Dairy Industry Facing Up To Volatile Markets

The dairy industry around the world is learning to face up to volatility in the market, writes TheDairySite Editor in Chief, Chris Harris.The industry has had to cope with disasters around the world that have had a significant effect on the market and the industry has also seen a steady upward trend in prices in recent years.

Shelagh Hancock, the milk training and membership director from Milk Link told the recent Outlook 2011 conference in London that the industry has virtually been turned upside down, but the farming community could reduce the volatility in the market by using fixed contracts.

She said that around the world milk buyers had been buying short, but were still having to come back into the market to meet demand.

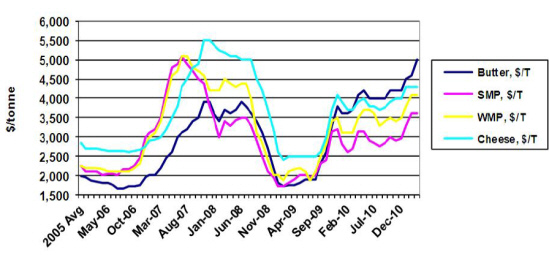

Ms Hancock said that butter prices have increased out of all proportion compared to the rest of the products in the dairy market, with dairy fats becoming highly valuable product.

Both cheese and whole milk powder production across the EU have increase and because of this the value of fats has also increased.

In global terms the melamine crisis in China, where milk powder was contaminated, has had an impact on the total milk market.

"Now most of the baby milk powder coming to China is from imported products, because of concerns over melamine," said Ms Hancock.

Whole milk powder has seen consumption double and double again with the main source being the New Zealand dairy industry.

"In the last 12 to 18 months commodities have become the new added value," she said.

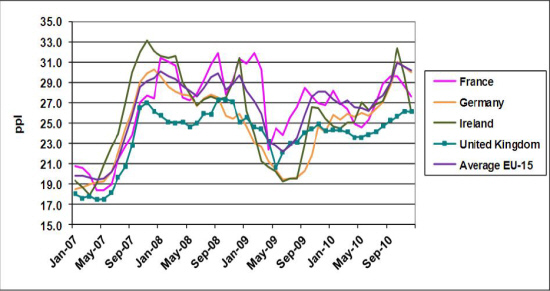

There has been a narrowing of the EU price premium over New Zealand prices and in the EU prices between the different countries are converging with UK prices moving down the EU league table.

She said that while UK milk prices have generally been more stable than in other EU countries but they have not responded in recent times as they did in 2007.

The UK milk supply has gone from a seven year decline between 2003/04 and 2009/10 to a four per cent rise of 500 million litres over the last year.

Ms Hancock told the Outlook Conference that there has been a very aggressive retail market for milk and food with a lot of competition.

"Milk has been used to drive footfall in the retail market," she said.

And she said that farmers have been left to fight for a market price.

Despite a fall in prices in March this year, she said that the UK is well placed for the future.

At the same time there is expected to be a world trade growth in primary commodities.

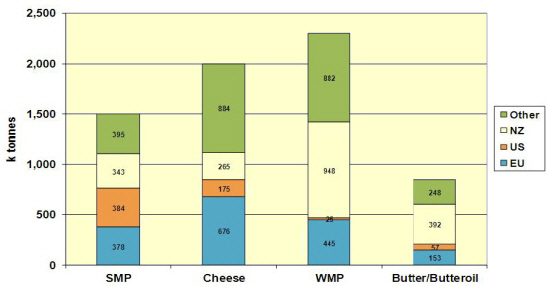

While New Zealand is expected to take 90 per cent of the export share of the world milk supply, the EU will be next with just 11 per cent and the US with seven per cent.

Much of this export demand will be driven by increased demand in China for whole milk powder.

"The makeup of production in New Zealand is governed by markets abroad," said Ms Hancock.

"Other markets such as the EU and the US are governed by what they consume."

July 2011