EU-27 Livestock and Products Annual 2008

By USDA, Foreign Agricultural Service - This article provides the cattle industry data from the USDA FAS Livestock and Products Annual 2008 report for EU-27. A link to the full report is also provided. The full report includes all the tabular data, which we have omitted from this article.Report Highlights

As a result of elevated beef and milk prices, EU beef production is expected to increase in 2008. This upturn in production will only partly relieve the tight supply in the EU. The EU enlargement cut off beef imports by Romania and Bulgaria, while the European Commission tightened the import requirements for Brazilian beef. This tight supply is expected to reduce exports as well as domestic consumption, but might stimulate beef cattle farming in the New Member States (NMS), and revive production in France and Ireland.

Executive Summary

The tight EU beef supply reduces exports and consumption.

During 2007, 2008 and 2009, the cattle herd is expected to contract, but at a relatively slow pace compared to the rate before 2007. As a result of elevated beef and milk prices, EU beef production is even expected to increase in 2008. This upturn in production will only partly relieve the tight supply in the EU. First of all, the EU enlargement in 2007 cut off beef imports into Bulgaria and Romania. In 2008, the supply was further tightened due to restrictions laid down by the European Commission (EC) on beef imports from Brazil. During the first five months of 2008, total beef imports declined by about twenty-five percent. European importers believe that purchases of Brazilian beef will decline further during the remainder of the year. The main reason on which traders base their opinion is that Brazilian producers lost interest to regain eligibility to export to the EU. Furthermore, a drop in demand for imported beef is reported, as Brazilian beef prices surged during the first half of 2008. Due to the tight supply, the high Euro/US$ exchange rate, and cuts of export refunds, EU beef exports decreased by a third during 2007, and are expected to decline about another third during 2008. The elevated beef prices are expected to significantly reduce beef consumption throughout the entire EU. A third anticipated effect of the tight supply is that it will stimulate domestic beef production. This revival is expected to mainly take place in the New Member States (NMS), France and Ireland.

2007 Cattle herd contraction is slowed down by elevated beef and milk prices.

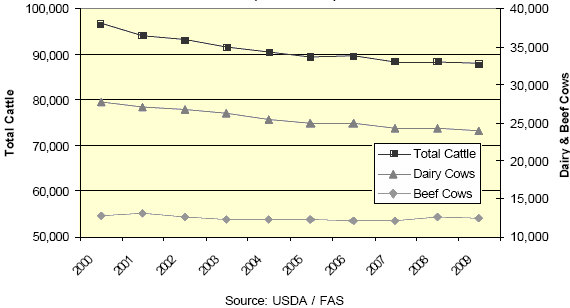

Three factors had a distinct effect on the cattle sector in 2007; the high beef and milk prices, the reduced profitability of veal production, and the spread of Blue Tongue Disease (BTD). As a result of the elevated beef prices during 2006 and 2007, the EU calf crop recovered by one percent. The effect of BTD on fertility is believed to have been limited. The high milk prices during 2007 induced farmers to hold to their cattle, mostly dairy cows, but also young calves and heifers destined for dairy production. As a consequence, the contraction of the dairy herd slowed down (see graph below). Expansion of the dairy herd is reported in Germany, the Benelux, and Poland. As farmers were holding to their cattle, cow slaughter as well as calf slaughter declined. Calf slaughter also declined as veal production became less profitable than beef production due to the high milk and milk replacer prices. BTD had also a negative effect on calf slaughter as it hampered intra-EU trade of veal calves. During 2007, total slaughter declined by 1.4 percent compared to 2006. In Romania and Bulgaria (NMS- 2), the situation was different from the general trend in the EU. In the NMS-2, restructuring of the dairy sector was accelerated by the dry summer period and high feed costs. This increased slaughtering by 60,000 head, and reduced the dairy herd by 90,000 head.

The EU beef cow herd is expected to have recovered during 2007 (see graph below). During the end of 2007, producer sentiment changed as the increase in cattle and beef prices offset the high feed prices. The beef cow herd expanded in France, the Iberian Peninsula and the NMS, in particular in the Czech Republic. An important factor for the expansion in France is that the sector kept the coupled payment for suckling cows. The reduction in cattle loss results from the end of the removal of older cattle under the Older Cattle Disposal Scheme (OCDS) in the UK.

(1,000 Head)

2008 & 2009 In the NMS, the dairy and beef sector is forecast to revive.

During 2008 and 2009, shrinking of the cattle herd is expected to continue, but at a relatively slow pace compared to the rate of contraction before 2007. After the temporary peak in 2007, the EU calf crop is expected to decline but the reduction is tempered by an expected recovery in the NMS and Ireland. This upturn is most prominent in Poland, where enlarged dairy quotas and the strong EU demand for beef is expected to revive the dairy and beef sector. Also, unprofitable hog production is forc ing pig farmers to switch to cattle fattening. The anticipated good grain crop in the NMS is also expected to have a positive effect on the calf crop in 2009, in particular in Romania. The spread of BTD and the high domestic milk and carcass prices will have a continuous negative effect on cattle exports throughout 2008 between EU Member States as well as to non-EU trading partners. Different from the trend seen since 2002, slaughtering is expected to increase during 2008. Increased slaughtering is anticipated in mainly Germany, the Iberian Peninsula, and Greece. The farmers’ consideration to slaughter is supported by the high carcass prices in combination with a significant reduction of the milk prices during 2008. Also the slaughter of young bulls, which were not slaughtered in 2007 due to trade restrictions related to BTD, is expected to increase during this year.

2007 The EU enlargement cut out 140,000 MT of beef imports in the NMS-2.

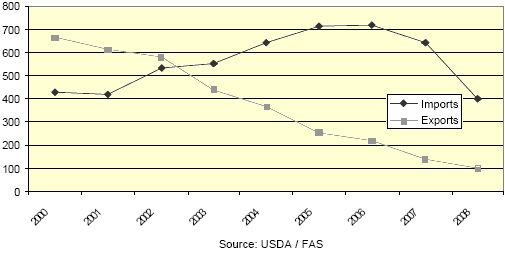

While slaughtering was reduced by 1.4 percent beef production increased by 0.7 percent during 2007. This recovery is a consequence of increased slaughter weight in mainly France, Germany, the UK, and Ireland. In France, heavier beef cows were slaughtered and fewer calves and dairy cows. In Germany, the share of calf slaughter decreased compared to the share of adult cattle. In the UK, cattle slaughter weight increased because slaughtering was hampered by Foot and Mouth Disease (FMD) related transport restrictions. Another factor for the increased beef production is the increased slaughtering in the NMS, in particular in Romania and Bulgaria. The upturn in production only partly relieved the tight supply in the EU. EU-25 beef imports increased by about 70,000 MT, but this was offset by the cutback of about 140,000 MT of beef imports into Bulgaria and Romania, as these NMS enforced the EU import regime. As a result, Brazilian beef exports to the EU-27 were reduced from 561,000 MT in 2006 to 472,000 MT in 2007 (see table below). Total EU-27 beef imports declined from 717,000 MT in 2006 to 640,000 MT in 2007. Due to the tight supply combined with the high Euro/US$ exchange rate and cuts of export refunds, EU beef exports decreased by a third to 140,000 MT. EU beef exports to Russia were reduced by more than half, and were replaced by Brazilian beef. Ireland, in 2006 with Germany the main beef exporter in the EU, stopped nearly all third-country beef exports in 2007. Irish traders reportedly have been maintaining their supply chains in non-EU markets with supplies of South American beef. Beef consumption rose slightly in those European markets that experienced an increased availability and moderate domestic prices, mainly in Germany and France. Due to the elevated prices beef consumption declined by about fifteen percent in the NMS.

2008 & 2009 Unsecure import supply further tightens domestic availability of beef.

In line with increased slaughtering, EU beef production is expected to peak in 2008. As a result of reduced imports, however, the total EU beef supply is expected to fall by about 220,000 MT in 2008 and 50,000 MT in 2009. This tight supply is due to restrictions laid down by the European Commission (EC) on EU beef imports from Brazil. On January 31, 2008, the EC imposed stricter traceability requirements for Brazilian beef imports, which in practice banned Brazilian beef from the EU market (see GAIN Report E48016). On February 27, 2008, the Food and Veterinary Office (FVO) relisted 95 farms as being eligible to produce for the EU market. In the meantime this number increased to 140 cattle farms. This is, however, only a fraction of the 6,780 Brazilian farms which had been certified during 2007. As a consequence, EU fresh beef imports declined by about forty percent, frozen beef imports by about thirty percent, and processed beef imports by about ten percent during the first five months of 2008 (see table above). Total beef imports declined by about twenty-five percent during this period.

European importers believe that Brazilian beef exports to the EU in 2008 will not pick up during the remainder of the year, but will decline even further. The main reason on which traders base their opinion is that Brazilian producers lost interest to regain eligibility to export to the EU. Brazilian suppliers reportedly changed focus due to the limited supply of Brazilian beef, higher domestic prices, and increased demand in other export markets. Furthermore, European importers report a drop in demand for imported beef, as prices of Brazilian beef surged during the first half of 2008. A drop in demand is in particular reported in the restaurant and the food service sector. Due to the elevated prices importers believe that Brazilian beef will not be as competitive as before. Importers also report that none of these beef products can be supplied by another producer in a sufficient volume.

Considering a further reduction of Brazilian beef imports, and replacement with about 20,000 MT of Argentinean and Uruguayan beef, total 2008 beef imports are expected to decline to about 400,000 MT (see graph below). Due to the limited availability of beef, and thus high domestic prices, EU beef exports are forecast to decline further, from 140,000 MT in 2007 to 100,000 MT in 2008. In addition, the elevated beef prices are expected to significantly reduce beef consumption throughout the entire EU. A third anticipated effect of the tight supply is that it will stimulate domestic beef production. This revival is expected to mainly take place in the NMS, France, and Ireland.

(1,000 MT Carcass Weight)

Policy

The EU’s high cost structure

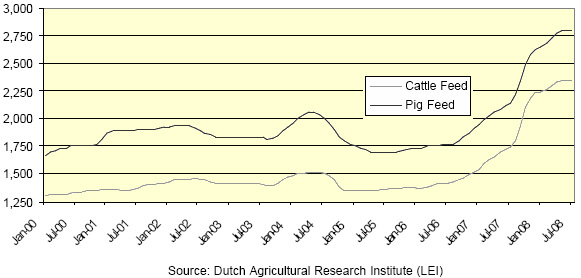

The high cost of production results from European legislation for food safety and “societal” demands on food production. The most notorious are the restrictions on GMOs, strict production methods, environmental restrictions and animal welfare measures. While each of these policies individually only has a limited impact on the production cost structure, their incremental combination has led to a serious cost gap with other world producers. This gap was only enhanced by recent increases in costs of production factors like feed (see graph below), energy and transportation. EU decision makers are increasingly becoming aware of this problem and several mitigation strategies are being considered. A proven approach is through lobbying in international institutions to increase international food (production) standards. Another potential approach that might come to the forefront again was mentioned by the French government at the end of June 2008, as it was preparing for its stint at the helm of the EU: that Europe should invest more in favoring community preference. The alternative is forcing “reciprocity” of European food production standards upon exporting countries. It is, however, difficult to understand how this rhymes with recent Common Agricultural Policy reforms, including the upcoming Health Check, and negotiations in the WTO Doha round.

(Euro per MT, on farm, the Netherlands)

Health Check

The upcoming Health Check can be seen as the final phase of the 2003 CAP Reform. The proposal suggests decoupling most of the remaining coupled farm supports as well as further dismantling of market restriction tools like set-aside and intervention storage. Increased production of arable crops, especially grains, as a result of farmer responses to price signals, should lead to decreased feeding costs for animal producers, although this might be accompanied by increased price volatility. It is unclear yet whether the Health Check will also lead to relocations in animal production. The European Commission (EC) has at least indicated its intention in the proposal to limit this relocation through special measures for Least Favored Areas (LFAs) by means of a redrafted Article 68 (formerly Article 69), at least for dairy production.

Animal welfare

EU animal welfare legislation has become a standard part of EU animal production legislation and part of cross-compliance demands for obtaining decoupled payments. More and larger parts of EU animal productions are switching to production methods that are perceived to be more animal friendly, because of consumer preferences, even if it increases biosafety risks. It is, however, one of the non-SPS concerns that EU producers are blaming for their competitive disadvantage vis-a-vis third country exporters.

Environmental restrictions and climate change

Environmental restrictions under the Nitrate Directive, especially groundwater quality protection from excessive manure spreading, have already put serious brakes on mainly pig production in several MS of the EU-15. New concerns about greenhouse gas (GHG) emissions from concentrated animal production are emerging, especially methane emission from ruminants, because of its high greenhouse gas coefficient compared to carbon dioxide. In more general terms, the impact of animal production on climate change has become a topic of debate. EU policy makers have already pointed out that animal farming will need to do its share in the reduction of GHG emissions to achieve the target of a post-Kyoto agreement. Another voice in the debate calls for decreased consumption of animal products in the developed world, including Europe, as the only way this will be achievable. The debate on climate change might well evolve in a way that would only further increase the European production costs for animal products.

Animal Health Situation

After its emergence in 2006 in Belgium and the Netherlands, Bluetongue serotype 8 disease rapidly spread in all directions to Denmark, the Czech Republic, Italy and the United Kingdom (UK) by 2008. The economic damage has not been fully assessed yet but is considered to amount to hundreds of millions of Euros. Mortality and reductions in birth/fertility in cattle and sheep from the second year infection wave have been reported to be up to 15-20 and 50 percent, respectively. Affected Member States hope that comprehensive vaccination of cattle and sheep herds will contain the disease. This should prevent even bigger losses in France, Germany and the UK. See also GAIN E48076.

As BSE numbers continue to decrease in the EU, the EC is taking further steps in its TSE Roadmap. It is expected that the age for systematic BSE testing will be increased to 30 months of age, while some MS, like Belgium, are already calling for a risk-based testing system rather than systematic testing (see GAIN E48074). Slowly, consensus is also building about lifting the absolute ban on MBM in feed. That would at the same time offer a chance of lowering the feed cost in the EU.

Further Reading

| - | You can view the full report by clicking here. |

List of Articles in this series

To view our complete list of Livestock and Products Annual, and Semi-Annual reports, please click hereAugust 2008