European Beef Herd Increasing With Export Potential

New buyers are emerging for European beef and a larger herd is now in place to service that need.Europe's major beef producing countries are seeing cattle numbers lift, says the European Commission in its short term outlook.

While the May-June livestock survey 2014 gave a first indication of the stabilisation of the EU suckler cow herd, the December survey showed an increase by 1.3 per cent compared to 2013.

This increasing trend was already visible in the EU-N13, but it is now also the case in major EU-15 beef producing countries, like Spain (+ 114 000 heads) and France (+32 000 heads). The herd changes at Member State level are very diverse.

The main driving factors are: competition between beef and milk production for land and in terms of profitability, the demand for beef and the implementation of the voluntary coupled support in the beef sector under the new CAP (around 40 per cent of the total coupled support envelop will be allocated to the beef sector). The latter effect is probably most pronounced in Spain.

Before the 2013 reform of the CAP, the number of eligible suckler cows for a premium (1.4 million heads) was well below the actual number (currently almost 1.9 million heads). While the new CAP still foresees a limited number of eligible cows, the ceiling is above the current suckler cows herd size in Spain.

In 2014, total EU beef production4 is estimated 2.1 per cent above 2013, after several years of decline. This development is partly driven by the increase in the number of dairy cows and the consecutive higher availability of bovine animals5 . Secondly, additional dairy cows have been culled in certain Member States because of the downward milk price but also in order to limit the production above 2014/15 quota and the associated surplus-levies. In addition, lower feed costs and good forage quality resulted in slightly higher carcass weights on average.

The increase in number of heads slaughtered was higher in the EU-N13 (+10.0 per cent) than in the EU-15 (+1.2 per cent), but very similar in terms of tonnes (around 80 000). In Poland, where more than half of the EU-N13 beef production takes place, slaughterings went up by 21 per cent in 2014 compared to 2013, especially from cows (+29 per cent).

In 2015, total beef production could further increase by close to 2 per cent, as the EU production capacity has risen, some further culling of dairy cows is expected and prospects for internal and external demand are quite positive.

Slight Increase in Export Potential of Bovine Meat and Live Animals

In 2014, beef export volumes increased strongly (by 29 per cent or 46 000 tonnes).

This is mainly thanks to increased exports to Hong Kong, Western Balkans and the Philippines (new market). In 2015, other destinations look also promising, like the US given that Ireland got official clearance to export beef there (moderate volumes expected) and shipments to Turkey seem to resume slowly, in spite of some administrative issues (BSE certificates), pushing EU exports in 2015 to an expected level of 224 000 tonnes.

Exports of live animals were higher in 2014 than in 2013 (+5.4 per cent), representing more than one third of the volume of bovine exports. Lebanon remained the main destination for live animals (+45 per cent). Worth noting is the re-opening of the Turkish market and resuming of exports since October, which could change significantly the level of EU exports of live bovine animals.

Therefore, live exports are expected to further expand in 2015 to a level of 130 000 tonnes (c.w.e.). In 2014, EU beef imports from Argentina and Uruguay declined due to their internal policy restricting exports to limit consumer prices increase, while Australia and Brazil increased their supply to the EU market (+21 per cent and +3 per cent respectively), despite a huge US demand.

Even though the export potential of Australia is expected to be reduced in 2015, Brazil might take over their share as exports to Russia have not taken off as expected. As a result, EU beef imports should stay virtually unchanged in 2015.

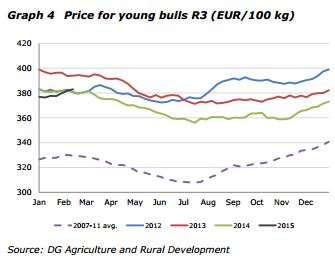

Beef prices were on a declining trend till July 2014 but they started to recover since then, and currently they remain well above the 2007-11 average. The EU beef price reached 383 EUR/100 kg by 15 February 2015 (see Graph 4).

World prices are to remain high because of tight supply, high demand in the US and Asia, and a temporary drop in the Australian production potential. In 2014, the higher beef availability on the EU domestic market allowed for a recovery of consumption of 10.5 kg/capita (in retail weight). This is expected to continue but the rising beef price could limit the upward move to reach 10.6 kg/capita in 2015 before going back to its declining trend.