Weekly global protein digest: USDA expands NWS eradication with major investment in Mexico; new report on China’s dairy industry

Livestock analyst Jim Wyckoff reports on global protein newsUSDA boosts state inspection programs amid funding concerns

USDA Secretary Brooke Rollins announced her department will distribute $14.5 million in reimbursements to state-run meat and poultry inspection programs. This move aims to bolster food safety and ensure that Americans continue to have access to safe, affordable meat and poultry products.

Rollins emphasized the Trump administration’s commitment to supporting the nation’s food supply chain, stating, “President Trump is committed to ensuring Americans have access to a safe, affordable food supply. Today, I exercised my authority to robustly fund state meat and poultry inspection programs to ensure states can continue to partner with USDA to deliver effective and efficient food safety inspection.”

She contrasted this action with previous years, saying, “While the Biden administration let this funding decline in recent years, the Trump administration recognizes the importance of our federal-state partnerships and will ensure services that our meat and poultry processors and producers rely on will continue to operate on a normal basis. The president’s commitment is reflected in his 2026 budget proposal, which calls on Congress to address this funding shortfall moving forward.”

USDA stresses importance — but warns of unsustainable path. USDA explained the critical nature of these funds, noting, “Without this funding, states may not have the resources to continue their own inspection programs which ensure products are safe. This funding increase ensures American produced meat and poultry can make it to market and onto the tables of families across the country.”

However, USDA also issued a warning: “This is not a sustainable path forward. Policymakers across the federal government should come together to think through ways to continue these critical state meat and poultry inspection programs.” This statement highlights the need for a long-term, bipartisan solution to secure ongoing support for state inspection efforts.

State agriculture officials expressed appreciation for the funding in a USDA news release, underscoring the importance of federal-state collaboration in maintaining a safe and reliable food supply.

Bottom Line: While the immediate funding boost will help states maintain vital inspection services, USDA and Secretary Rollins are calling on Congress and policymakers to find a lasting solution for the future of state meat and poultry inspection programs.

Brazil faces new bird flu alarms, maintains focus on poultry as export threats loom

Wild bird cases rise; officials monitor second potential commercial outbreak while dismissing cattle testing for now; Brazil negotiating with the EU and U.S. to limit animal disease trade bans

Brazil, the world’s top chicken exporter, is grappling with renewed avian influenza concerns after confirming additional bird flu cases in wild animals and probing a potential outbreak at a second commercial poultry farm in Anta Gorda, Rio Grande do Sul. This comes on the heels of its first-ever confirmed farm outbreak earlier this month in Montenegro, which triggered widespread trade restrictions from importing nations.

Agriculture Minister Carlos Favaro emphasized that wild bird infections — most recently detected in Mateus Leme, Minas Gerais — should be seen as a natural consequence of the country’s rich population of migratory birds and do not currently impact commercial trade. However, he acknowledged that two of about a dozen suspected bird flu cases are being investigated at commercial farms.

Despite mounting global concern over the virus's spread into mammals, including U.S. dairy herds, Brazil has not yet initiated testing in cattle. Chief Veterinary Officer Marcelo Mota stated the priority remains the poultry sector, citing differences in herd management and Brazil’s limited focus on dairy cows. “We don't want to raise concerns where we don't have a problem,” Mota told Reuters, adding that strong biosecurity practices have historically kept farm-level outbreaks at bay.

Officials continue to downplay immediate risk but face rising pressure as international scrutiny grows over Brazil’s animal health controls in the face of escalating global outbreaks.

Of note: Brazil is negotiating with the European Union and U.S. to limit animal disease trade bans to affected regions, its chief veterinarian said on Tuesday, expressing strong confidence in reaching deals as bird flu disrupts Brazilian poultry exports. The EU said no poultry or poultry meat products could be exported to the bloc from any part of Brazil after discovery of an outbreak in the state of Rio Grande do Sul, which accounts for 15% of Brazilian poultry production and exports. The U.S. applied a country-wide but not full ban, opens new tab on Brazilian poultry products following the farm outbreak. Processed products, byproducts and eggs may still be imported if they meet certain treatment and certification requirements. Negotiations with the two blocs are taking place at the general session of the World Organization for Animal Health in Paris.

"We know this is not the perfect time to negotiate, but it will happen eventually, as major poultry producers like the U.S. and Brazil face the same challenges," Brazil's Chief Veterinary Officer Marcelo Mota told Reuters.

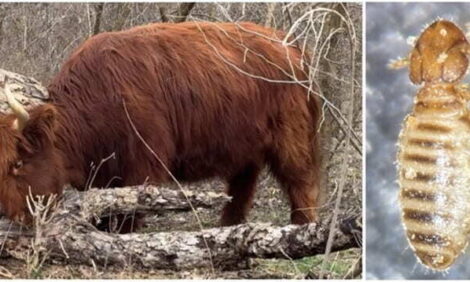

USDA expands screwworm eradication efforts with major investment in Mexico

USDA Secretary Brooke Rollins announced a significant escalation in efforts to fight the New World Screwworm (NWS) through a strengthened bilateral strategy with Mexico. USDA will invest $21 million to modernize a fruit fly facility in Metapa, Mexico, which will be converted to produce 60 million to 100 million sterile NWS flies per week — dramatically expanding current capacity and enhancing the reach of the sterile insect technique (SIT). The flies will complement current operations from the COPEG facility in Panama, which is already operating at full capacity with 44 weekly release flights. USDA will continue to evaluate the current suspension of live animal imports from Mexico every 30 days.

US cash cattle prices continue historic rise

USDA reports US cash cattle averaged a record $226.97 last week. That was the sixth straight weekly increase and the fifth consecutive record price. Wholesale beef prices were mixed on Tuesday, with Choice up 30 cents to $361.85 and Select down 49 cents to $350.83. Packer margins have improved but remain deep in the red.

India’s dairy sector pushes back in US trade talks

Farmers warn of crisis if cheap US imports enter Indian market

India’s dairy industry is urging the government to shield it from liberalization pressures in ongoing trade negotiations with the United States, warning that allowing U.S. dairy imports could devastate millions of small-scale farmers, Reuters reports.

India, the world’s largest milk producer, is in talks with Washington on a comprehensive bilateral trade agreement after the U.S. imposed — and then paused — reciprocal tariffs, including a 26% duty on Indian exports. One key sticking point: the U.S. dairy industry's push to open India’s heavily protected dairy market, which is currently safeguarded by steep import tariffs and non-tariff barriers. “It is necessary that we do not give them very cheap access to our markets,” said Jayen Mehta, managing director of GCMMF (Amul). “They are intending to dump their surplus in our country, which we cannot afford.”

With more than 80 million Indian farmers dependent on dairy production — often with just two or three animals each — the structural differences with U.S. mega-dairies are stark. India produces nearly a quarter of the world’s milk, totaling 239 million metric tons annually — more than twice the U.S. output.

The Indian Dairy Association and senior trade officials have reaffirmed New Delhi’s firm stance to exclude dairy from the deal, citing both economic and cultural concerns, including U.S. practices involving animal by-products in cattle feed that clash with Indian dietary norms.

Economists warn that lifting protections could flood India with cheaper U.S. cheese, yogurt, and skimmed milk powder, undercutting domestic producers and suppressing local milk prices. “If that happens, the whole industry will suffer — and so will farmers like us,” said dairy farmer Mahesh Sakunde from Maharashtra, according to Reuters.

Neutral USDA Cattle on Feed Report

USDA estimated there were 11.376 million head of cattle in large feedlots (1,000-plus head) as of May 1, down 178,000 head (1.5%) from year-ago. April placements declined 2.6%, while marketings dropped 2.5%. The report data is fully neutral and should have no impact on price action, especially after an extended holiday weekend.

Mildly negative USDA Cold Storage data

USDA estimated there were 893.6 million lbs. of red meat in frozen storage as of April 30, up 39.5 million lbs. from March but 56.0 million lbs. less than last year. Beef stocks totaled 418.1 million lbs., down 7.0 million lbs. from March, which was less than the five-year average decline of 16.5 million lbs. during the month. Still, beef inventories declined 8.2 million lbs. (1.9%) from last year and 52.1 million lbs. (11.1%) from the five-year average. Pork stocks totaled 455.8 million lbs., up 46.3 million lbs. from March. That was more than double the five-year average increase of 21.7 million lbs., though some of that was due to a 12.8-million-lb. downward revision to March stocks. Still, pork stocks declined 43.5 million lbs. (8.7%) from April 2024 and 92.5 million lbs. (16.9%) from the five-year average.

USDA lowers 2025 food price forecasts

Grocery inflation slows sharply, but egg and beef prices still rising

USDA revised its 2025 food price outlook downward, offering some relief to consumers facing inflation fatigue. The agency now forecasts a 2.9% increase in all food prices, down from 3.5% in April, with grocery prices (food at home) expected to rise only 2.1%, a sharp reduction from last month’s 3.2% estimate. However, restaurant prices (food away from home) are still expected to increase 4.0%, slightly higher than April’s forecast of 3.8%.

If realized, this would align overall food inflation with the 20-year average, but keep restaurant prices above trend and grocery prices below the long-run norm of 2.6%.

Egg prices: High, but cooling. Retail egg prices dropped 10.5% from March to April, but remain 49.3% higher than a year ago. USDA attributes this to earlier surges from Highly Pathogenic Avian Influenza (HPAI) disruptions. The new forecast of +39.2% for 2025 reflects sharp moderation from the March forecast of +57.6%, though eggs remain the fastest-rising food item in percentage terms.

Broader trends and takeaways

- Six food categories are now expected to post year-over-year price declines, including pork and fresh vegetables.

- Eggs, beef, and sugar remain inflation hotspots.

- Eggs: Still volatile, but 2025 increase now forecast at +39.2%, down from +54.6% last month. Prices fell 10.5% from March to April but remain nearly 50% higher YoY, due to HPAI-related supply issues.

- Pork: Now forecast to decline 0.2%, versus a 1.8% increase in April, as production rises.

- Beef & veal: Revised upward to +6.6%, driven by tight supply and strong demand.

- Fats & oils: Shifted to a 1.8% decline, down from a modest 0.2% increase.

- Fruits & vegetables: Overall prices to fall 0.7%; fresh vegetables down 2.9%, fresh fruits up 1.3%.

- Nonalcoholic beverages: Unchanged at +4.2%.

- Other foods: Flat at +1.8%.

- Perspective: Despite lower grocery price forecasts, consumers will still pay more for food in 2025 than in 2024.

- Of note: Food expenditures make up 13.7% of the Consumer Price Index, with eggs accounting for just 1.5% of total food spending.

Bottom Line: USDA’s revised outlook reflects improving supply conditions and easing inflationary pressures — but persistent volatility in select categories like eggs underscores ongoing market uncertainties.

USDA issues report on China’s dairy industry

The forecasts and revised estimates provided in this report are issued by FAS China and are not official USDA data. FAS China provides this analysis and reporting as a service to the United States agricultural community, and to our farmers, ranchers, rural communities, and agribusiness operations in support of a worldwide agricultural information system and a level playing field for U.S. agriculture.

Fluid Milk: Post forecasts that fluid milk production will decline in 2025, as rising per-cow milk yields are insufficient to offset the continued contraction in dairy cow inventories. Fluid milk consumption is expected to decrease due to economic headwinds and weak consumer sentiment. Imports will decline as strong domestic output and growing pasteurized milk availability reduce demand for imported UHT milk.

Whole Milk Powder (WMP): Post forecasts that WMP production will decline in 2025 due to a tighter raw milk supply and continued financial pressure on processors. Post also forecasts that WMP consumption will decline as processors shift focus toward higher-margin products. To partially offset reduced domestic production, Post forecasts that WMP imports will increase modestly.

Skim Milk Powder (SMP): Post forecasts SMP production to rise in 2025, supported by higher butter output and favorable processing margins. SMP consumption will decline slightly due to weak demand in dairy-based beverages and food applications. Imports are expected to fall as domestic production increases and competitively priced alternatives such as raw milk and WMP become more widely used.

Cheese: Post forecasts cheese consumption to grow in 2025, primarily driven by strong demand from foodservice channels such as Western-style restaurants and fast food. Domestic cheese production will increase gradually, with growing investment in natural cheese capacity. Imports are forecast to rise modestly from higher demand.

Butter: Post forecasts butter production and consumption will both increase in 2025, supported by abundant raw milk supply and growing demand from bakery and foodservice segments, particularly in second- and third-tier cities. Imports will grow to meet rising demand, although strong early-year import volumes may normalize in the second half of 2025.

Whey and Whey Products: Post forecasts China’s whey imports to decline in 2025 due to China’s retaliatory tariffs on U.S. origin product even though feed and food sector demand, especially for infant formula, remains firm. Domestic production remains limited, and long-term supply risks persist.

Supreme Court weighs new challenge to California’s Proposition 12

Justice Kavanaugh’s prior dissent offers road map for future legal strategies

Last week the U.S. Supreme Court was actively considering whether to rehear a legal challenge to California’s Proposition 12, the state law that bars the sale of pork from animals not raised under strict welfare standards. The latest petition, Iowa Pork Producers Association v. Bonta, asserts that Proposition 12 unlawfully discriminates against out-of-state pork producers and violates the dormant Commerce Clause. The case has been relisted for discussion at an upcoming Supreme Court conference, signaling heightened interest among the justices.

The American Farm Bureau Federation and NPPC lost their prior Supreme Court challenge to California’s Proposition 12 because the Court found the law was not protectionist, did not impose a substantial burden on interstate commerce, and that resolving such policy disputes is the responsibility of Congress, not the judiciary. The justices made clear that if agricultural interests seek relief, they should pursue a legislative solution rather than further litigation.

Justice Brett Kavanaugh did offer suggestions — effectively a "road map" — for how future challenges to California's Proposition 12 or similar state laws might succeed where the American Farm Bureau Federation and NPPC failed. In his concurring in part and dissenting in part opinion, Justice Kavanaugh highlighted several alternative constitutional grounds that were not fully developed or argued by the plaintiffs in this case. He wrote that while the Court rejected the dormant Commerce Clause challenge as insufficiently pled, state laws like Proposition 12 could also raise "substantial constitutional questions under the Import-Export Clause, the Privileges and Immunities Clause, and the Full Faith and Credit Clause" in future litigation. Kavanaugh noted that he was not expressing a view on whether such arguments would ultimately prevail, but emphasized that these issues "warrant further analysis in a future case".

Kavanaugh also pointed out that a properly pled dormant Commerce Clause challenge under the Pike v. Bruce Church balancing test could potentially succeed, or at least survive a motion to dismiss, if plaintiffs presented more detailed and compelling allegations of substantial burdens on interstate commerce. He specifically criticized the economic impact of Proposition 12, noting that California's large market share makes it "economically infeasible for many pig farmers and pork producers to exit the California market," which in his view could amount to a significant burden on interstate commerce.

In summary, Justice Kavanaugh suggested that future litigants could:

- Present more robust factual allegations to meet the "substantial burden" requirement under the dormant Commerce Clause.

- Explore alternative constitutional arguments under the Import-Export Clause, the Privileges and Immunities Clause, and the Full Faith and Credit Clause.

- Consider the broader implications for federalism and interstate commerce, potentially prompting congressional action.

Of note: On the legislative front, at least one bill — the Ending Agricultural Trade Suppression (EATS) Act — was introduced in Congress as a potential solution, and on the Prop 12 issue there was language in the House farm bill version that would have addressed it.

Brazil pushes to loosen global bans on chicken exports

Targeted restrictions, global supply shortage may accelerate reopening

Current situation: After a confirmed avian flu case at a poultry farm in Montenegro, Rio Grande do Sul, more than 20 international markets — including the Philippines, Jordan, Namibia, and Russia — have partially or fully banned Brazilian chicken exports. However, Brazilian officials say no new outbreaks have been detected and are aggressively lobbying for a return to regionalized, rather than national, restrictions.

Disinfection efforts at the outbreak site concluded Wednesday night, launching a 28-day virus incubation period that, if uneventful, could allow Brazil to declare itself avian flu-free. In the meantime, the Ministry of Agriculture is negotiating with trade partners to restore market access based on geographic containment of the virus.

Luis Rua, Secretary of Trade and International Relations, said the government expects progress next week as partners evaluate containment documentation. “Everything is proceeding as expected,” he said, noting that regionalized restrictions like the UAE’s recent Montenegro-only ban are a positive sign. The UAE accounted for 8.8% of Brazil’s chicken exports in 2024.

Global shortages may favor Brazil. The ongoing global poultry shortage could prompt countries to prioritize supply security over blanket bans. “Brazil was the last major producer without avian flu. That may encourage countries to reduce restrictions,” Rua added.

Private-sector stakeholders in markets like the Philippines and Mexico are pressuring their governments to avoid total bans, citing food inflation risks and Brazil’s robust inspection protocols.

To bolster domestic oversight, Brazil’s Ministry of Agriculture has activated 440 new personnel, including 200 federal agricultural auditors and 100 lab technicians, to strengthen biosecurity and inspection efforts.

As of the latest update, nine suspected cases are under investigation across several states, but none have yet been confirmed as new outbreaks.

Weekly USDA dairy report

CME GROUP CASH MARKETS (5/23) BUTTER: Grade AA closed at $2.4200. The weekly average for Grade AA is $2.3620 (+0.0200). CHEESE: Barrels closed at $1.8525 and 40# blocks at $1.8700. The weekly average for barrels is $1.8550 (+0.0525) and blocks $1.9100 (+0.0630). NONFAT DRY MILK: Grade A closed at $1.2525. The weekly average for Grade A is $1.2325 (+0.0155). DRY WHEY: Extra grade dry whey closed at $0.5425. The weekly average for dry whey is $0.5370 (-0.0015).

BUTTER HIGHLIGHTS: Domestic butter demand is generally steady. Stakeholders anticipate the holiday weekend positively contributing to food service demand. Export demand is strong. Cream volumes are more than ample throughout most of the country for butter manufacturers. Butter production schedules vary from strong to lighter with the holiday weekend at hand. Bulk butter overages range from 3 cents below to 5 cents above market across all regions.

CHEESE HIGHLIGHTS: Cheese production in the East is strong this week. Milk production remains high, but the spring flush is nearing its end. Cheesemakers are taking in more milk for production as bottling slows. Cheese prices are trending upward. CME spot sales for barrels rose six cents and twelve cents for 40-pound blocks from last week. In the Central region, retail cheese sales are steady to stronger. Cheesemakers are running busy production schedules as some prepare for down time this weekend. As of report publication, reported spot trades of Class III milk are moving as low as $7-under. Some cheese manufacturers in the West note Class III milk availability is looser with Class I bottling demand generally lightening due to spring recesses beginning or fast approaching at educational institutions. In some cases, cheese manufacturers note tight spot inventories regardless of what variety is being requested.

FLUID MILK HIGHLIGHTS: Milk production varies in each geographical region. The East and upper Midwest are holding steady with production as the spring flush draws to an end, while the western states are seeing a decline in milk production. Some areas are seeing a decline in milk components as the days get warmer. Despite that, cream supplies are still sufficient to meet demand. Class I milk production is declining nationwide, predominantly due to the end of the spring semester. Class II production is increasing nationwide. Ice cream manufacturers are producing more volumes of ice cream to account for the summer demand. Milk for Class III use is steady to stronger this week. Cheese makers are taking on the excess milk from bottlers. Contacts report spot milk prices ranging from $7-under to $1.5-under. Butter production is still high nationwide. Butter churns are operating near capacity, but some manufacturers are planning downtime during the holiday weekend. Spot loads of cream are available from butter manufacturers scheduling the down time. Condensed skim is widely available nationwide. Sales of condensed skim are slow this week with sales typically falling below Class price. Cream Multiples for All Classes Range: East Region – 1.10 – 1.27; Central Region – 1.10 – 1.26; West Region – 1.02 – 1.20.

DRY PRODUCTS HIGHLIGHTS: Low/medium heat nonfat dry milk (NDM) prices are generally increasing, with only the bottom of the mostly price series in the Central and East regions not moving higher. Demand for low/medium heat NDM is strong and contacts say purchasers in Mexico are active. Spot inventories are tightening. High heat NDM prices increased in all regions. The top of the Central and East dry buttermilk range pushed higher, while prices were unchanged at the bottom. Dry buttermilk prices contracted in the West, while both ends of the mostly price series shifted lower. Prices for dry whole milk increased across the range. The Central region dry whey price range and mostly price series pushed higher. Dry whey prices increased at the top of the East region’s price range. In the West, dry whey prices pushed higher but the mostly price series contracted. Animal feed whey prices were unchanged this week. Whey protein concentrate 34% (WPC 34) prices moved lower across the range and mostly price series. The bottom of the lactose mostly price series pushed higher this week, while the top and both ends of the range were unchanged. Prices for acid and rennet casein held steady this week.

INTERNATIONAL DAIRY MARKET NEWS

WEST EUROPE: The UK-based Agriculture and Horticulture Development Board (AHDB) released data showing daily milk deliveries for the week ending April 26 averaged at 38.46 million liters, down slightly from the week prior and up 0.9 percent from the same week last year. The UK average farm-gate milk price for April 2025 is listed at 43.69 pence per liter, down 2.6 percent from March 2025, but up 14 percent from April 2024.

EAST EUROPE: In Ukraine, a committee formed in 2024 is working on a roadmap for integrating with the EU to increase economic growth and competitiveness.

OCEANIA: AUSTRALIA: Despite above average rainfall in northeastern Australia in April, portions of South Australia, New South Wales, Victoria, and Tasmania experienced continued dry conditions. Milk production data from Australia for April 2025 were recently released. These data show total April 2025 production was 594.0 million liters, up 0.4 percent year over year.

NEW ZEALAND: Milk production data from New Zealand for April 2025 were recently released. These data show total April 2025 production was 1.46 million metric tons, down 0.5 percent compared to a year earlier. Weather conditions in New Zealand turned in April as remnants of Tropical Cyclone Tam resulted in higher-than-average rainfall across the country.

SOUTH AMERICA: South America milk production is steady for key dairy producing countries as the seasonal change to the winter season begins to take place. Demand is strong from buyers in the region. South American traders describe buyers as very active recently.

US NATIONAL RETAIL REPORT: In the week 21 retail ad survey, the number of conventional dairy ads increased, but total organic ads declined. Conventional cheese, the most advertised conventional dairy commodity, appeared in more ads this week. Organic cheese ads decreased. Total ads for the most advertised organic commodity, milk, decreased from the prior survey. Yogurt overtook cheese as the second most advertised organic dairy commodity this week. Total ads for conventional ice cream, the second most advertised dairy commodity, increased. Meanwhile organic ice cream ads totals decreased slightly.