Dairy Margin Protection Programme: What Is the Best Option For Me?

Time is running out for US dairymen to make the choice between Livestock Gross Margin insurance and the new Margin Protection Programme.There are many questions to be answered before making a step into a new insurance option by November 28, according to Jim Salfer, regional extension educator, University of Missouri.

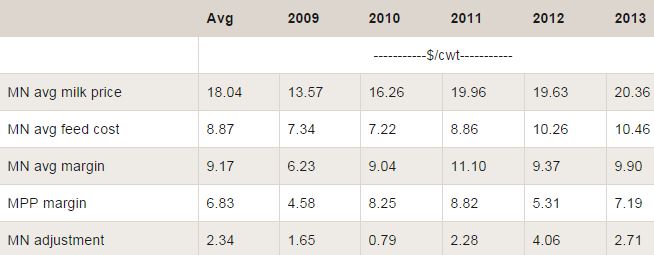

In this article, Mr Salfer addresses some frequently asked questions on how the new programme is calculated and what the margin would have done over the period 2009 to 2013.

A New System: Farm Bill in February

After what seems like years of negotiation and discussion with dairy organizations, the federal government finally signed a new farm bill in February.

This bill ushered in a new era of federal dairy programs. There are two government dairy programs that producers can currently use, livestock gross margin (LGM) insurance and the new margin protection program (MPP).

The sign up for MPP started on September 2 and will remain open until November 28th. Farmers are not allowed to participate in both LGM and MPP. They can choose to opt into the MPP annually during the up period, but once enrolled they are committed until 2018 and become ineligible to participate in LGM.

University of Minnesota Extension along with FSA is conducting meetings throughout the state to discuss the rules and potential strategies (locations and times can be found at z.umn.edu/DairyFarmBill).

Minnesota Milk Producers Association is also conducting educational meetings throughout the state (visit MMPA.org). Here are some frequently asked questions to consider before making the decision about sign up:

1. How does this program compare to the milk income loss contract (MILC)?

Unlike MILC, there are premiums that must be paid to participate in MPP. However, MPP provides the opportunity to protect better margins at very reasonable costs (less than 10 cents/cwt). This program is also more flexible and does not have a farm size cap.

2. How is the margin calculated?

This program specifically protects income over feed cost. The milk price is determined by the national all milk price and feed cost is determined by a formula for corn, soybean meal, and hay. Corn is 49 per cent, soybean meal is 27 per cent, and hay is 24 per cent of the feed cost formula.

3. How do Minnesota margins compare to the national average margins?

Using Farm Management data from the University of Minnesota Centre for Farm Financial Management, Minnesota farm's income over feed cost margin has averaged $2.34 higher than the calculated national margin (see Table 1).

4. How much money would I have received in the past if this program was in place?

There are two levels of premiums for each coverage level. Premiums are lower for the first 4 million pounds of your historical base. We examined net income at different coverage levels from 2008 through 2013 for a farm with a base of 4 million pounds and a base of 20 million pounds with 90 per cent coverage.

At the $4.00 coverage level, payments would have been received in two of the six years (2009 and 2012) with a net payment of $0.10/cwt across all years for both size herds.

At the $6.50 coverage level, payments would have been received in three of the six years (2009, 2012 and 2013). Net income would have been $0.54 per cwt for the herd with a base of 4 million pounds and $0.40 per cwt for the 20 million pound herd.

5. How do I determine the best level of coverage to select?

A farm can cover 25 to 90 per cent of their base coverage in 5 per cent increments. They are also able to select coverage from $4.00 to $8.00 per cwt in $0.50 increments.

There are two potential strategies.

- One strategy is to use this program to protect against the risk of a low margin. In this strategy, a producer could identify a level of coverage that is best and keep that coverage every year. A coverage level of $4.00 would be very minimal and payments will only be received in very poor margin years. Payments will be less than MILC payments. To get adequate coverage, producers should consider higher coverage levels up to $6.50. Above a coverage level of $6.50, premiums increase substantially, especially when covering production above 4 million pounds.

- Another possible strategy is to select the highest predicted net payment based on the MPP software. The software can be accessed at www.dairymarkets.org/MPP/Tool/. This tool uses the current futures prices of feed and milk to predict what potential payments will be for the upcoming year. Information is updated daily. Producers can enter their actual production history and select the "select coverage" tab to look at what the model predicts will be the best choice. In retrospect, the MMP decision tool correctly forecasted positive net returns in 6 out of 7 years. However, selecting incorrectly can have significant financial impact. In the fall of 2010, the model predicted that the best financial choice was to select the $8.00/cwt coverage level. For our model 4 million pound farm, the model predicted a net payment of over $41,000. In reality this farm would have ended up paying $16,000 into the program. For the model 20 million pound farm, the MPP tool predicted a net income of nearly $82,000. Because margins stayed high, this farm would have ended up paying over $205,000 in the program. Going all the way to the $8.00 level can be risky, especially for large farms, unless you are very certain margins will be low.