People's Republic of China Livestock and Products Semi-Annual Report

By USDA, Foreign Agricultural Service - This article provides the livestock industry data from the USDA FAS Livestock and Products Semi Annual 2008 report for the Voluntary Semi Annual Report from the People's Republic of China. A link to the full report is also provided. The full report includes all the tabular data which we have omitted from this article.Report Highlights:

It is uncertain when China will lift its BSE-related import ban on U.S. beef and beef products. FAS Beijing forecasts China's 2008 beef production to increase by three percent to 7.7 MMT. Despite the BSE-related import bans, low production growth combined with strong demand is expected to increase beef imports by four-fold to 30,000 MT. Beef exports are forecast to fall by four percent to 78,000 MT because of short supplies and the appreciating Renminbi. Pork production is expected to grow from 2007’s blue ear disease-affected drop by one percent to 42 MMT. Struggling production combined with rapidly growing consumption is expected to push imports to 200,000 MT in 2008. This dynamic will also push exports down by six percent to 330,000 MT.

Executive Summary

It is uncertain when China will lift its BSE-related ban on U.S. beef and beef products. Although bilateral negotiations continue, no agreement has been reached.

China’s livestock production was adversely affected by snowstorms, the worst in 50 years, during the latter half of January and first half of February 2008. See next section for more details. At the same time, both pork and beef were affected by high prices for both inputs and for meat products. High commodity prices from grains and oilseeds and continuing short meat supplies will likely continue through 2008.

FAS Beijing forecasts China’s 2008 beef production to increase by three percent to 7.7 MMT. Beef imports are expected to increase nearly four-fold to 30,000 MT because of low domestic production combined with strong demand. Interest in beef could be especially high during the Olympic Games to be held in Beijing in August 2008. Some beef may be supplied by South America since China has lifted its ban on four Brazilian states. Chinese beef exports are forecast to fall by four percent to 78,000 MT because of tight domestic supplies, high domestic beef prices, and appreciating Chinese currency, the Renminbi (RMB).

FAS Beijing forecasts China’s 2008 pork production to grow by one percent to 42 MMT (CWE), thus partially reversing a nine percent decline in 2007 caused by blue ear disease. Since the 2007 fall came right after a sharp 2006 fall, 2008 production will likely be 16 percent less in 2005. As a result, the slow recovery in production in the face of strong domestic demand is expected to keep pork prices high. The short supplies are also expected to drive 2008 pork imports up by eight percent to 200,000 MT while pushing pork exports down by six percent to 330,000 MT (CWE) because of low production, higher domestic prices and the appreciating Renminbi, which has risen 13 percent against the U.S. dollar since July 2005.

Note: No data included in this report is official. All official USDA data is available at

http://www.fas.usda.gov/psdonlineonline).

Small Winter Storm Effects on Livestock

At the end of January and beginning of February 2008, 25 provinces in China were hit by the worst snowstorms in the last 50 years. The bad weather caused 129 human deaths and resulted in economic losses estimated at RMB 151.7 billion ($21.4 billion). On February 19, the Ministry of Agriculture (MOA) reported in its Work Plan to Resume and Develop Livestock Production After Disasters that as of February 14, the snow storms killed 4.09 million pigs, 393,000 cattle, 1.38 million sheep and goats, 63.1 million birds, and 596,000 rabbits. There were 2,028 breeding animal and poultry farms impacted by the disasters. Despite the large numbers cited in media reports, the storms only reduced the hog population by one percent and the cattle population by 0.3 percent.

Post believes that the severe winter storms will only have a slight and a short-term influence on China’s livestock production. These kinds of effects are more easily reversed than outbreaks of diseases such as FMD or swine blue ear disease that kill more animals over time and disrupt production and consumption more profoundly. To assist farmers, China passed The Law of the People’s Republic of China on Corporate Income Tax, and the Regulation on Implementing the Corporate Income Tax, both effective on January 1, 2008. According to the Law, domestic and foreign companies enjoy the same tax rate (25 percent). According to the regulation, companies that engage in raising animals and poultry can be exempt from corporate income taxes. Depending on how it is implemented, this measure may further help livestock and poultry sectors.

BSE-Related Bans To Continue

It is uncertain when China will reopen its market to U.S. beef and products. Although China has offered to open the market since 2006, its proposals have not been consistent with OIE (World Organization for Animal Health) guidelines on beef trade and BSE that became effective in May 2007 (Please see the China Livestock Annual, CH7076). According to OIE standards, China should open the market to the full range of U.S. beef and beef products from cattle of all ages. Since China did not follow OIE guidelines, the United States refused China’s offer to resume imports of U.S. boneless beef (June 30, 2006), bone-in beef, and most bovine offal (August 12, 2007), because China insisted on excluding beef and beef products from cattle over 30 months old. In addition, the offers were not accepted because the Chinese offers also excluded an important offal, the omasum (third bovine stomach).

New rounds of bilateral negotiations took place in December 2007 in Beijing during the Third Strategic Economic Dialogue (SED) and the 19th Joint Committee for Commerce and Trade (JCCT). This was followed by joint negotiations of U.S. Trade Representative (USTR) and U.S. Department of Agriculture (USDA) with China’s Ministry of Agriculture (MOA) and the General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ) in January 2008 and with MOA, AQSIQ and MOH (Minister of Health) in February 2008. None of these meetings yielded a way forward on beef. The continuing ban may encourage grey channel trade via South China because of strong demand for U.S. beef while giving ever-wider openings to U.S. competitors such as Australia, New Zealand, Brazil, and Uruguay.

Production Growth Weak

Although China’s beef demand is strong, the slaughter is not likely to increase significantly in 2008. FAS Beijing forecasts China’s 2008 beef production at 7.7 MMT, a three percent increase from the previous year. This estimate is smaller than Post’s previous estimate in the last livestock annual report (CH7076) because of weather-related losses in 2008. Post also revised China’s total cattle beginning year inventory for 2007 downward by one percent because outbreaks of foot and mouth diseases (FMD) in 2005 and 2006 and lower profits caused by increased production costs. The slow increase in beef production combined with strong domestic demand, especially during the Olympic Games, will likely lead to large imports in 2008.

Although FMD gradually came under control in 2007 with the help of government-subsidized vaccines, other factors are slowing beef production. Rising feed prices and production costs, lack of land and pasture forages, increasingly expensive labor, and tight credit have all had their effects on feedlot placements.

High commodity prices have been particularly painful for cattle producers. Year-on-year corn price and soybean meal prices rose by nine percent and 30 percent in 2007. Global high feed grain prices are expected to continue pressure on China’s feed grain prices in 2008, further squeezing cattle producers. At the same time, forage has also become more expensive. Extremely hot weather in China in 2007 impacted alfalfa harvests leading to short supplies. This drove a large increase in alfalfa imports despite the high prices. The high domestic alfalfa prices are expected to continue in 2008 because China is expected to have more dry weather this year.

At the same time, credit is tightening. China’s central bank, the People’s Bank of China, used six interest rate hikes and a higher reserve in 2007 to tighten the monetary supply and cool down speculation and inflation. The same story may continue in 2008.

Mass migration is pushing up rural labor costs. According to the second national agricultural census published by the National Statistics Bureau (NSB) on February 21, 2008, more than 131.8 million rural labors moved to urban areas by the end of the 2006 -- with male labors accounting for 64 percent of the total. China’s new Labor Contract Law also became effective on January 1, 2008. This law may attract even more rural labor to urban areas because it mandates a package of benefits and salaries that farms have difficulty matching. It also requires that employers to provide proper benefits and salaries, which will increase further production costs.

However, despite higher feed costs, milk production will continue expanding in 2008. This reflects China’s stable breeding cattle imports (mainly dairy heifers) that are expected to recover from a sharp decline (62 percent) in 2005. China started subsidizing dairy cow production in 2005-2007 because cow milk has become an increasingly important nutritional product for the Chinese – and there are few substitutes (Please see the 2007 Dairy Annual Report, CH7080). Additionally, dairy farmers can get RMB 500 subsidy for each Holstein heifer in 2007 and 2008. In response to higher production costs, China will continue focusing on improvements in dairy cattle genetics to get better yields. China will be more careful to avoid importing large number of low quality cows as it did in 2003 and 2004, which were useless as breeding stock. At the same time, China will quicken the slaughter of lowmilk yielding cows. As a result, increasing dairy cow slaughter will offset the slow beef cattle slaughter, resulting in a two percent increase in 2008 beef production.

Beef Prices High in 2008

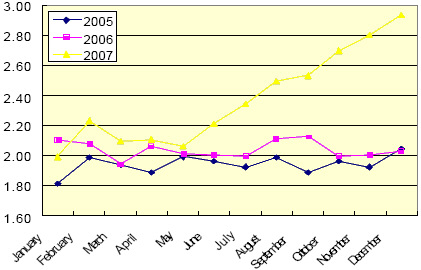

Chinese beef pric es in 2007 increased by 17 percent on average because of short meat supplies caused by swine blue ear disease in the latter half of 2006 and first half of 2007. Post forecasts that China’s beef prices will continue climbing in the first half of 2008 as domestic CPI (consumption price index) rises because of domestic inflation caused by commodity prices and other increasing costs.

The National Statistics Bureau (NSB) reported on February 19, 2008 that China’s CPI in January 2008 increased by 7.1 percent over the same month in 2007, a record high since 1997. Food prices surged 18.2 percent, with meat and poultry prices up 41.2 percent on average in January. Beef prices are expected to remain high because of strong demand.

FAS Beijing forecasts Chinese beef prices to relax slightly in the second half of the year as swine production recovers gradually. Prices should also ease as more imported beef comes on the market and there is a fall in seasonal consumption after the Olympic Games in August 2008. The government’s price controls will also likely mute inflation. The National Development and Reform Commission (NDRC), China’s top economic planning agency, announced in mid January 2008 that it will impose price caps on a range of products, including grain, edible oils, meat, milk, eggs and liquefied petroleum gas. Food producers and sellers must ask government permission before rising prices.

Increasing Consumption

FAS Beijing forecasts China’s year-on-year beef consumption in 2008 to increase by four percent to 7.68 MMT. The current estimate is two percent higher than the previous estimate in the last livestock annual report (CH7076) because of high economic growth, increased incomes, increased domestic slaughter, and large imports. In the last five years from 2003 to 2007, China’s GDP growth increased by 10, 10.1, 10.4, 11.1 and 11.4 percent respectively. It is expected to increase by 10.7 percent in 2008. Chinese urban per capita disposable incomes in 2007 increased by 12 percent to RMB13,786 ($1,942), while per capita rural cash incomes increased by 10 percent to RMB4,140 ($583). These changes have made outdoor dining or buying ready-to-eat products from supermarkets affordable. Most of the increase in consumption is expected to come from dining away from home and ready-to-eat products. Many Chinese do not cook beef at home because it takes more time and beef is used in fewer traditional dishes than pork and poultry.

Increasing Beef Imports

FAS Beijing forecasts China’s 2008 beef imports to increase nearly four-fold to 30,000 MT (CWE). This sharp rise from 2007’s 8,000 MT of carcass weight equivalence (CWE) is because of China’s slow domestic production and strong demand, with a peak likely around the Olympic Games. Some imported beef will go to state strategic reserves. Post estimates China’s year-on-year beef offal imports in 2008 to remain at least at 12,000 MT (production weight), the same level as the previous year. This includes both direct shipments and indirect shipments via Hong Kong. China has to import high-quality beef for high-end hotels and restaurants because domestic high quality beef production is very small.

Imports are expected to shift sharply in favor of inexpensive beef from South America, which can be half the price of U.S. product. In 2007, China’s average beef and veal import price was $4,663 per ton from the world -- but only $2,309 per ton from Uruguay. The average price of beef offal imports was $1,465 per ton from the world, but only $1,195 per ton from Uruguay. According to the Chinese meat industry, the President of the Brazilian Confederation of Agriculture and Livestock (CNA) confirmed on December 18, 2007 that China and Brazil reached an agreement in November 2007. Under this arrangement, China will import boneless beef from four Brazilian States, Rio Grande de Sul, Santa Catarina, Acre, and Rondonia. Industry sources claimed that the first shipment has already been sent.

Strong demand and short domestic supply, combined with China’s ban on beef imports from the United States have encouraged grey channel trade visa South China. In 2007, Hong Kong re-exported 435 MT of U.S. beef valued at HK$5.58 million (About US$1=HK$7) and 942 MT of U.S. beef offal valued at HK$3.425 million to Mainland China. This trend is expected to continue in 2008 due to the same reason.

China’s live cattle, frozen bovine embryos, and semen imports should move in the same direction as Post’s previous forecast in the last livestock annual report (CH7076). With U.S. and Canadian beef absent from the Chinese market for five years because of BSE-related restrictions, Australia and New Zealand have dominated China’s imports of both live cattle and beef supplies, accounting for almost 100 percent and 68 percent respectively via direct shipments in 2007. With many major suppliers blocked from the Chinese market, the Chinese are trying to find new trading partners to reduce prices.

Decreasing Beef Exports

This forecast revised China’s live cattle and beef exports in 2008 to fall by four percent. This change came from the last livestock annual report because of a shortfall in domestic meat supplies caused by the swine blue ear disease in China in 2006 and 2007. Two other factors may also explain this change. Live cattle exports are allocated by export quota issued by the Ministry of Commerce (MOFCOM) each year. Since the quotas are allocated by lottery, it prevents export prices from going very high. With higher production costs have squeezing profits; some traders are not interested in exports. In addition, the rising Renminbi also makes exports more costly.

Further Reading

| - | You can view the full report, including tables, by clicking here. |

List of Articles in this series

To view our complete list of Livestock and Products Annual, and Semi-Annual reports, please click hereMarch 2008