In Focus Economic Dairy Report

In the rural commodities wrap, NAB Agribusiness Economist Michael Creed discusses global dairy prices and the global supply outlook.Dairy prices continue slow correction

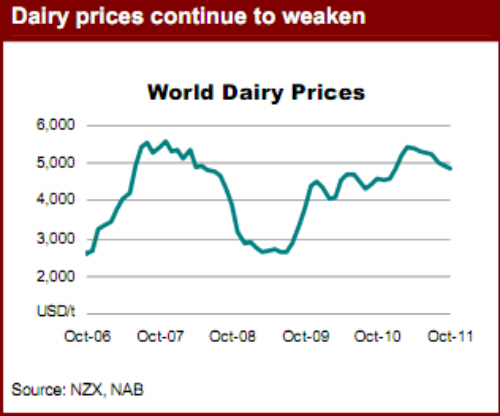

The peak in the recent cycle in dairy prices has well and truly passed, with prices having now declined for seven consecutive months. On a product weighted basis, average dairy prices in October were down 1.3 per cent in USD and are down 10.4 per cent since peaking in March. Driving price falls through the month were largely falls in anhydrous milkfat, casein and butter.

In contrast, prices for milk powders and cheese have been relatively flat in recent weeks. A steady production response has been the catalyst to falling prices. In the northern hemisphere, we have seen a fairly solid season out of the EU and US, both recording solid gains on last years’ production figures. Similarly, with the spring flush in full swing in Oceania, dairy production has generally exceeded expectations, placing considerable downward pressure on prices.

While a considerable exportable surplus has been building up in the big exporters, demand has not. Importantly, Chinese demand appears to have slowed, with the quantity of dairy imports down 10.3 per cent year-on-year in September while Russian dairy imports have also slowed through 2011.

Further weighing down dairy prices has been concerns on the macroeconomic front, with repeated downgrades to global growth and financial market jitters weighing heavily on all commodity markets. Nonetheless, despite the consecutive monthly declines, dairy prices are still strong and have held up reasonably well given the circumstances. In October, prices were 48.5 per cent above their average over the past decade, and up 6.3 per cent on a year earlier.

Looking ahead, dairy market fundamentals point to further price falls through the year. Oceanic supplies are surprising on the upside, with Australian milk production up 6 per centyear-on-year in September while New Zealand production is up around 13 per cent. With the Oceanic spring flush following a stronger-than-expected northern hemisphere season, the key question is who is going to absorb the exportable surplus.

Chinese buyers are likely to be buoyed by their tariff free window with New Zealand while South East Asian and Middle East buyers have shown solid demand for imported dairy products. However, this is not likely to offset the rising surpluses in key exporting nations this year. As such, we expect prices to continue falling, although the pace of price falls should be relatively moderate. We anticipate an end point price in our weighted average price of 4450 USD/t by June 2012 (was 4685.90 USD/t in October). In our view, much of the risk will be on the downside. Production in key exporters is rising at a time when there is considerable uncertainty on the macroeconomic front and this does pose some considerable tail risk to the prices.

Global Supply Outlook

New Zealand dairy is looking positive. The new season is already off to a flyer, with 13 per cent year-on-year growth rates on a daily basis being recorded early on. The milk flow has been so strong it bought a temporary increase (through to the end of the year) in tanker loading limits to help deal with the extra milk. But the initial very high year-on-year growth rates also reflect the shocker at the start of last season as a result of the wicked September storms. This being so, we do not expect the very high annual growth rates to apply across the season as a whole. Indeed, we anticipate annual comparisons to turn negative around March, given last autumn’s very strong production.

Overall, we anticipate milk production in 2011-12 to be up around five per cent on the previous season, fundamentally driven by more cows and through ongoing land conversions and recovery from previous drought helping productivity. Whatever the final amount of milk that is actually processed for the season, it will have a sense of it could have been a bit more if it wasn’t for the losses incurred due to the gas pipeline rupture.

Despite earlier concerns surrounding the hot and dry summer and rising feed costs, dairy production in the United States has shown a marked improvement in recent months. According to USDA statistics, US milk production was up 1.7 per cent year-on-year in September. This follows a 2.1 per cent year-on-year rise in August. Explaining the solid performance in recent months has been a significant lift in milk output per cow while the size of the US dairy cattle herd has expanded.

The USDA now expects the US cattle herd to average 9.2 million head for the year, up from 9.1 million head a year earlier. Reflecting these improvements, US milk production forecasts have also been upgraded, with US milk production now expected to come in at 88.9 billion litres in 2011, up 1.6 per cent on 2010. Looking to 2012, the USDA currently expects further expansion in US milk production, although the US dairy herd is expected to contract. Overall, the USDA expects milk production to increase by 1.3 per cent in 2012.

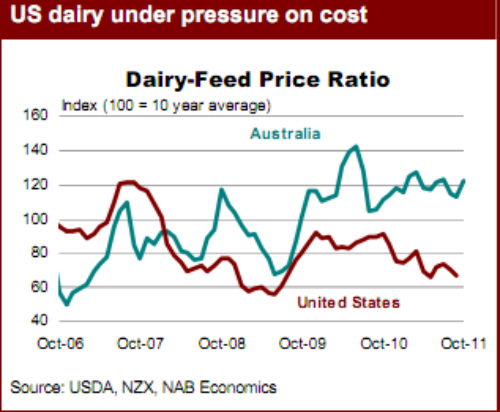

Despite the recent uplift in US production, however, dairy producers are still coming under pressure from external markets. Even with corn and soybean meal prices coming off recent highs, prices for feed remain restrictive. This is especially so with the continued high prices of alfalfa, hay and other forages. Reflecting this, the US milk-feed price ratio continues to track at around 30 per cent below its decade long average, suggesting producer margins are coming under considerable pressure.

Adding to producer woes, conditions in the two key oceanic producers (who make up almost half of all global dairy exports) favour a solid production outlook, while their competitive position is relatively strong. As opposed to the US, producers in Australia have access to relatively cheap feed, while there is ample fodder availability. The dairy-feed price ratio for Australia currently sits at 20 per cent above its decade long average. While not directly comparable to the US ratio, it does imply that Australian producers are more likely to keep margins positive in an environment of falling global prices for dairy. This could enticefurther dairy cattle herd reductions in the US than currently predicted.

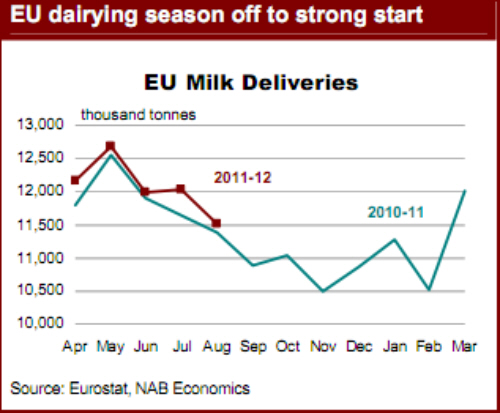

Similar to other key exporters, milk producers in the European Union have put in a solid season. In August, milk deliveries recorded in the EU were up 1.1 per cent year-onyear, with the 2011-12 dairying season shaping up to be the strongest in over five years. Driving the EU result has been a very solid performance by France, with dairy production in August up 9.1 per cent year-on-year. Similarly, Austria (up four per cent), the Czech Republic (up four per cent) and Ireland (up 3.4 per cent) have had a solid start to the year. Germany is also looking strong, with year-on-year growth up 1.6 per cent in August. In contrast, milk production in the United Kingdom and Italy has been lacklustre. Overall, we expect EU dairy production to increase by around one per cent on 2010-11 levels.