Weekly Global Protein Digest: US beef herd falls to lowest level since 1951

Livestock analyst Jim Wyckoff reports on global protein newsTurkey shuts livestock markets nationwide amid FMD outbreak

Turkey has temporarily closed all livestock markets across the country to halt the spread of a highly contagious new serotype of foot and mouth disease (FMD), the ag ministry announced. The outbreak intensified following Eid al-Adha, when the traditional slaughter of animals increased livestock movement and heightened transmission risks. Authorities are deploying vaccination teams nationwide and pledged to gradually lift restrictions once the entire livestock population is immunized against the new FMD strain. Officials emphasized the temporary closures will not disrupt meat or dairy supplies and are necessary to safeguard animal health and protect the agricultural sector.

Liquidation pressure hits US cattle futures

Cattle futures faced active long liquidation pressure on Tuesday, despite steep discounts to the cash market. The lower futures price action this week is expected to weigh on cash cattle prices. Active cash trade has not yet gotten underway, though packers and feedlots are likely to wrap up negotiations early ahead of Friday’s holiday.

US Supreme Court declines to hear a challenge from Iowa Pork Producers Association seeking to overturn California’s Proposition 12

The Court’s action effectively allows the law’s animal welfare standards for pork sold in California to remain in place. The Court did not provide an explanation for its decision, though Justice Brett Kavanaugh indicated he would have granted review.

Proposition 12, passed by California voters in 2018, prohibits the sale of uncooked pork in the state unless the animals were raised according to specific animal welfare requirements, regardless of where they are produced. Pork producers and several states have argued that the law places an unfair burden on out-of-state producers and violates the Commerce Clause of the U.S. Constitution. The Supreme Court previously upheld the law in a 2023 decision, ruling it did not violate the Commerce Clause, and this latest denial of certiorari leaves that ruling in place.

This marks the 19th consecutive federal court defeat for pork producers and their allies in challenges to Proposition 12 and similar state animal welfare laws. The Supreme Court’s action ensures that the Ninth Circuit’s decision upholding Proposition 12 remains binding.

US beef cattle herd falls to lowest level since 1951 as drought and disease threats mount

Record-high beef prices driven by decimated herd, persistent demand, and biosecurity concerns

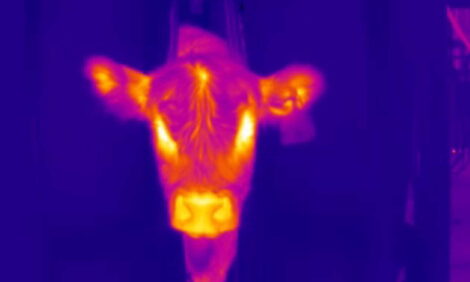

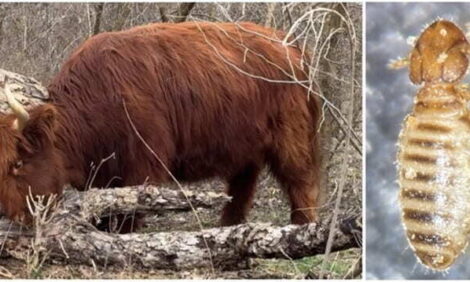

Years of persistent drought and the looming threat of the New World screwworm have pushed the U.S. beef cattle herd to just 86.7 million head—the smallest since the Truman administration in 1951, according to USDA. Dry conditions across the heartland have depleted grazing land, causing nutritional shortfalls and the spread of toxic, drought-resistant weeds, the Wall Street Journal notes (link).

The situation has been further complicated by lethal infections from the New World screwworm, which is moving north through Mexico, a key cattle exporter to the U.S. While no cases have yet been detected in the U.S., all imports of cattle from Mexico were suspended in May as a precaution, but USDA on Monday announced a phased-in reopening. (See related item in the Trade section.)

Despite these supply challenges, consumer demand for beef remains strong following the pandemic. The retail price of ground beef has climbed to a record $6.67 per pound, according to the American Farm Bureau Federation — the highest since their survey began in 2013.

USDA to reopen southern ports for Mexican livestock imports after screwworm ban

Phased reopening begins July 7, prioritizing biosecurity and ongoing surveillance

USDA will begin a phased reopening of southern border ports to cattle, bison, and equine imports from Mexico, following a nearly two-month closure triggered by the New World screwworm outbreak. The reopening process starts July 7, with the Douglas, Arizona port — the lowest-risk entry point due to its geography and longstanding cooperation between Sonora officials and USDA’s Animal and Plant Health Inspection Service (APHIS).

Background and timeline. USDA halted all live livestock imports from Mexico on May 11, 2025, after the detection of the New World screwworm — a pest eradicated from the U.S. for decades — moving northward in Mexico. The reopening schedule is as follows:

- Douglas, Arizona: July 7

- Columbus, N.M.: July 14

- Santa Teresa, N.M.: July 21

- Del Rio, Texas: Aug. 18

- Laredo, Texas: Sept. 15

Each port’s reopening will be followed by a risk evaluation to ensure that enhanced biosecurity measures are effective, and the pest does not reemerge.

Binational response and biosecurity. The New World screwworm is highly dangerous to livestock, with larvae that can cause severe and fatal wounds. USDA and Mexican authorities have increased surveillance, detection, and eradication efforts, including:

- Establishing a sterile fly dispersal facility in Texas and upgrading a Mexican plant to produce 100 million sterile flies weekly for aerial release.

- Conducting daily flights in Mexico to suppress screwworm populations.

- Deploying APHIS teams to Mexico for technical support and response coordination.

- Mexico banning livestock movement from affected regions without proof of inspection and treatment, and scheduling bilateral technical meetings with U.S. officials.

Continued vigilance. USDA Secretary Brooke Rollins stressed commitment to “heightened vigilance,” noting equines entering reopened ports will undergo a seven-day quarantine as a precaution. No significant increase in screwworm cases or northward spread has been reported in the past eight weeks, supporting the gradual reopening. USDA will continue risk assessment and adapt its strategy as needed to safeguard U.S. livestock.

The National Cattlemen’s Beef Association (NCBA) voiced strong support for USDA’s strategy. NCBA CEO Colin Woodall praised USDA’s “measured, thoughtful approach,” highlighting the agency’s five-pronged plan to combat the screwworm threat. Key elements of the plan include upgrading the sterile fly production facility in Metapa, Mexico, and constructing a new fly dispersal center at Moore Air Base in Texas. The plan also ramps up surveillance and strengthens technical cooperation with Mexican authorities.

NCBA and its state affiliates previously supported the May 2025 closure of southern border livestock imports, calling it a necessary pause to assess risks and protect the U.S. herd. With expanded surveillance and technical input from USDA’s Animal and Plant Health Inspection Service (APHIS), NCBA now supports the phased reopening and ongoing accountability measures. “NCBA and our affiliates will continue working with USDA and Congress to ensure the U.S. cattle industry remains protected as trade resumes,” Woodall said.

Australia’s livestock industry drops 2030 carbon neutral target

Red meat sector cites unrealistic timetable despite major emissions reductions and over $66 million in sustainability investments

Meat and Livestock Australia (MLA) has formally abandoned its ambitious target of making the nation’s livestock sector carbon neutral by 2030, with Managing Director Michael Crowley acknowledging the goal is currently out of reach. “We need more time, more support, and more investment to meet our goal,” Crowley said, as the Australian Red Meat Advisory Council also shelved the industry’s 2030 target last week.

While Australia’s red meat industry reported a 78% reduction in emissions from 2005 to 2021, this progress mainly reflected reduced land clearing and a smaller national herd, not significant decreases in methane emissions per animal. Crowley added that recent analysis shows the sector could still reach 80% to 90% of its carbon neutrality target by 2030, but stronger adoption of emissions-reducing practices is needed. The industry has invested over A$100 million (about $66 million USD) in sustainability efforts aimed at supporting the goal.

The US hog and pig inventory totaled 75.1 million head as of June 1, 2025

That’s according to the USDA’s latest Quarterly Hogs and Pigs report, marking a slight year-over-year increase and a 1% rise from the March tally.

Key findings:

- Of the total inventory, 69.2 million were market hogs and 5.98 million were kept for breeding.

- Between March and May, 34.2 million pigs were weaned — up 1% from the same period last year — with an average of 11.75 pigs per litter.

- Producers intend to farrow 2.97 million sows from June to August and 2.95 million sows from September to November.

- Iowa leads all states with 24.7 million head, followed by Minnesota (9.30 million) and North Carolina (7.80 million).

- The report is based on surveys from 4,476 operations nationwide, collected through a mix of online, mail, phone, and in-person responses.

The report signals continued stability in the U.S. swine sector, with producers maintaining steady production plans for the coming quarters.

USDA makes minor revisions to 2025 food price outlook

Grocery price increases edge up, restaurant price rises ease slightly

USDA’s latest Food Price Outlook released June 25 projects only modest changes to its 2025 food inflation forecast, with the overall message that consumers will keep facing higher food costs — both at the grocery store and when dining out.

Key takeaways:

- Overall food prices: USDA now expects total food prices to rise 2.9% in 2025 versus 2024, matching the 20-year historical average. That’s slightly more than the 2.3% increase seen in 2024.

- Grocery (food at home): Prices are forecast to increase 2.2%, a notch higher than the 2.1% projected in May and well above the 1.2% increase recorded in 2024, though still shy of the 20-year average (2.6%).

- Restaurant (food away from home): Prices are now seen rising 3.9%, a shade lower than May’s 4.0% forecast, but still above the historical average of 3.5%. This would be less than the 4.1% rise in 2024.

Category Highlights and Changes:

- Beef: Prices are projected to jump 6.8% from 2024 — up from the 6.6% increase forecast in May — driven by record-high retail prices, continued strong demand, and tight supplies. Beef price increases have outpaced other food categories so far in 2025.

- Eggs: While the projected rise in egg prices has been trimmed to 33.2% (down from May’s 39.2% forecast), prices remain sharply elevated, mainly due to ongoing impacts from highly pathogenic avian influenza (HPAI). Despite recent declines, May egg prices were still 41.5% above May 2024.

- Other meat & poultry: Pork prices are now expected to rise 0.5% (a reversal from the previous outlook of a decline), while poultry prices are set to increase 2.3% (up slightly from May’s 2.1%).

- Fats & oils, fruits & vegetables: USDA now expects more modest price declines in these categories, softening from steeper drops forecast in May. Fats and oils are expected to fall 0.6%, and fresh vegetable prices are now forecast to decline 2.5%.

Trends:

- Food price pressures in 2025 will be driven especially by beef and eggs — categories that have shown continued volatility and upward price movement. Meat, poultry, and fish together account for 10.6% of grocery costs, second only to “other foods.”

- Eggs: Since USDA began forecasting 2025 food prices in July 2024, the outlook for eggs has swung dramatically, reflecting the volatility of that market.

- Price changes between April and May 2025 included increases in 11 grocery categories and declines in four, with notable swings in processed foods, fats and oils, cereals, and eggs.

Bottom Line: U.S. consumers should expect grocery and restaurant bills to keep climbing in 2025, with beef and eggs leading the gains. The new USDA outlook signals only minor shifts from last month, reinforcing the broader trend of above-average food inflation, especially for key protein categories.

Poultry farmers sue major processors for alleged “no poach” conspiracy

Class action accuses Foster Farms, Mountaire, George’s, and others of suppressing grower pay

A coalition of poultry farmers filed a proposed class action lawsuit in federal court on Tuesday, accusing several of the nation’s leading chicken processors — including Foster Farms, Mountaire, George’s, and House of Raeford — of conspiring to restrict competition for chicken growers and artificially suppressing their pay. The suit, filed in the U.S. District Court for the Eastern District of Oklahoma, claims these processors illegally agreed not to recruit or hire each other’s contract growers, thereby violating federal antitrust laws.

The complaint alleges that the companies worked together to enforce a “no poach” agreement, limiting growers’ ability to move between processors and shielding the companies from normal market pressures that would raise grower compensation. “The cartel members attempted to insulate themselves from normal competitive pressures,” the lawsuit states.

This new case, brought by law firms Hausfeld and Berger Montague on behalf of thousands of growers, builds on previous antitrust litigation against the poultry industry. Last year, Pilgrim’s Pride and Tyson Foods paid $100 million and $21 million respectively to settle similar claims, while denying any wrongdoing.

Plaintiffs in the new lawsuit seek unspecified monetary damages and a court order to block further anticompetitive conduct. The case is Haff Poultry et al v. Mountaire Farms Inc et al, No. 6:20-md-02977-RJS-CMR. Foster Farms, Mountaire, George’s, and House of Raeford did not immediately comment on the allegations.

Weekly USDA dairy report

CME GROUP CASH MARKETS (6/27) BUTTER: Grade AA closed at $2.5625. The weekly average for Grade AA is $2.5360 (-0.0134). CHEESE: Barrels closed at $1.6650 and 40# blocks at $1.6200. The weekly average for barrels is $1.6405 (-0.0864) and blocks $1.6170 (-0.1055). NONFAT DRY MILK: Grade A closed at $1.2500. The weekly average for Grade A is $1.2520 (-0.0168). DRY WHEY: Extra grade dry whey closed at $0.5850. The weekly average for dry whey is $0.5745 (+0.0201).

BUTTER HIGHLIGHTS: Domestic retail butter demand varies from steady to lighter throughout the country. Some eastern stakeholders convey bulk butter is stronger. Strong demand continues to be exhibited by international buyers. US butter remains competitively priced compared to butter produced outside of the country. Spot cream availability is mixed. Butter production schedules vary from steady to strong. In a few cases, production managers convey cream availability is limiting how strongly butter churns are running. Bulk butter overages range from 7 cents below to 5 cents above market across all regions.

CHEESE HIGHLIGHTS: A heat wave is crossing the Northeast, negatively affecting milk production in the region. Prior to the temperature rise, contacts reported a spring flush-like surge in milk production. Cheese production was heavy during this time. CME prices fell over the past week. International demand for Class III remains strong. In the Central region, summer heat is reducing cow comfort and having a negative impact on milk output. Some cheesemakers in the Midwest say they are offering loads of milk on the spot market due to unplanned down time. Spot Class III milk prices are holding steady in the Midwest ranging from $8-under to flat, as of report time. In the West, retail cheese demand is steady, but contacts report retail interest is light. Export demand for cheese is strengthening. Increasing temperatures in the West are having a negative impact on milk output. Spot loads of cheese are available for purchase, but some purchasers say specific varieties are more difficult to obtain than others.

FLUID MILK HIGHLIGHTS: Nationwide, rising temperatures contributed to a decrease in milk volume this week, except for the Northeast. The Northeast saw an increase in milk volume. Milk components are declining during the summer months but remain higher than this time last year. Class I milk production remains low, keeping with normal trends for this time of year. Class II production is on the rise. Ice cream producers are pulling on cream, condensed skim and condensed buttermilk during peak production. Spot loads of each product are available for ice cream manufacturing. Class III production is slower than anticipated. Some facilities are experiencing unplanned downtime contributing to excess milk available for purchase. Class III spot load prices range from $8 under to flat this week. Class IV production remains strong nationwide. Churns are full and running daily. Cream multiples increased in the Northeast and remained the same everywhere else in the country. Condensed skim is readily available, and sales are steady. Class II and Class III purchases of condensed skim were reported. Condensed skim price range went from $.10 under to $.10 over Class price. Cream multiples for all Classes range 1.18-1.32 in the East, 1.15-1.26 in the Midwest, and 1.04-1.20 in the West.

DRY PRODUCTS HIGHLIGHTS: The bottoms of the low/ medium heat price ranges moved higher in all regions, while the top of the Central and East range moved lower. Demand for low/medium heat NDM is declining, but contacts in the Central and East regions say inventories remain somewhat tight. High heat NDM prices were unchanged in the West but increased at the bottom of the range. Dry buttermilk prices increased across the Central and East regions. The top of the West dry buttermilk price range moved higher, and the bottom shifted lower. Dry buttermilk inventories are tightening. Dry whole milk prices increased at both ends of the range. Prices for dry whey in the Central and East regions were unchanged this week. Meanwhile, the bottoms of the West price range and mostly price series moved higher. Domestic dry whey sales were light in the Central and East regions, but contacts report steady demand in the West. The bottom of the whey protein concentrate 34% price range moved lower, as contacts report spot inventories are growing amid a recent uptick in production. Lactose prices were unchanged across the range and at the top of the mostly price series, but prices increased at the bottom of the mostly price series. Prices for acid and rennet casein were unchanged this week.

ORGANIC DAIRY MARKET NEWS: Federal Milk Market Order 1, in New England, reports utilization of types of organic milk by pool plants. During April 2025, organic whole milk utilization totaled 19.41 million pounds, down from 21.43 million pounds the previous year. The butterfat content, 3.28 percent, is up from 3.27 a year ago. The April 2025 European organic milk average pay price increased in Austria, Germany, and Bavaria compared to March but decreased in France. In a recent report from a Pacific Northwest livestock auction, the top 10 organic cull cows and the overall average for organic cull cows traded lower than conventional cull cows. The average price for the top 10 organic cows auctioned was $131.57 per hundredweight, compared to an average price of $154.26 per hundredweight for the top 10 conventional cows auctioned.

NATIONAL RETAIL REPORT: Conventional ads increased 40 percent in week 26, while organic ads grew 79 percent. Every conventional commodity that appeared in last week's retail ad survey was present in more ads this week. In the first retail survey of the summer, ice cream overtook yogurt as the most advertised conventional dairy commodity. Cheese is the second most advertised dairy product in both the conventional and organic aisles this week.