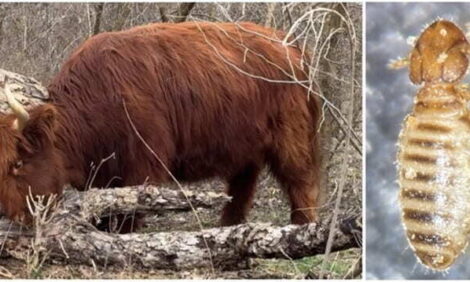

Mexico Tightens Cattle Movement as Screwworm Threat Delays US Border Reopening

Internal restrictions grow, but USDA says conditions still not met to resume live-cattle trade

Mexico is tightening controls on cattle movement inside the country as both U.S. and Mexican authorities race to contain the New World screwworm outbreak that has shut down cross-border cattle shipments for months. While Mexico has not announced a full formal freeze on all south-to-north cattle movement, officials have imposed new restrictions, intensified inspections, and limited import routes from Central America — steps seen as essential prerequisites for eventually reopening the U.S./Mexico cattle corridor.

Mexican ag-health authority SENASICA has restricted imports of Central American cattle to a single port of entry, Puerto Chiapas, where more rigorous inspection and biosecurity protocols can be applied. The move followed concerns that cattle shipments entering through multiple southern gateways could accelerate the northward spread of the parasite.

Those import limitations are paired with strengthened surveillance inside Mexico, including new checkpoints, sterile-insect releases, and movement-control measures intended to prevent infected livestock from traveling toward northern states. The urgency increased after Mexican officials confirmed a screwworm case in Nuevo León — just 70 miles from the U.S. border.

Despite progress on the Mexican side, USDA officials say the United States is not yet ready to reopen the border to live cattle. The agency continues to cite unresolved concerns about containment, inspections, and the risk that the parasite could enter the U.S. herd if restrictions are lifted prematurely. Mexico’s agriculture minister acknowledged there remains no official date for restarting exports northward.

The continued halt has sharply disrupted trade flows. U.S. imports of Mexican feeder cattle have plunged, while Mexican ranchers are struggling under the weight of stalled sales and lower domestic prices. Feedlot operators in the U.S. Southwest report shortages from the normally steady cross-border supply.

For now, movement controls inside Mexico — including the new south-entry bottleneck — appear to be one of the requirements Washington expects before considering any partial reopening. But with the screwworm still active in parts of Mexico and containment still underway, the path to resuming cattle exports remains unclear and politically sensitive on both sides of the border.

As for any potential timeline, most sources continue to signal January for the beginning of a phased-in reopening of the border. Some reports continue to signal this month.

Brazil’s beef exporters brace for China’s January ruling after a record year

Sector closes 2025 on strong volumes as Beijing weighs quotas, tariffs or other safeguards

Brazil’s beef industry is ending 2025 on a high note — but with an anxious eye on Beijing. China’s decision to extend its investigation into surging beef imports, largely from Brazil, has given meatpackers short-term breathing room but no real certainty. The probe, which examines whether rising imports from 2019–2024 harmed China’s domestic market, now runs through January 2026 and could result in quotas, tariffs, or other safeguard measures.

From January to October, Brazil shipped 2.79 million tonnes of beef valued at $14.31 billion to more than 160 markets. China accounted for nearly half: 1.34 million tonnes worth $7.1 billion.

Exporters expect to end the year with a global record of roughly 3 million tonnes and close to $15 billion in receipts — with about 1.6 million tonnes headed to Chinese ports.

A ruling that could reshape global beef trade. Unofficial assessments suggest several safeguard options are being weighed. One would establish a global import quota allocated proportionally among suppliers, with tariffs imposed on volumes above the ceiling. That scenario would preserve Brazil’s dominant market position and largely lock in today’s trade structure.

A more restrictive option — a global quota administered directly by China’s General Administration of Customs (GACC) — is seen as potentially “awful” for Brazil, introducing uncertainty and disrupting existing supply chains. Brazilian industry groups, including ABIEC and ABRAFRIGO, are holding comments until the decision is made. Some argue the Chinese process violates WTO rules and warn that an unfavorable ruling could prompt a formal challenge in Geneva.

China buys time — and tests market balances. The extension also appears to give China breathing room as it prioritizes broader trade talks with the United States. Domestic beef prices in China have begun to recover, easing pressure to act aggressively against imports. Yet Beijing still faces political demands to protect farmers while staying within WTO disciplines.

China’s reliance on foreign beef complicates its choices. The U.S. shipped fewer than 140,000 tonnes of beef to China in 2024, compared to more than 1.3 million tonnes from Brazil. American beef tends to serve the premium market, while Brazilian product is used mainly in processed or sauce-based dishes — meaning the two do not compete directly.

Reports say China has limited supplier alternatives. Brazil, they argue, grew into the gap left by declining U.S. and Australian shipments rather than from expanding Chinese consumption. Any safeguard that meaningfully constrains Brazilian volumes, they warn, would push prices higher. “They want us to stop exporting, but who will fill that demand?” one meatpacker said. “Neither China nor our competitors have the production.”

Industry prepares for January — and possible WTO action. Brazil’s private sector is keeping quiet publicly, but behind the scenes exporters are documenting how their products complement, rather than displace, Chinese production. Most Brazilian beef imported into China, they stress, is processed by Chinese companies rather than competing with domestic farmers.

UPSHOT: With a record export year nearly in the books, Brazil’s beef sector now enters 2026 waiting for a ruling that could cement its dominance — or force a painful strategic reset.

Spain’s pork exports to China resume after ASF regionalization deal takes effect

New protocol contains fallout from Bellaterra outbreak, allowing trade from disease-free zones

Spain’s new regionalization agreement with China is already paying dividends after an African swine fever (ASF) detection briefly halted the country’s pork exports to its largest non-EU customer. China suspended all Spanish pork imports on Nov. 28 following confirmation that two wild boars found dead in Bellaterra tested positive for ASF. But under the Nov. 12 protocol reached during King Felipe VI’s visit to Beijing, both sides agreed to limit trade disruptions to affected zones rather than impose blanket bans.

Spain’s agriculture ministry announced that China has now implemented that deal — establishing an exclusion zone around the Bellaterra area—and has resumed pork imports from all regions outside the containment zone.

The move is significant for Spain, the EU’s largest pork producer, which ships €3.5 billion ($4.05 billion) in pork annually. China alone represents 42% of Spain’s pork exports beyond the EU.

Authorities are still investigating the source of the outbreak. The European Commission said it will refrain from comment until an EU veterinary team conducts an on-site assessment this week. Meanwhile, Spain has imposed operating and sales restrictions on hog farms within a 20-kilometer radius of the detection site as part of its containment protocol.

Of note: The situation underscores the importance of regionalization agreements which limit the trade impacts from animal diseases with the U.S. and China inking a regionalization on highly pathogenic avian influenza (HPAI) deal via the Phase One agreement just ahead of a case being found in South Carolina turkeys. Prior to the regionalization agreement, China would normally have blocked all U.S. poultry, but the deal prevented the widespread trade halt.

Tyson plant closure narrows excess capacity but doesn’t upend national beef slaughter utilization

Southern Ag Today analysis shows adjusted 2025 capacity use moves closer to historical norms after Lexington shutdown

The announced closure of Tyson’s Lexington, Nebraska beef-processing plant — set for January 2026 — has triggered significant questions about national slaughter capacity utilization (CU) amid already tight fed-cattle supplies. In Southern Ag Today’s latest analysis (link), Charley Martinez (Assistant Professor, Univ. of Tennessee) and Parker Wyatt (Graduate Teaching Assistant) assess how the shutdown reshapes national CU in the short run and whether this marks a structural shift for the packing sector.

Tyson’s Lexington facility processed roughly 5,000 head per day, equal to about 20% of Tyson’s 25,800-head daily company capacity. Using methods outlined in Martinez et al. (2023), the authors adjust the national CU measure by removing that daily volume and comparing it with the five-year average, 2024 utilization, and 2025 levels.

Their updated monthly estimates show that 2025’s adjusted CU tracks notably closer to the historical five-year average.

• The five-year average CU through November is 90.1%

• 2025 CU averages 83.1%

• 2025-adjusted CU rises to 87.7%

For November specifically, CU stood at 83.5%, down from 88.4% in November 2024, the five-year norm of 89.8%, and the 2025-adjusted figure of 87.8%.

The authors note that 2025’s tight fed-cattle supplies, lighter cattle-on-feed numbers, and elevated fed-cattle prices have squeezed packer margins. Larger carcass weights have provided only partial relief. Tyson’s decision to shutter Lexington — the first major plant closure since Cargill shut its Plainview, Texas facility in 2013 during similar supply-tight conditions — suggests the industry may now be operating with excess physical capacity.

Egg sector warns holiday demand could push prices higher again

Producers still recovering from massive flock losses as HPAI threat persists

The U.S. egg industry is sounding fresh alarms that highly pathogenic avian influenza (HPAI) could tighten supplies and nudge prices upward just as the holiday season boosts demand. American Egg Board CEO Emily Metz told Politico that Thanksgiving and Christmas represent “the highest demand periods of the year,” and with limited supply, “prices do what they do in those conditions.”

Since Sept. 25, four confirmed HPAI outbreaks have hit commercial table-egg flocks, wiping out a combined 5.3 million birds. The largest was a 3.08-million-bird operation in Jefferson County, Wisconsin. Metz noted the sector still hasn’t fully recovered from the devastating 50 million birds lost between October 2024 and February 2025 — a shock that continues to constrain production capacity heading into winter.

“We’re not out of the woods yet,” Metz said. “Our farmers are doing everything they can, but we need some more tools in our toolbox, and those tools are a ways off yet.”

Industry leaders are working closely with USDA to advance an HPAI vaccination strategy. USDA has earmarked $100 million for vaccine development as part of its broader plan to stabilize egg supplies. But vaccine development is inherently slow, and international trade partners continue to raise concerns about the market implications of vaccinating poultry, creating additional hurdles.

For now, the sector remains focused on avoiding further outbreaks — and preparing for potential market turbulence if more cases emerge during peak holiday demand.

Why the Big Four meatpackers keep their grip — and why Trump’s new crackdown won’t break the mold

Decades of failed reform attempts show how structural economics, regional lock-in, and strict antitrust standards have allowed JBS, Tyson, Cargill and National Beef to dominate — and why the latest push by President Trump, USDA and DOJ is likely to yield investigations and transparency rules, but not a fundamental industry overhaul.

For more than half a century, four companies have dominated America’s beef and pork processing sector despite repeated efforts by presidents, USDA leaders and rural lawmakers to loosen their grip. The reason is simple: massive economies of scale, geographically concentrated livestock supplies, and high legal thresholds for proving anticompetitive harm have repeatedly neutralized reform efforts, even when political pressure is intense. While President Trump, USDA and the Justice Department are again targeting packer power with new investigations and rulemaking, the underlying economics of the meat industry still favor the entrenched “Big Four.” As a result, industry experts say the current crackdown is likely to produce stepped-up enforcement actions and new transparency requirements — but not a structural breakup or a meaningful shift in market dominance.

1. Immense Economies of Scale Make It Hard to Break In

Modern beef, pork, and poultry processing requires:

• Facilities costing hundreds of millions to build.

• High-throughput lines, cold storage, wastewater systems, robotics.

• Nationwide trucking and distribution networks.

• Dedicated supply relationships with thousands of feeders and ranchers.

This means:

• Entry barriers are enormous, even for well-funded new players.

• Existing “Big Four” (JBS, Tyson, Cargill, National Beef) keep per-unit costs far lower than any newcomer.

Result: Antitrust action doesn’t easily create viable new competitors.

2. Farmers’ Livestock Is Geographically Concentrated

Feedlots and hog/poultry complexes are clustered in:

• Texas/Kansas/Nebraska (beef)

• Iowa/Minnesota (pork)

• Arkansas/Georgia (poultry)

Packers built massive regional plants in these hubs. Even if new companies tried to enter, the industry’s geographic lock-in means farmers have few realistic alternatives.

Result: Structural advantages persist regardless of political will.

3. Antitrust Law Has a High Burden of Proof

To “break up” or restrain packers, DOJ must prove:

• Market power, not just size.

• Anticompetitive intent or effects, not merely farmer dissatisfaction.

• Consumer harm, usually meaning higher prices.

But:

• Meat is a globally traded commodity, which weakens monopoly claims.

• Courts have repeatedly rejected rancher-led cases for failing to show concrete anticompetitive harm.

Result: Structural consolidation is legal unless clear collusion or price-fixing is shown.

4. Congress Has Never Fully Resourced Competition Policy

Farm-state lawmakers criticize packers publicly, but:

• Livestock states also depend heavily on packers as major employers.

• Rural delegations often resist aggressive antitrust enforcement that could close plants.

This means political pressure is split — angry producers vs. job-dependent communities.

Result: Congress sends mixed signals that neuter long-term structural reforms.

Why Past Presidents Have Failed

• Obama: Tried GIPSA “Farmer Fair Practices” rules; Congress repeatedly defunded enforcement.

• Trump (term 1): Criticized packers but largely focused on trade shocks; COVID plant closures exposed concentration but didn’t lead to structural change.

• Biden: Launched a $1B “independent packer” initiative; most projects stalled or too small to compete meaningfully.

Pattern: Administrative actions can't overcome the underlying economics.

Fate of Trump–USDA–DOJ’s Current Focus (2025)

1. They will make noise and bring select enforcement actions

Industry analysts expect:

• A push for investigations into buyer-power abuses.

• DOJ likely probing procurement practices, potential collusion signals, and labor-market suppression.

But serious structural remedies like breakups remain a long shot.

2. No meaningful breakup unless DOJ finds “smoking gun” evidence

A modern breakup would require:

• Hard evidence of coordinated slaughter reductions, procurement agreements, or price signals.

• Explicit internal communications.

Historically, such cases rarely materialize. Unless DOJ obtains internal emails or data showing explicit coordination, courts will not allow it.

Probability of forced divestitures: Very low.

3. USDA will focus on transparency, not restructuring

Expected actions:

• Strengthened reporting under LMRA.

• Faster mandatory reporting on plant downtime.

• Possibly updated GIPSA rules on tournament systems (especially poultry) and unfair practices.

These will increase visibility, but won’t change concentration.

4. Industry structure will remain largely unchanged

Even if Trump demands a more competitive landscape:

• You cannot build a new major beef packer in under 5–7 years.

• No private investor wants to risk $500M+ for a plant that competes with JBS/Tyson’s scale.

• Packers have the labor, logistics, export channels, and customer relationships that newcomers cannot replicate.

BOTTOM LINE: the Big Four will still dominate in 2030 unless a black-swan antitrust case succeeds.

Most Likely Outcome (2025–2027)

✔ More investigations and public pressure

✔ Possible fines or settlements (labor-market cases are most likely)

✔ New transparency rules from USDA

✖ But no structural breakup

✖ No significant new competitors entering the beef/pork market

Why? The economics of meatpacking overwhelm the politics of meatpacking.

Weekly USDA dairy report

CME GROUP CASH MARKETS (11/26) BUTTER: Grade AA closed at $1.4500. The weekly average for Grade AA is $1.4467 (-0.0553). CHEESE: Barrels closed at $1.5825 and 40# blocks at $1.4700. The weekly average for barrels is $1.5825 (-0.0225) and blocks $1.4900 (-0.0680). NONFAT DRY MILK: Grade A closed at $1.1425. The weekly average for Grade A is $1.1550 (-0.0300). DRY WHEY: Extra grade dry whey closed at $0.7325. The weekly average for dry whey is $0.7442 (-0.0348).

BUTTER HIGHLIGHTS: Western region contacts report domestic butter demand varies from lighter to somewhat stronger, while contacts in the Central and East regions report demand varies from steady to strong. Demand from international buyers varies from steady to strong throughout the country. For the Thanksgiving holiday week, some butter manufacturers were taking in spot cream loads, while others were content with their contractual cream intakes. Butter production schedules were mixed. Some butter producers continued to focus their bulk butter production lines on loads for international sales, keeping availability of domestic bulk butter loads somewhat tight. Bulk butter overages range from 3 cents below to 5 cents above market across all regions.

CHEESE HIGHLIGHTS: Eastern cheese production is steady, supported by adequate milk and balanced demand. Inventories remain stable, spot activity is quiet, and overall market tone is firm heading into the holiday period. Central region production is steady, though less product is available for spot needs as increased bottling activity pulls more milk from cheese manufacturing. Retail interest is stronger with holiday buying, barrel supplies are tight, and milk volumes remain sufficient. Western plants report steady output with contracted and spot milk available. Spot opportunities tightened due to the Thanksgiving holiday week, while domestic and export demand stay supportive across key varieties.

FLUID MILK HIGHLIGHTS: Nationwide, milk production is steady to strong. Milk components continue to be strong, contributing to higher volumes of cream available to manufacturers. Demand for all classes is lighter this week. The Thanksgiving holiday negatively impacted demand as several processors nationwide had scheduled downtime. Spot sales to bottling facilities are down, but processors are anticipating sales to pick up in the first week of December. Class II production is expected to pick up as well, as many facilities are preparing for the end of year holidays. Class III spot milk is light, as plant managers are utilizing internal volumes. Spot prices for Class III are unchanged from last week ranging from $1.5-under to $1.5-over Class. Cream is plentiful, and contacts say lighter demand during the week of Thanksgiving pushed multiples lower. Condensed skim was widely available ahead of the Thanksgiving holiday, contributing to lower prices for spot loads. Condensed skim prices range from $0.10 under to $0.15 over Class price. Cream multiples for all Classes range: 0.95 – 1.26 in the East; 0.85 – 1.24 in the Midwest; 0.90 – 1.22 in the West.

DRY PRODUCTS HIGHLIGHTS: The price range for low/ medium heat nonfat dry milk (NDM) in the Central and East regions was steady, while the West region increased modestly; the mostly ranges in both regions saw no movement. The Central and East high heat NDM price range was firm, while the West region saw a minor decrease at the low end and no change at the high end of the price range. The price range for dry buttermilk in the Central and East was unchanged, while the West price range was up on the low end and down on the high end. The West dry buttermilk was down slightly on both ends of the mostly range. Dry whey prices in the Central region were down marginally at the bottom and unchanged at the top of the price range, but up across the mostly range. West region dry whey prices strengthened at the low end and weakened slightly at the top end of the price range. Similarly, the mostly range was up on the low end and down on the high end. Dry whey in the Northeast region saw a dip at the low end but was steady at the upper end of the price range. The price series for lactose was stagnant. Whey protein concentrate 34% increased at both ends of the price range, while the mostly range remained firm. Dry whole milk was steady at the low and up on the high end of the price range. No movement was seen for either acid or rennet casein.

ORGANIC DAIRY MARKET NEWS: Federal Milk Market Order 1, in the Northeast, reports utilization of types of organic milk by regulated plants. During October 2025, organic whole milk utilization totaled 18.73 million pounds, up from 16.17 million pounds the previous year. The Foreign Agricultural Service (FAS) releases monthly export data which includes export volumes and values for organic milk categorized as HS-10 code 0401201000. Recently released data for August 2025 indicated organic milk exports were 587,472 liters, down 24.2 percent from the month prior, but up 101.7 percent from August 2024. A large Dutch organic milk processor announced that the guaranteed price for organic farm milk in December 2025 is 68.71 EUR/100kg ($79.86 USD), up 0.21 Euros from November 2025. The processor stated they anticipate reference companies to keep prices aligned with organic market developments.

OCTOBER MILK PRODUCTION (NASS): Milk production in the 24 major States during October totaled 18.7 billion pounds, up 3.9 percent from October 2024. September revised production, at 18.2 billion pounds, was up 4.0 percent from September 2024. The September revision represented a decrease of 34 million pounds or 0.2 percent from last month's preliminary production estimate.