How Much You Can Pay For Bull

When looking at Bulls, remember that they could represent $150,000 in calf sales annually, advises a South Dakota beef specialist.

It’s bull-purchasing season! Purchasing an animal, especially a bull, should be considered an investment. Over the years, you have heard that you should be reducing your production and investment costs, writes Professor Julie Walker, a beef specialist at South Dakota State University.

It is time to make wise investments, which will improve your profitability. Purchasing bull(s) can be a large investment. Let’s determine what that bull is producing for your herd.

A 500-pound steer calf is bringing in excess of $1,000 (500 lb x $2.11/lb) currently (South Dakota Weekly Feeder Cattle Averages, week ending January 25, 2014). A bull retained for 5 years should produce a total of 150 calves (30 calves/year), which equates to $150,000 gross income. Is this the place to reduce investment?

The simple answer is no. We all are looking for good buys, however, saving a few hundred dollars now, may cost more in future revenue.

How much more can you pay for a bull with better EPDs (Expected Progeny Difference)? The definition of EPD is the prediction of how future progeny are expected to perform relative to the progeny of other animals.

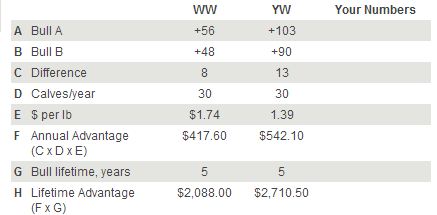

Comparing weaning weight of the two bulls in table 1, on average, bull A’s progeny would be 8 pounds heavier. Based on this additional performance, we can determine the additional revenue generated from progeny of the higher EPD bull.

What does the additional 8 pounds per calves generate in revenue? Table 1 shows the calculations used to determine the advantage for a specific bull. Assumptions are 30 calves per bull per year and the bull is retained for 5 years. Weaning price per pound ($1.74) was obtained from USDA Long-Term Agricultural Projection report and the yearling price ($1.39) was taken from Livestock Marketing Information Center.

At weaning, bull A has an advantage of $417 because of the additional pounds sold annually and $2,088 over its lifetime. In this example, even higher revenue was found if the rancher sold calves as yearlings. If bull A is $500, 1,000 or even $1,500 more to purchase than bull B, his EPDs indicate that you will receive that investment back at selling time. Jim Krantz has an article titled, Sale Catalog Information: Homework required, which discusses the homework you should complete before the sale.

He indicates that you should define the genetic parameters for your operations and then select bulls that meet your parameters. You now have a list of acceptable bulls you would consider purchasing, but they probably don’t have the exactly same EPDs.

So, this is the time to determine how much you can invest in a specific bull based on his reported EPDs. Completing this before the sale, allows you to have a good plan for purchasing your next herd bull(s).