Weekly Protein Digest: JBS to shut Riverside, California beef plant, cutting 374 jobs

Livestock analyst Jim Wyckoff reports on global protein news

Cattle futures see some routine profit taking

February live cattle on Wednesday fell $1.15 to $229.55. January feeder cattle lost $1.80 to $341.525. The live and feeder cattle futures markets saw some profit-taking from the shorter-term futures traders. Still, the markets so far this week are pausing after recent good gains, which is not bearish and suggests the near-term price uptrends will continue. Higher cash cattle trade so far this week, following last week’s solid gains, is limiting seller interest in the cattle futures this week. USDA at midday Wednesday reported very light cash cattle trading at $229.00. Cattle futures traders are looking ahead to Friday afternoon’s USDA monthly cattle-on-feed report.

Trump’s beef pricing push splits his base

Efforts to curb food costs by easing tariffs and expanding imports fuel discontent among US producers even as consumers benefit

President Donald Trump’s recent decision to roll back tariffs on imported beef and other food staples has ignited a fresh political and economic debate — one that pits grocery affordability against the livelihoods of America’s ranching communities.

Trump’s recent executive actions eliminating or reducing tariffs on products including beef, tomatoes, coffee and bananas were designed to ease the pressure of high grocery prices facing US households. The administration has framed the changes as a response to voter concerns about inflation and living costs, and has justified exemptions on the grounds that many of these goods cannot be produced domestically in sufficient quantities.

However, the impact on US cattle producers has been sharply negative, threatening the economic foundation of a sector that has long been politically aligned with Trump. Ranchers contend that importing more Argentine and Brazilian beef under lower tariff barriers undercuts domestic cattle prices at a time when supplies are already tight. “It would turn us against him,” said one rancher, reflecting widespread frustration that a policy intended to help consumers is being perceived as detrimental to producers’ margins and long-term viability.

The response from key industry groups has been negative. The National Cattlemen’s Beef Association acknowledged the potential benefits of lower consumer prices but warned that flooding the domestic market with imported beef could undermine US family farmers and ranchers who are already grappling with high input costs and a reduced cattle herd.

Underlying the controversy is the broader contradiction in Trump’s trade strategy. Earlier in the year, the administration had erected sweeping tariffs under its so-called “liberation day” policy aimed at protecting US producers and reducing trade deficits. Many ranchers initially welcomed tougher trade barriers, saying they helped elevate cattle prices after years of depressed markets.

But the recent tariff rollbacks — particularly on beef — have reversed course sharply, triggering volatility in cattle futures and creating uncertainty among ranchers about future policy direction. Some ranchers, worried that the plan to increase beef imports would make it harder to justify long-term investments, said prices sagged immediately after the announcements.

Economists also question whether expanded imports will meaningfully lower retail beef prices in the short term. US cattle supplies remain at multi-decade lows owing to drought and other constraints, and imported lean beef is often blended into processed products rather than sold as prime cuts, diluting the effect on consumer bills.

The political consequences are already surfacing. Ranchers in key swing states have expressed deep disappointment with a president they helped carry to victory, even as some voters elsewhere continue to prioritize lower food costs over producer interests. A recent Reuters survey found that many Trump supporters blame factors beyond presidential policy for inflation, though concerns about price spikes — especially for food — weigh heavily on public opinion.

Ahead of future elections, the beef pricing battle raises tough questions about how far a sitting president can balance competing priorities within his own political coalition — between rural producers dependent on strong farm economics and urban and suburban voters eager for everyday affordability.

Mexico opens trade probe into US pork imports

Anti-dumping and subsidy investigation raises fresh uncertainty for US producers despite USMCA protections

Mexico’s Economy Ministry has launched anti-dumping and anti-subsidy investigations into imports of US pork leg and shoulder, a move that could ultimately result in new duties on the products, according to a government document released Monday.

The probe will examine whether US pork exports harmed Mexico’s domestic pork industry between 2022 and 2024, following petitions filed by five Mexican pork producers. The petitioners allege that US pork was sold under conditions of price discrimination and supported by subsidies, pressuring domestic prices and eroding profitability and returns on investment for Mexican producers.

Details: According to a report from Noticias Financieras, the investigation covers imports from Jan. 1-Dec. 31, 2024, and a period of Jan. 1, 2022-Dec. 31, 2024, as the injury period in the exam. Companies asking for the probe said they cited a range of subsidies that were provided by the US government, state governments, and the US pork industry. The total imported volume of pork grew 10% over the 2022-2024 period, including a 1% rise in 2023 and a 9% increase in 2024, while domestic production grew 1% in 2023 and 7% in 2024, according to the report, with imports from seven different countries with the US holding 86% of the shipments. The industry contends the imports captured nearly all the demand growth for pork, forcing Mexican producers to find other markets that were not TIF (Tipo Inspección Federal) markets. The TIF is a strict government certification process for meat processing plants which facilitate the products entering international commerce. The rise in imports meant that the excess production was forced to be put into non-TIF markets where the companies said can result in lower prices received for the product as the non-TIF markets are ones where consumers are not willing to pay the costs involved in meeting the TIF process, the report said.

NPPC responds. “Our industry prides itself on fair business practices with all our international markets, and we are disappointed the Mexican government is moving forward with this investigation,” Maria C. Zieba, vice president of government affairs at the National Pork Producers Council, said in a statement. She added that NPPC is reviewing the petitions and emphasized that Mexico is a major US pork market with “decades-long partnerships.”

The Economy Ministry said it elected to open the investigation based on the producers’ filings. USDA and the Office of the US Trade Representative did not respond to requests for comment.

Any duties imposed because of the investigation would come despite the US-Mexico-Canada Agreement, signed during President Donald Trump’s first term, which generally eliminates tariffs on qualifying goods traded among the three countries.

China cuts pork duties on EU imports after lengthy probe

Final anti-dumping ruling sharply lowers tariffs, easing pressure on European exporters while offering modest support to China’s struggling hog sector

China has significantly reduced tariffs on pork imports from the European Union, delivering partial relief to European producers after an 18-month anti-dumping investigation that was widely viewed as retaliation for EU duties on Chinese electric vehicles.

In its final ruling released Tuesday, China’s Ministry of Commerce set new tariffs ranging from 4.9% to 19.8% on EU pork imports for a five-year period starting Wednesday. The move marks a sharp rollback from preliminary rates of 15.6% to 62.4% imposed in September. Importers will be refunded the difference on duties paid since the provisional decision.

The ruling affects more than $2 billion in EU pork exports to China and comes as a relief to producers that rely heavily on the Chinese market, particularly for offal such as pig ears and feet, which have limited demand elsewhere. China imported $4.8 billion worth of pork and offal in 2024, with over half sourced from the EU. Spain was the bloc’s largest exporter by volume.

The investigation, launched in June 2024, hit major exporters including Spain, the Netherlands and Denmark. It unfolded alongside broader diplomatic engagement, including renewed talks on EV tariffs and recent visits to Beijing by French President Emmanuel Macron and Spain’s King Felipe. Spanish regional officials also pressed for tariff relief, citing Spain’s openness to Chinese investment in autos.

Industry groups welcomed the lower rates but stressed they still represent a cost. France’s pork association Inaporc said all cooperating exporters were granted a 9.8% rate, offering “a sense of relief,” though not something the industry could celebrate outright.

The decision comes as China’s domestic hog sector struggles with oversupply and weak consumer demand. Pork prices have fallen throughout 2025 and are expected to remain under pressure. While the reduced duties may slightly lift imported pork prices and ease food price deflation, analysts say the impact will likely be modest — benefiting Chinese pig farmers more than price-sensitive import segments.

China continues to wield trade tools elsewhere against the EU, with an anti-subsidy investigation into EU dairy exports due to conclude next February and tariffs already imposed on EU brandy, underscoring that trade tensions between Beijing and Brussels remain far from resolved.

Texas hosts regional talks on New World screwworm threat

Agriculture and public-health officials from Latin America join Texas leaders to coordinate surveillance, prevention, and response strategies

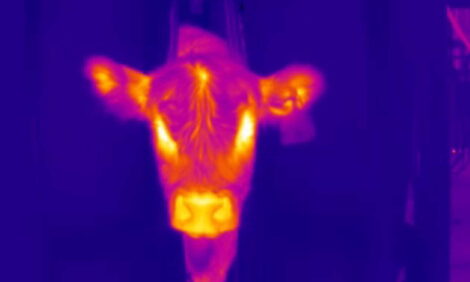

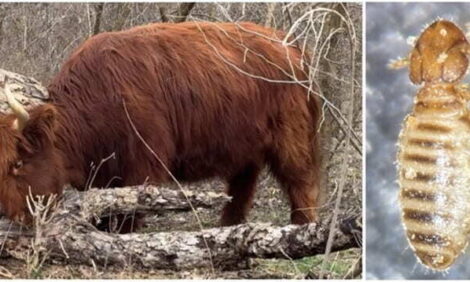

The Texas Department of Agriculture last Thursday convened agricultural, veterinary, and epidemiological leaders from across Latin America to address the growing threat posed by the New World screwworm, a parasitic fly that can cause severe and often fatal infections in livestock and wildlife if not rapidly contained.

The meetings focused on strengthening cross-border coordination, early detection, and rapid response capabilities as officials warned that climate variability, animal movement, and lapses in surveillance could increase the risk of the pest spreading northward. Texas officials emphasized that preventing the re-establishment of screwworm in the United States is a top priority given the state’s large cattle industry and its role as a major gateway for livestock trade with Mexico and Central America.

Participants discussed the importance of maintaining robust monitoring programs, sharing real-time epidemiological data, and sustaining proven control tools such as sterile insect technique programs that historically helped eradicate screwworm from the US and much of Mexico. Officials also underscored the need for coordinated communication with producers so infestations can be identified and reported quickly.

The talks come amid heightened concern among US cattle producers, who have been closely watching animal-health risks at the southern border, including screwworm, foot-and-mouth disease, and other transboundary pests and diseases. Texas agriculture officials framed the meetings as a preventive step aimed at protecting livestock health, trade flows, and rural economies on both sides of the border.

Bird flu detected in Wisconsin dairy herd as vaccine pressure builds

Second recent case in cattle underscores biosecurity concerns, while lawmakers push USDA to fast-track an avian flu vaccine

Bird flu has been detected in a Wisconsin dairy cattle herd, marking the second case in cattle in the past month and highlighting the virus’s unpredictable spread beyond poultry. USDA’s Animal and Plant Health Inspection Service (APHIS) confirmed the case Sunday, emphasizing that it poses no risk to consumers or the commercial milk supply, citing FDA confidence that pasteurization effectively inactivates the HPAI virus.

APHIS said it will complete genetic sequencing of the virus and coordinate with Wisconsin officials on on-farm investigations and diagnostic testing. The Wisconsin Department of Agriculture, Trade and Consumer Protection noted the state’s participation in the National Milk Testing Strategy, which requires lactating dairy cattle to test negative for influenza before interstate movement — an effort aimed at containing spread.

Industry groups warn that bird flu remains a significant threat to agricultural supply chains, particularly poultry, given the virus’s unpredictable transmission via migratory birds.

The Wisconsin case also comes amid renewed pressure on USDA to accelerate vaccine development. A bipartisan group of 23 lawmakers urged USDA Secretary Brooke Rollins to expedite review of an avian flu vaccine for poultry and to prioritize a vaccine for dairy cattle thereafter. USDA responded that its biosecurity and epidemiological framework remains strong and that it continues to support producers with assessments and improvements. Major industry groups, including the National Turkey Federation, United Egg Producers, and National Milk Producers Federation, endorsed the lawmakers’ call.

JBS to shut Riverside, California beef plant, cutting 374 jobs

World’s largest meatpacker cites strategic restructuring amid tight US cattle supplies and record beef prices as production shifts to other facilities

JBS announced it will permanently close its Swift Beef Company beef preparation facility in Riverside, California, on Feb. 2, 2026, affecting 374 employees. The Riverside plant, which processes beef for retail sale in grocery stores but does not slaughter cattle, will cease operations and production will be shifted to other JBS facilities.

The closure comes against a backdrop of tight US cattle supplies and record-high beef prices, stemming from a shrinking US cattle herd due to persistent drought conditions and restrictions on Mexican cattle imports. These supply pressures have raised costs for meatpackers nationwide.

JBS characterized the shutdown as part of a strategic initiative to streamline its “value-added and case-ready business” and simplify operations across its network, rather than a direct result of cattle shortages. The company said it remains focused on maintaining service quality while adjusting to evolving market demands, and will offer affected workers the opportunity to transfer to other JBS locations where possible.

The plant’s closure follows broader industry consolidation trends: Rival Tyson Foods is also winding down a larger slaughter facility in Nebraska, and other processors have idled shifts or reduced hours. Collectively, the moves suggest the industry is planning for several more years of constrained cattle availability, not a quick rebound.

Impacts to watch:

- Local employment: 374 jobs eliminated, with relocation or transfer options offered but community labor impacts likely significant.

- Beef supply chain: while JBS emphasizes production continuity, tighter cattle supplies and reduced processing capacity could contribute to price volatility in beef markets.

- Policy focus: beef price inflation and supply constraints may draw increased scrutiny from policymakers focused on food affordability and agricultural resilience.

Political and policy backdrop. The move is also likely to draw attention in Washington and Sacramento, where beef prices and food inflation remain politically sensitive. California officials are expected to scrutinize the job impacts, while farm-state lawmakers may point to the closure as further evidence of stress in the US protein supply chain.

Bottom Line: JBS’s Riverside shutdown is less about California specifically and more about an industry recalibrating to scarce cattle, shifting demand, and a longer-than-expected recovery timeline. For producers, processors and policymakers alike, it’s another reminder that the cattle cycle is still very much in its tight phase — and relief may not come quickly.

USDA Australian dairy report

Milk production in Australia is forecast to rise by 0.6 percent in 2026 to 8.55 million metric tons (MMT), following an estimated 1.9 percent decline in 2025 to 8.50 MMT. Production in 2025 would be higher were it not for low irrigation water availability in one of Australia’s key dairy regions. Fresh milk consumption is expected to continue its downward trend, while factory milk use is forecast to edge higher, with much of the additional supply directed toward cheese production. Output of butter, skim milk powder (SMP), and whole milk powder (WMP) is expected to remain steady. Trade in butter and SMP is also forecast to remain stable, while WMP imports are expected to increase and exports decline in 2026.

Weekly USDA dairy report

CME GROUP CASH MARKETS (12/12) BUTTER: Grade AA closed at $1.4800. The weekly average for Grade AA is $1.4785 (+0.0150). CHEESE: Barrels closed at $1.4125 and 40# blocks at $1.3500. The weekly average for barrels is $1.4125 (-0.0520) and blocks $1.3490 (-0.0605). NONFAT DRY MILK: Grade A closed at $1.1600. The weekly average for Grade A is $1.1670 (+0.0115). DRY WHEY: Extra grade dry whey closed at $0.7650. The weekly average for dry whey is $0.7550 (+0.0185).

BUTTER HIGHLIGHTS: Domestic retail butter demand is stronger this week. Contacts report flat domestic food service butter demand. Demand from international buyers varies from steady to strong. Cream loads are readily available. Cream demand from butter manufacturers is mixed. Butter production schedules are strong. Some butter manufacturers note international loads continue to be the priority for their bulk butter production lines. Domestic bulk butter and 80 percent butterfat unsalted butter loads are somewhat tight. 80 percent butterfat salted butter loads are readily available. Bulk butter overages range from 5 cents below to 5 cents above market across all regions.

CHEESE HIGHLIGHTS: Cheese output in the East is trending higher as year-end production ramps up and additional milk moves into cheese vats. Retail activity is seasonally supportive as grocers build inventories, while bulk demand remains steady to lighter. Inventory levels are balanced and aligned with current movement. Cheese production in the Central region remains strong, though some contracts note output has eased from recent weeks. Winter weather is impacting milk production and transportation, prompting some cheesemakers to secure spot volumes to maintain steady schedules. A few plants report downtime and are selling spot milk. Retail cheese demand is firm heading into the holidays, while food service activity holds steady. Export interest remains strong, and spot loads of cheese are available to meet current demand. Western cheese manufacturers continue to receive strong milk volumes, keeping production schedules active. Domestic demand is flat overall, though export interest remains steady to strong. Producers are focused on meeting December needs, with some varieties seeing tighter availability.

FLUID MILK HIGHLIGHTS: For much of the United States, milk output was lighter this week. Some regions experienced extreme weather, which greatly affected cow comfort. Milk component levels remain strong. Class I demand is strong. Contacts mention bottling facilities are finalizing orders for educational institutions prior to the start of their winter breaks. During that time bottling is expected to decline. For now, spot purchases for Class I are in demand and some Class III manufacturers are selling loads to Class I facilities. Class II demand is steady in some regions and light in others. Class II production is expected to remain light since most holiday demand is already fulfilled. Class III activity is stronger this week. Some cheesemakers are purchasing spot loads of milk ahead of forecasted winter weather that may cause transportation disruptions. The range for spot loads of milk for Class III are selling for $2.00 under to $3.50 over Class price. Class IV is steady. Some butter manufacturers are purchasing spot loads of cream, but many are covered by contracted amounts. Spot loads of cream are readily available. Condensed skim is in higher demand this week. The price for condensed skim ranged from flat to $0.15 over Class price. Cream multiples for all Classes range: 1.05 – 1.32 in the East; 1.05 – 1.25 in the Midwest; 0.90 – 1.20 in the West.

DRY PRODUCTS HIGHLIGHTS: Prices for low/medium heat nonfat dry milk decreased across the range in the Central and East regions and at the bottom of the West range. The bottom of the Central and East high heat NDM price range moved lower, while moving higher in the West. Dry buttermilk prices are unchanged in the Central and East regions. In the West, both ends of the price range for dry buttermilk moved higher, but the mostly price series held steady. Dry whey prices increased at the bottom of the range in the Central and West regions, and at the top of the range in the West. The mostly price series for dry whey in the Central region is unchanged, but both ends moved higher in the West. Prices for lactose decreased at the top of the range, while the bottom and both ends of the mostly price series held steady. The mostly price series for whey protein concentrate 34% is unchanged, but both ends of the price range shifted higher this week. Prices for both acid and rennet casein are unchanged.

ORGANIC DAIRY MARKET NEWS: The Pennsylvania Monthly Organic Dairy Report, a report created as part of the Organic Dairy Initiative sponsored by the 2018 farm bill, covering September 2025 was released on December 12, 2025. This report showed the weighted average price for fluid milk increased by 1.77 percent from August. The Vermont Monthly Organic Dairy Report, a report created as part of the Organic Dairy Initiative sponsored by the 2018 farm bill, covering September 2025 was released on December 12, 2025. This report showed the weighted average price for fluid milk decreased 0.49 percent from August. The Foreign Agricultural Service (FAS) releases monthly export data which includes export volumes and values for organic milk categorized as HS-10 code 0401201000. Recently released data for September 2025 indicated organic milk exports were 596,774 liters, up 1.6 percent from the month prior, and up 122.0 percent from September 2024.