Just Who Makes the Biggest Margins in UK Cheddar?

Just exactly who comes out the better off from the dairy supply chain is a hot topic and in this first installment, DairyCo analyses farm and processor margins on mild and mature cheddar.The beneficiaries of changes in price within dairy supply chains are a constant source of speculation within the industry. This report seeks to identify them within the Cheddar cheese supply chain, using information on farmgate milk prices and average gross margins made by processors and retailers on the sale of mild and mature Cheddar.

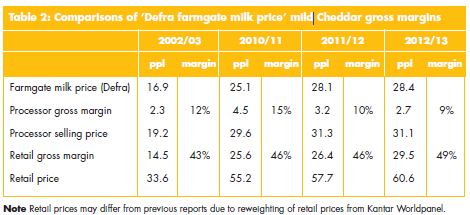

Average UK farmgate prices rose by 11.6 per cent in 2011/12 but in 2012/13 the average farmgate milk price only rose marginally by 1.2 per cent to 28.4ppl. Farmgate prices came under pressure when world commodity markets for dairy fats collapsed in the first half of 2012/13 due to a surge in global milk supplies.

Prices recovered through the second half of 2012 and early 2013 as adverse global weather conditions brought a sharp correction to the balance of global supplies to market demand.

Wholesale Cheddar prices remained largely stable, reflecting a well-balanced market with steady domestic demand, stronger export demand and lower domestic production, counteracting increased imports from the Republic of Ireland. When wholesale prices for fat-based commodities such as butter and cream collapsed in the first half of 2012/13, the values of protein-based commodities were less affected.

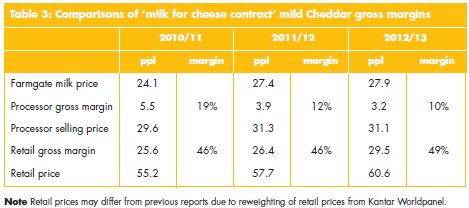

This was largely due to high demand for whey protein and a steady demand for cheese from the growth of ‘middle class’ consumers in emerging markets. With wholesale Cheddar prices over the past three years remaining stable, processer margins have been squeezed to absorb an increase in farmgate price during this period. This squeeze in processor margins may have been partially off-set by stronger returns from whey powder during this period.

Retail margins accounted for just under half of the retail selling price during this period. In 2012/13, retail margins for mild Cheddar increased to 49 per cent – the highest level recorded since this report began.

This was achieved on the back of substantial price increases within some major retailers for private label mild Cheddar. Retailers’ overall revenue has remained largely stable as the volume of sales has declined.

The overall revenue achieved by processors, however, is estimated to have declined on the back of lower volumes and static wholesale prices. At the same time, mature Cheddar sales have remained intensely competitive.

Higher value branded mature Cheddar has lost sales volume to lower-value budget varieties. During 2012/13, according to data provided by Kantar Worldpanel, retailers increased the number of temporary price promotions for branded mature Cheddar, although the overall discount offered was reduced.

Consumers, meanwhile, spent more at discount stores and on budget mild and mature Cheddar within major retailers. Whereas multiple retailers were able to increase the price of mild Cheddar, strong brand competition in the mature Cheddar category saw a slight fall in the net average retail price after taking discounting through promotional activity into account. Nevertheless, retailers still managed to retain a margin of 48 per cent on mature Cheddar.

The practice of selling forward on contract may be partly responsible for the lack of movement in wholesale prices on Cheddar markets. As such, the fall in processor gross margins may be a temporary feature of the market.