End Users 'Rattled' By Cull Cow Prices

US – Record cull cow prices have ‘rattled’ food service companies in recent weeks by mirroring the trend of fed and feeder cattle, according to two leading market analysts.Len Steiner of Steiner Consulting and Dr Steve Meyer of Paragon Economics say this coincides with US cow slaughter running 14 per cent below year ago levels.

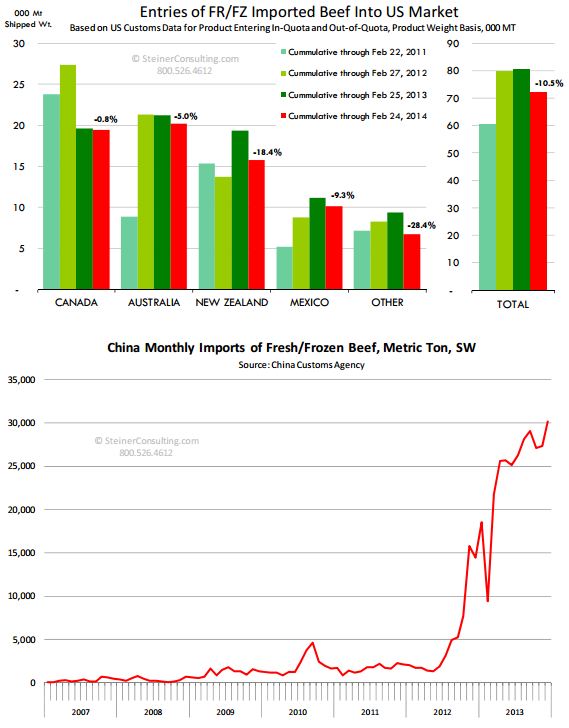

Contracting domestic cow supply and China’s developing presence on the global stage are combining to squeeze supplies, said Mr Steiner in the daily livestock report from the CME.

Fewer US dairy and beef cows are being slaughtered because of milk and livestock prices being so high, he added.

The result has been an all-time high of $250.68/cwt for 90 CL boneless beef – 16 per cent up on a year ago.

The pair listed multiple reasons for the spike and said the impacts would also be varied. However, Messrs Steiner and Meyer said the food service and retail markets will be hit the hardest.

In the CME daily livestock report, Dr Meyer said: “The sharp appreciation in lean grinding beef value has significant implications for a wide range of US end users.”

The pair explained the seasonality of cow slaughter – mostly happening in the autumn – and said that US demand could increase this spring, unsure of where prices could finish for March and April.

Imports may not provide the answer and fast food operators in particular could be exposed, they added.

“Most imported meat coming into the US, especially beef from Australia, New Zealand, Uruguay and Central America tends to be lean grinding beef.”

“Traditionally this supply accounts for a significant proportion of US lean grinding beef supply – especially for fast food operators.”

Another factor is China’s capacity to purchase slaughtered cows from drought-hit Australia.

Meanwhile, New Zealand's dairy cows are being retained to profit from record farmgate milk price forecasts amid strong global dairy markets.

Chart courtesy of Steiner Consulting

“Australian producers continue to struggle with drought conditions and slaughter numbers in the last few months have increased by around 15 per cent,” said Mr Steiner. “China has managed in a matter of months to become one of the largest world beef importers.”

The report described China’s beef imports at 1700 MT a month in 2011 and early 2012 and the rise to 28,000 MT a month in the last six months of 2013.

Mandatory Country of Origin Labelling rules are also a factor, said Dr Meyer, who added: “Cool rules have further limited the use of imported grinding beef at retail outlets.”

A stronger US dollar and high grinding beef prices would normally lead to an increase in US beef imports, but Mr Steiner said: “COOL rules will likely keep the spread between domestic and imported quite large.”

Michael Priestley

News Team - Editor

Mainly production and market stories on ruminants sector. Works closely with sustainability consultants at FAI Farms