Feedlot Profitability: What Will Happen in the Fourth Quarter?

Many have been surprised by margins made in the feedlot sector this year. However, a Kansas economist explains why things may not remain positive going into winter.According to data out of Kansas State University, high feeder cattle prices will be too much for feedlot margins, causing a positive year to end on a sour note.

The feedlot sector has long been noted to be in an unfavorable position of having excess capacity in the face of tight and dwindling feeder cattle supplies reflective of the multi-year decline in the U.S. breeding herd,writes Professor Glyn Tonsor of the Department of Agricultural Economics.

Given this backdrop, many analysts (including yours-truly) were not anticipating 2014 to be anything feedlot producers would be excited about. Counter to these expectations, feedlot returns so far in 2014 have been very positive.

The most recent estimates of closeouts offered in K-State's Kansas Feedlot Net Return series indicate steers sold in June at a profit of $197.44/hd(1). This marks the sixth consecutive month of closeouts with profits exceeding $125/steer which is something that has never previously occurred going back to 1993 when the current K-State analysis starts.

Moreover, current projections for closeouts during the July-September period are all over $200/steer. These positive returns essentially reflect the substantial increase in fed cattle prices relative to expectations when feeder cattle were purchased, at levels much lower than today's prices.

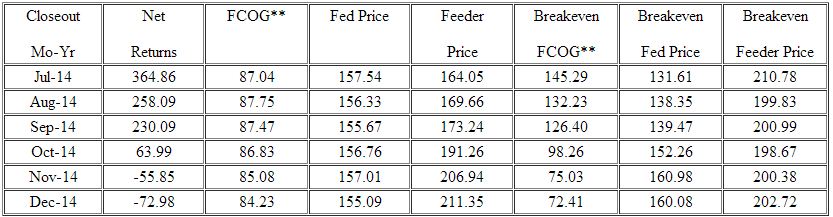

While this positive start to 2014 is certainly welcomed by feedlot operators, a word of caution follows current projections for animals scheduled to be sold later in the year. As shown in table 1, net returns are expected to turn much lower and actually negative in the fourth quarter. This sharp reversal reflects the notable increase in feeder cattle prices and the corresponding lack of further increases in expected fed cattle prices.

It is important to recognize the Kansas Feedlot Net Return series assumes a "hand-to-mouth" cash based process of procuring feeder cattle and corn as well as selling fed cattle. That is, the calculations purposely assume no risk management, forward pricing, or other strategies are in-place for feedyards.

While this approach is used to provide a benchmark over time for profitability trends, it fails to capture notable variability in feedlot specific situations and managerial approaches. This firm-specific variation is noteworthy as many operations likely have not realized the full magnitude of positive returns so far this year (e.g. they may have hedged fed cattle sales) or may have implemented some protection on upcoming closeouts (e.g. they may have hedged upcoming feeder cattle placements).