Weekly global protein digest: Brazil eyes Japan beef market as US tariffs threaten $1B in exports

Livestock analyst Jim Wyckoff reports on global protein newsWeekly US beef, pork export sales report

Beef: Net sales of 4,300 MT for 2025--a marketing-year low--were down 73 percent from the previous week and 66 percent from the prior 4-week average. Increases primarily for Japan (3,200 MT, including decreases of 900 MT), South Korea (500 MT, including decreases of 1,800 MT), the Philippines (500 MT, including decreases of 100 MT), the Netherlands (200 MT), and Taiwan (100 MT, including decreases of 700 MT), were offset by reductions for Mexico (600 MT) and Peru (100 MT). Exports of 11,400 MT were down 19 percent from the previous week and 8 percent from the prior 4-week average. The destinations were primarily to Japan (3,900 MT), South Korea (3,300 MT), Mexico (1,300 MT), Taiwan (1,100 MT), and Canada (600 MT).

Pork: Net sales of 21,200 MT for 2025 were down 32 percent from the previous week and 19 percent from the prior 4-week average. Increases primarily for Japan (6,500 MT, including decreases of 100 MT), Mexico (4,700 MT, including decreases of 600 MT), South Korea (3,500 MT, including decreases of 100 MT), Colombia (1,700 MT, including 100 MT switched from Guatemala and decreases of 100 MT), and Honduras (1,200 MT), were offset by reductions for Hong Kong (100 MT). Exports of 27,000 MT were down 4 percent from the previous week and 1 percent from the prior 4-week average. The destinations were primarily to Mexico (13,200 MT), Japan (3,500 MT), South Korea (2,300 MT), China (2,200 MT), and Colombia (1,400 MT).

USDA Monthly livestock report

LIVESTOCK, POULTRY, AND DAIRY: The forecast for 2025 red meat and poultry production is reduced from last month. Beef production is lowered on reduced fed and non-fed cattle slaughter and lighter dressed weights. Pork production is reduced reflecting official data reported through the first half of the year, as well as a slower slaughter rate and reduced dressed weights in the third and fourth quarters. Broiler production is raised reflecting recent production and hatchery data. Turkey production is reduced on recent hatchery data indicating lower production in the fourth quarter of the year.

Egg production is lowered on reported data through June and slower growth expected in the second half of the year based on recent hatchery data. For 2026, beef production is lowered due to reduced expected placements in the second half of 2025, as well as reduced cow slaughter in 2026. Pork production is lowered on reduced slaughter and lighter dressed weights carrying into 2026. Broiler and turkey production are raised for the year on lower feed costs and supportive demand due to tighter red meat supplies. Egg production forecasts are unchanged from last month.

Beef imports for 2025 are lowered to reflect reported trade data through the first half of the year, as well as reduced shipments due to higher tariff rates, particularly from Brazil. The reduction is carried into beef imports for 2026. The beef export forecast is reduced for 2025, reflecting tighter domestic supplies. The reduction is carried into lower exports for the first half of 2026.

The pork export forecast for 2025 is raised based on official data reported through June and no changes are made to 2026 pork exports. The broiler export forecast is also raised for 2025 based on data through June and is unchanged for 2026. The turkey export forecast for 2025 is raised on data through June and higher exports for the third quarter. The 2026 turkey export forecast is unchanged. Cattle price forecasts for 2025 are raised for both the third and fourth quarters based on recent price strength and resilient demand for beef. The higher cattle price forecasts are carried into 2026.

The 2025 hog price forecast is raised based on recent prices, with increases continuing into 2026 on tighter pork supplies. Broiler price forecasts for 2025 are reduced for the second half of the year based on recent price declines through early August, with reduced prices carrying into next year.

Turkey prices are raised for the second half of 2025 and 2026 based on recent price strength and support from tight supplies of red meat. The egg price forecast for 2025 is reduced on lower fourth-quarter prices reflecting recent prices and improved shell egg inventories. The egg price forecast in 2026 is unchanged.

The milk production forecasts for 2025 and 2026 are raised from last month. The cow inventories are raised for both years based on the most recent data in the Milk Production report. The growth in output per cow is also increased for 202 and 2026. Fat basis imports for 2025 are reduced from last month, mainly on butterfat products. Skim-solids basis imports for 2025 are raised on higher milk protein concentrates. For 2026, imports are raised on skim-solids basis reflecting higher imports of milk protein concentrates but are unchanged on a fat basis.

The 2025 fat basis export forecast is raised on higher expected shipments of butter and cheese. The skim-solids basis export forecast for 2025 is also raised on more exports of dried skim milk products and whey products. The fat basis export forecast for 2026 is raised on higher exports of cheese. The skim-solids basis export forecast for 2026 is raised primarily on higher shipments of whey products, lactose, and dried skim milk products. The price forecast for 2025 butter is lowered from the previous month based on recent price weakness.

The 2025 price forecasts for cheese and whey are unchanged, while nonfat dry milk (NDM) is raised. The Class III price is unchanged based on cheese and whey prices. The Class IV price is lowered on lower butter more than offsetting higher NDM. The all milk price is WASDE-663-5 unchanged at $22.00 per cwt. For 2026, the price forecasts for butter and NDM are raised based on firm demand from domestic and international markets. Cheese and whey prices are unchanged from last month. As a result, the Class III milk price is unchanged from last month and the Class IV price is increased. The all milk price is also raised to $21.90 per cwt.

Smithfield boosts 2025 profit outlook on strong meat demand

Smithfield Foods posted quarterly sales of $3.79 billion for the period ended June 29, an 11% increase from a year earlier. Adjusted earnings rose to 55 cents per share from 51 cents last year. The company now expects 2025 adjusted operating profits between $1.15 billion and $1.35 billion, up from its prior forecast of $1.10 billion to $1.30 billion. In the second quarter, packaged meat sales climbed 6.9%, while fresh pork sales advanced 5%. Smithfield attributed the gains to robust demand for products such as bacon and fresh pork cuts, with more consumers choosing to dine at home.

Brazilian beef sales to Argentina soar on herd shortage

Record exports follow steep cattle decline and surging meat prices in Argentina

Brazilian beef exports to Argentina surged to a record 6,200 tonnes in the first half of 2025 — up from just 146.4 tonnes a year earlier — as Argentina’s cattle herd shrinks and beef prices climb nearly 59%. Persistent drought, herd depletion, and delayed slaughter cycles have left Argentina facing its second-lowest per capita beef consumption in history, while imports of Brazilian pork and chicken have also skyrocketed.

Ground beef or future calves? High cull cow prices put 2026 herd expansion in question

Record lean trim values and tariffs on Brazilian beef drive culling decisions that could shape next year’s calf crop

Tight cattle supplies, strong ground beef demand, and shifting trade flows have pushed cull cow prices to historic highs — forcing ranchers to weigh the immediate payout against the long-term value of keeping cows for the 2026 calf crop, says Josh Maples, Mississippi State University Extension.

Cull cow prices at local auctions in the Southeast are topping $160–$190 per cwt, while the national direct dressed price for 85% lean boner cull cows exceeded $300 per cwt for the first time in history. Ground beef demand is a major driver — average U.S. retail prices topped $6 per pound in June for the first time ever, according to the Bureau of Labor Statistics.

US Court upholds EPA livestock emissions exemption

Judge says 2018 law supports agency’s decision not to require disclosure

The US District Court for the District of Columbia on Aug. 7 upheld an EPA rule exempting livestock operations from reporting toxic air emissions, finding it aligned with congressional intent under the 2018 Fair Agricultural Reporting Method Act. Judge Timothy Kelly said the rule was a “straightforward reading” of the law and consistent with decades of interpretation under CERCLA and EPCRA.

What’s next: Environmental groups, which argued the exemption violated EPCRA by shielding ammonia and hydrogen sulfide emissions from disclosure, have not yet decided whether to appeal.

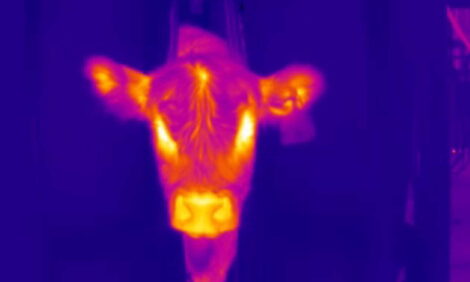

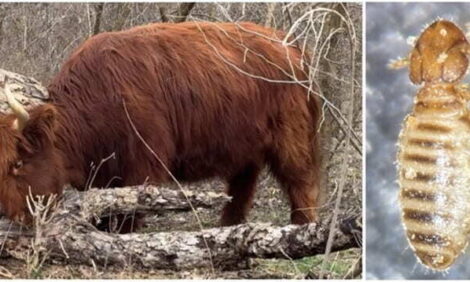

USDA secretary to make New World Screwworm announcement Friday

USDA Secretary Brooke Rollins on Friday, Aug. 15, in Texas is expected to deliver what she promised would be the “biggest announcement to date” in the battle against the New World Screwworm (NWS). While specific figures and other final details are still to be determined and thus subject to change, the announcement is expected to expand the multi-layered NWS eradication strategy previously launched. That plan included:

- Establishing an $8.5 million sterile‑fly dispersal facility at Moore Air Base in South Texas

- Investing $21 million to upgrade the Metapa, Mexico facility—raising production capacity to 60–100 million sterile flies per week, supplementing the existing 100 million per week from Panama

- A five‑pronged strategy involving improved coordination with Mexico, enhanced surveillance along the border, emergency preparedness, domestic production planning (up to 300 million sterile flies weekly), and innovation in technologies like e-beam sterilization and next-gen traps

- A temporary halt on livestock imports from Mexico amid new screwworm detections in Veracruz — just 370 miles from the U.S. border—which delayed phased re-openings of border ports

Public and industry reaction to the June announcement was supportive. Leaders from across Texas and the federal government praised the move: Governor Greg Abbott deemed it a “critical step,” while Texas lawmakers applauded the firm action.

What the Aug. 15 announcement may include:

- Expanded domestic sterile‑fly production capacity — possibly a fully operational facility at Moore Air Base or a modular, scalable version to meet aggressive production targets.

- Enhanced coordination with Mexico, including bolstered surveillance and swift response capabilities.

- Revised livestock import protocols, perhaps another attempt at conditional port reopenings based on real-time Mexican progress.

- New research and innovation initiatives, with public input continuing via stakeholder forums.

Bottom Line: Rollins’ likely announcement builds upon the foundation laid in June. It signals an escalation in the fight against NWS through increased production, smarter monitoring, and broader collaboration.

Brazil eyes Japan beef market as U.S. tariffs threaten $1 billion in exports

Meat industry pushes for nationwide approval, but Tokyo likely to greenlight only southern states

Brazil’s beef sector is intensifying efforts to secure access to Japan’s lucrative 700,000-tonne import market as U.S. tariffs threaten up to $1 billion in annual export revenue. Negotiations with Tokyo — ongoing for over 20 years — have advanced since Brazil’s 2025 certification as free of foot-and-mouth disease without vaccination, but Japan is poised to approve exports only from Paraná, Santa Catarina, and Rio Grande do Sul.

Industry leaders warn that excluding top producers like São Paulo, Mato Grosso, and Goiás would be an “unjustified restriction” and are lobbying for full national approval. While the government supports broader access, it says final decisions rest with Japan.

Of note: A Ministry of Agriculture delegation will meet Japanese officials next week, with a potential announcement timed for Prime Minister Shigeru Ishiba’s November visit to Brazil.

Beyond Meat misses Q2 targets

Plant-based meat maker cites weak U.S. demand and global uncertainty

Beyond Meat reported second quarter net revenues of $75 million, down 19.6% from a year ago and well below Wall Street expectations. Gross profit dropped to $8.6 million (11.5% margin), compared to $13.7 million (14.7%) in Q2 2024. The company blamed soft U.S. retail demand, weak international foodservice sales, and losses from exiting its China operations. “We are disappointed with our second quarter results,” said CEO Ethan Brown, attributing the miss to ongoing softness in the plant-based meat category. Elevated consumer price sensitivity continues to weigh on alternative protein sales.

Brazil races to beat tariff deadline with record U.S. beef exports

Shipments surge 17% year-over-year as exporters front-load ahead of U.S. tariff hike

Brazil exported a record 276,900 metric tons of beef to the U.S. in July, surpassing the previous high of 270,300 metric tons set in October 2024. The total was 17% higher than July 2024, reflecting an aggressive push by Brazilian exporters to move product ahead of expected U.S. tariff increases. The U.S. remains Brazil’s second-largest beef market after China. Tight U.S. cattle supplies and elevated domestic beef prices have driven import demand, contributing to the surge. However, with new U.S. tariffs set to take effect, Brazilian beef shipments are widely expected to drop sharply in the coming months.

China moves to cut pig numbers amid glut

Industry to curb overcapacity and stabilize hog prices

China’s hog industry will meet in Beijing next week to discuss cutting breeding sow numbers by 1 million, according to a notice seen by Reuters and first reported by Bloomberg. With the national sow herd at 40.43 million — well above the optimal 39 million — the move aims to ease oversupply and stabilize cash hog prices, which have dropped to below 14 yuan/kg from around 20 yuan a year ago. The meeting will also target speculative "secondary fattening" practices and enforce stricter slaughter weight controls.

US meat export snapshot – June 2025

Pork rebounds sharply; China lockout drags down beef shipments

US pork exports surged in June, helping offset earlier-year losses and ending the first half of 2025 on a strong note, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). However, beef exports slumped to their lowest level in five years, largely due to China’s failure to renew most U.S. plant registrations. Lamb exports posted gains from 2024 but saw their weakest monthly performance of the year.

Pork Exports Rebound

- June total: 239,304 mt (+7% YoY) valued at $682.6M (+3.5% YoY)

- Top market: Mexico — $250M (second highest on record)

- Growth areas: Central America, Colombia, Caribbean, Vietnam

- Variety meats: +10% YoY, boosted by shipments to China

- H1 2025: 1.46M mt (–4% YoY); $4.11B (–3.5% YoY; 3rd highest on record)

“We anticipated a June rebound for pork,” said USMEF CEO Dan Halstrom, citing eased trade tensions with China.

Beef Exports Slump

- June total: 93,928 mt (–15% YoY) valued at $769M (–18% YoY)

- Lowest monthly volume: Since June 2020

- China Impact: Plant registration lapse blamed for steep losses

- Bright Spots: Strong growth in Central/South America, Korea, Mexico, Egypt, and emerging African markets

- H1 2025: 602,221 mt (–6.5% YoY); $4.92B (–6% YoY)

- Estimated loss from China access issue: $150–$165/head or ~$4B/year

“With only a few U.S. plants eligible, the tariff is irrelevant,” said Halstrom. “China must honor the 2020 Phase 1 commitments.”

Lamb Export Trends

- June total: 223 mt (+37% YoY); $905,000 (+21% YoY)

- H1 2025: 1,590 mt (+43% YoY); $8.3M (+25%)

- Markets with growth: Mexico, Canada, Caribbean islands

- Note: June was the lowest export month of 2025 for lamb

Weekly USDA dairy report

CME GROUP CASH MARKETS (8/8) BUTTER: Grade AA closed at $2.3550. The weekly average for Grade AA is $2.4175 (-0.0610). CHEESE: Barrels closed at $1.7975 and 40# blocks at $1.8500. The weekly average for barrels is $1.7845 (+0.1185) and blocks $1.8115 (+0.1325). NONFAT DRY MILK: Grade A closed at $1.2650. The weekly average for Grade A is $1.2760 (-0.0130). DRY WHEY: Extra grade dry whey closed at $0.5800. The weekly average for dry whey is $0.5640 (+0.0250).

BUTTER HIGHLIGHTS: Many sellers indicate domestic food service demand is down this year. Domestic retail butter demand is stronger in the West region, steady in the Central region, and lighter in the East region. Demand from international buyers is mixed throughout the country as well. Spot cream availability is looser with production of a few other dairy products, such as ice cream, slowing down. In some cases, plant downtime or higher cream prices are moving spot cream away from butter churns and into Class II or Class III dairy product manufacturing. Butter production schedules are mixed. Bulk butter overages range from 5 cents below to 5 cents above market across all regions.

CHEESE HIGHLIGHTS: Cheese manufacturers in the Northeast are purchasing spot loads for condensed skim to help fortify production. Cheesemakers in the Central region are running steady to lighter schedules as some plant managers say tight spot volumes and increasing demand from Class I processors is reducing their ability to run full schedules. Domestic demand varies from steady to light. Demand from international buyers varies from steady to strong. Stakeholders indicate prices for U.S. cheese remain competitive compared to prices for internationally produced cheese.

FLUID MILK HIGHLIGHTS: Milk production is lighter and milk components are decreasing seasonally nationwide. Raw milk production remains sufficient to meet industry demand. Year over year milk production remains higher in 2025 than in 2024. Class I bottling is increasing in the Southeast and Southwest due to educational institutions beginning the fall semester. The remainder of the U.S. notes normal bottling operations for this time of year. Class II production is starting to decline. Contacts note a drop in hard pack ice cream manufacturing is occurring earlier in the summer than anticipated. Class III production is steady but trending lighter this week. Class III milk is trading within a tighter range this week; $1-under to $2-over. Some cheesemakers say they continue to purchase Class III milk that is available due to downtime at nearby production facilities at or below Class III prices. Cream production is lighter in most regions. Butter production is slow, making cream widely available for spot purchases. East and West regions cream multiples were unchanged. Central region cream multiples dropped slightly for the top end of the range. Condensed skim production is heavy. Sales activity is strong in the Northeast and is light to steady in other regions. Sales of condensed skim are going for $0.20 to $0.30 over Class price.

DRY PRODUCTS HIGHLIGHTS: Low/medium heat nonfat dry milk (NDM) prices declined across the range in the West this week, and the top of the price range for the Central and East regions declined. Contacts in the Central and West regions say demand from purchasers in Mexico is declining. High heat NDM prices remained steady throughout the country. Prices moved lower at the top of the range for dry buttermilk in every region. In the West, dry buttermilk demand is steady to lighter. The bottom of the price range for dry whole milk slid lower. In the Central region, dry whey prices increased at the top of the range but moved lower at the bottom. Prices decreased across the West dry whey price range but held steady in the Northeast. Animal feed whey prices are unchanged. The price ranges for lactose, whey protein concentrate 34%, acid casein, and rennet casein were all unchanged this week.

ORGANIC DAIRY MARKET NEWS: The Pennsylvania Monthly Organic Dairy Report, a report created as part of the Organic Dairy Initiative sponsored by the 2018 farm bill, covering May 2025 was released on August 8, 2025. This report showed the weighted average price for fluid milk increased by 0.52% from April. The Vermont Monthly Organic Dairy Report, a report created as part of the Organic Dairy Initiative sponsored by the 2018 farm bill, covering May 2025 was released on August 8, 2025. This report showed the weighted average price for fluid milk decreased 11.94% from April. The Foreign Agricultural Service (FAS) releases monthly export data which includes export volumes and values for organic milk categorized as HS-10 code 0401201000. Recently released data for June 2025 indicated organic milk exports were 388,978 liters, up 47.0 percent from the month prior, and up 38.7 percent from June 2024.

NATIONAL RETAIL REPORT: Total conventional dairy ads are down 4 percent in the week 32 retail ad survey, but organic dairy ads increased 162 percent. Conventional cheese, the most advertised conventional dairy commodity, appeared in 12 percent more ads this week. Greek yogurt in 4-6-ounce containers, the most advertised conventional yogurt product, appeared in 28 percent fewer ads this week. Conventional milk ads are down 30 percent.