QMS Market Report - August 2010

After a seasonal bounce lasting from the third week of June to the third week in July Scottish deadweight prices have since fallen sharply again...Cattle

Prices and Supplies

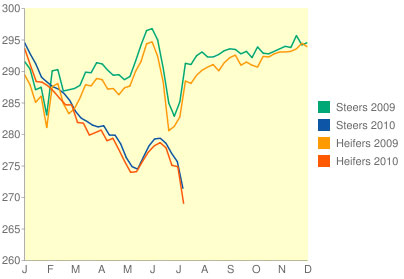

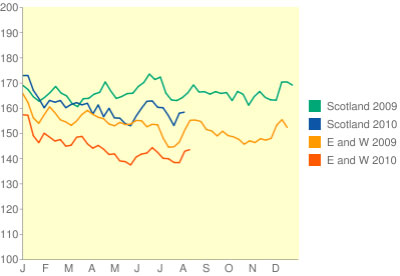

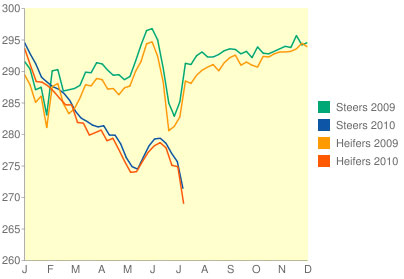

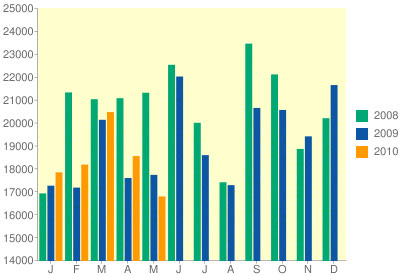

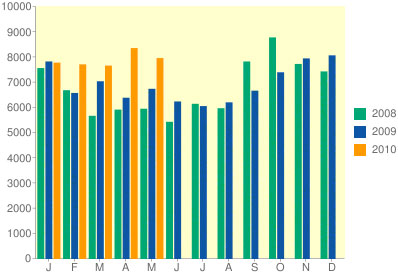

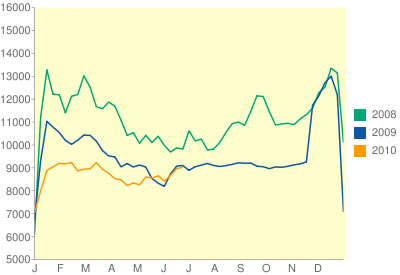

They appear to have moved back towards the downward trend that they followed from January until June. Until the end of July movements in prime cattle prices at auction had almost mirrored those of deadweight prices, but in the last couple of weeks they have diverged as auction prices have increased.

Scottish Deadweight Prices (p/kg dwt)

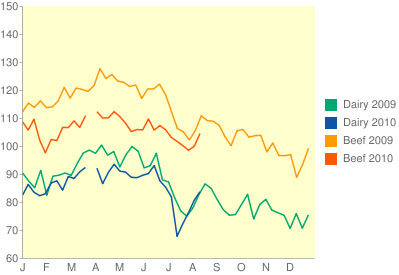

Cull cow prices now appear to be recovering from their seasonal dip in July. Nevertheless beef cow prices remain some 6% below year earlier levels, while dairy cows are now 3% cheaper than in the same week of 2009.

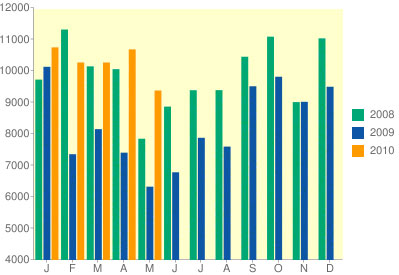

Lower cattle prices in 2010 than 2009 may be explained by UK and Irish slaughter statistics. In the first six months of 2010 UK abattoirs slaughtered 5% more prime cattle than last year and 9% more cull cattle. In contrast the Scottish prime cattle kill fell 0.6% in the first half of 2010, although supplies were abundant during June, while the cull kill was up by more than 6%. Irish cattle slaughterings from January to the week ending 7 August were more than 12% higher than last year, though in the last two weeks throughputs have fallen below year earlier levels for the first time in 2010. Higher slaughterings in the British Isles have meant that more product is available on the market and, combined with weak consumer confidence, this has held back prices.

Prime Cattle - Auction Prices (p/kg lwt)

The recent strengthening of sterling, from €1 = 90p in March to €1 = 83p in early July, is placing downward pressure on market prices by making Irish product more competitive at home and Scottish product less competitive in the European market.

Scottish Auction Prices for Cull Cows (p/kg lwt)

Irish prime cattle producer prices are now similar to last year after trailing year earlier levels by around 2% until June, although cows are still making marginally more than a year ago. Average prices across Europe are also very similar to last year but have been fluctuating in recent weeks.

Customs and Excise trade data shows exports to be far higher in the first five months of this year than in the same period of 2009. Exports increased by more than 14%, helped by upwardly revised April figures which had provisionally been lower on the year. Strong growth in deliveries to the Netherlands and Italy are reported with some growth to Germany and France as well. More fresh beef carcases are being shipped to Ireland but less frozen product so exports to Ireland in total are little changed.

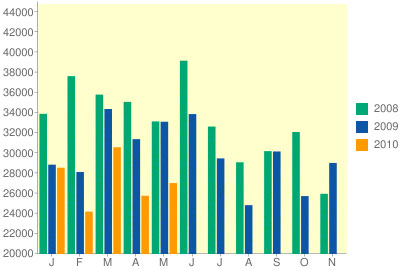

Clean Cattle Scottish Slaughterings - 3 week rolling average

In the January to May period imports of beef were around 2% higher year-on-year at 92,000 tonnes. However, a large increase in deliveries of fresh beef (up 11.2%), were almost cancelled out by a 15.5% decline in frozen product on the year. Ireland has supplied 15% more fresh beef but less frozen beef, in part explained by their abundant supply of cattle although some UK exports to Ireland may be returning as processed product.

News Roundup

Analysts in Argentina are expecting at least three years of tightened supplies as producers need to rebuild decimated herds. Current stocks are some three million head below the number required to fully satisfy demand in domestic and export markets. Improved producer prices have not yet convinced producers to rebuild their herds as they have little confidence in government policy. A new government initiative to prevent processors from going out of business and to protect jobs is to place a maximum on slaughterings at each plant. With each slaughterhouse having a limit, the hope is that business will have to be shared between plants securing jobs and capacity. Export restrictions are also going to be loosened with new quotas of 20,000t a month of bone-in beef and 30,000t a month of boneless beef. The policy of keeping 13 retail cuts cheaper than market prices in supermarkets appears to be failing as retailers are now increasing prices. It seems likely that the government has realised that the problem could become long-term unless it offers support to the supply chain. With beef being such a major part of the Argentine diet a shift towards being a net importer is unlikely to appeal to legislators.

Cattle Imports (Tonnes)

Despite expectations in Brazil last month that processed beef exports to the USA would resume, restrictions remain in place. Some processed Brazilian beef contained as much as 65 times the US regulatory maximum level of the drug Ivermectin. The ban was voluntary on the part of the Brazilians, but before exports can resume they must prove to the US that they will take steps to prevent contamination in the future. So far it is estimated to have cost Brazilian exporters around £45m in lost revenues, and with prospects of a quick resolution appearing bleak, it is set to cost a lot more.

On a more positive note for Brazilian exporters, a report by the European Commission’s Food & Veterinary Office (FVO) on the EU mission to Brazil in March shows improvements in the country’s traceability and abattoir inspection systems. One concern raised was that large numbers of cattle were missing one of their two ear tags. Although this meets Brazilian traceability regulations, EU requirements are more stringent as this practice could mean unidentifiable cattle on EU-approved farms. The FVO also recommended that internal certification measures are checked more closely, otherwise they could lack credibility. Continued progress by the Brazilian beef industry is likely to increase its access to the EU market, which has been limited by strict controls for the past two and a half years.

Cattle Exports (Tonnes)

Morocco has reopened its markets to Irish beef and live cattle after banning them in the mid-nineties during the BSE crisis. The same procedure will be used as for exports into the EU, with BSE-negative cattle over 48 months of age being granted access while tests will be waived for beef from animals under four years of age.

After three months of restrictions FMD controls have now been removed in Japan’s Miyazaki prefecture on the southern island of Kyushu. Measures adopted during the outbreak included banning the movement of livestock inside a 10km exclusion zone around affected farms, and the prevention of shipping livestock from farms between 10km and 20km away. Some 220,000 cattle and 68,000 pigs were culled as a precaution and it may take farmers a considerable amount of time to restore their herds. Stock rebuilding is expected to be allowed from September and Japan will apply for FMD-free status later in the year.

Pigs

Prices and Supplies

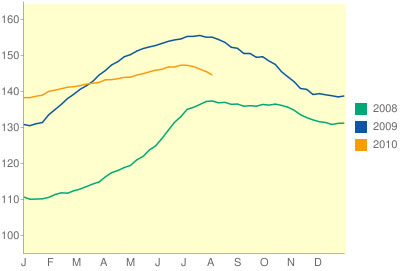

Producer prices have continued to fall into August and the rate of decline has steepened since the end of July. After stabilising in May and June the price differential with last year has now widened to 6.4%. The deadweight average appears to have peaked three weeks earlier than in 2009 and producer prices are expected to fall slowly to the end of the year. With feed costs likely to rise at a time when prices are falling seasonally, due to a spike in global wheat prices, producers face shrinking margins in the remainder of 2010.

Pigs DWT Adjusted Euro Spec Average (p/kg)

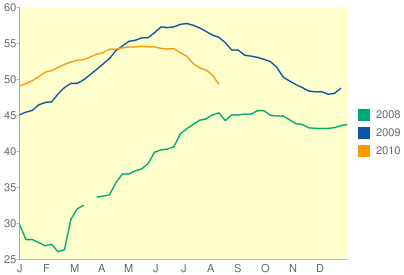

Like the DAPP the weaner price has fallen sharply over the last month. As a result the gap with its year earlier level has become quite pronounced in recent weeks. Downward pressure on prices in the last two months may be attributed to increased weaner availability.

Cull sow prices stabilised in July and are trading in a range between 95p/kg dwt and 100p/kg dwt. As the Euro strengthened against the pound in mid-July demand from mainland Europe improved, though prices remain more than 20% behind a year ago as production volumes are around 14% higher.

30kg Winner Pigs - GB (₤/head)

After two months of strong growth in the average European pig price it has flattened out in July. Over the month it fell marginally to begin August at €1.50/kg. The average price closed July 4.2% lower than a year ago. The premium between producer prices in the UK and on the continent declined to 13%, as the UK reference price fell more steeply over the month. The EU average price appears to have reached its annual peak a couple of weeks earlier than in recent years, and is expected to continue declining slowly through the remaining months of 2010.

In the final two weeks of May, Scottish slaughterings of clean pigs exceeded their year earlier levels after trailing 2009 throughputs in every week since the start of 2010. The average weekly kill in May was 10,500 head, approximately 150 head higher than in May 2009. In June throughputs fell back below 2009 levels by 12%, and for the first half of the year slaughterings were 8.2% behind H1 2009.

In the first half of 2010 UK clean pig slaughterings were 6.2% higher than in the corresponding period a year earlier at 4.5m head. Throughputs in June exceeded those of June 2009 by 2.5%.

Clean Pigs Scottish Slaughterings - 3 week rolling average

UK sow slaughterings were up by some 9.5% for the first half of the year compared with the same period in 2009. In the month of June throughputs were 6.3% above year earlier levels.

Compared to the first six months of 2009, overall UK production volumes rose by 7.9% year-on-year to 370 000t due to the combination of a greater number of slaughterings and higher average carcase weights. Production was nearly 7% higher in the first quarter and then approximately 9% higher in Q2. In the first quarter the dominant factor was increased carcase weights whereas in the second quarter increased throughputs had a greater impact on production volumes. Carcase weights, which have already fallen back from their highs in Q1, are expected to fall further as rising feed costs will penalise producers that hold on to their pigs for too long. This may lead throughputs higher than expected over the next couple of months.

May 2010 pigmeat exports exceeded those of the same month the previous year by 42% and were higher than in the same month of any year since at least 2002. For the first five months of 2010 export figures continued to look extremely positive, at 29.5% more than the January to May period of 2009. They also exceeded exports for this period dating back to at least 2002. With the pound on average 2.5% stronger over the period and consequently weakening the UK’s competitive position compared to last year, the substantial increase in exports is positive news for the industry.

In May, pigmeat imports continued to be lower than in the same month of 2009. Provisional May import data shows supplies were down more than 18% year-on-year. For the first five months of the year volumes show a 12.7% decline compared to the same period in 2009. This is despite the relative strength of the Sterling exchange rate making imports from Europe cheaper in Sterling terms this year

News Round up

German pigmeat exports for the January to May period were up by 2% year-on-year. Overall deliveries to other EU nations fell, but were more than offset by gains in sales to Russia which increased by nearly a quarter to 118,000t. Demand also strengthened in its two largest EU export markets of Italy and the Netherlands, with exports increasing 2.5% and 4% respectively. However, it has lost share in the EU market to Denmark as currency movements improved Danish competitiveness.

Pork Exports (Tonnes)

The July pig census in Denmark showed that despite a year-on-year reduction in sows of almost 2% the total pig population expanded by 0.7%. This can be explained by improved sow productivity. As prices rose nearly one-third between January and June it suggests that profitability within the country’s pig sector is improving. However, production still remains challenging and a more than 3% decline in in-pig gilts reflects this suggesting that the breeding herd will fall further in the year to July 2011.

The US pigmeat sector has received a major blow as President Obama’s request for £9m worth of funding for a national traceability scheme was overlooked by Senate and House agriculture sub-committees. The National Pork Producers Council is worried that US pork producers will suffer from a competitive disadvantage in global trade since importers are beginning to demand traceability as a condition for access to their market. A further concern is that without traceability disease eradication will become harder. Meanwhile Korea is set to introduce a national traceability scheme for all its 9,500 pig farms as a disease prevention measure.

Pork Imports (Tonnes)

In the first half of 2010 Japan imported 383,000 tonnes of pigmeat, 4% more than in the first half of 2009. Within this total, fresh imports fell 8% while frozen deliveries increased by a tenth. With the Euro weakening over the period frozen product from the EU became more competitive and Japan imported 11% more EU pigmeat on the year. The US and Canada also sent more frozen pigmeat to Japan compared with a year earlier.

A new pigmeat processing plant is to be constructed in north-eastern China’s Jilin province. The plant is expected to cost meat company Zhongpin an initial £40m and should be fully operational by early 2012. The company hopes for an annual throughput of 1.2m pigs, with an output of 125,000 tonnes of meat. More than half of production is set to be fresh pork, while 20% will be frozen pork. Processed pork products will make up the remaining 25%.