The Beef Complex - Revenue, Volatility and Policy Keys to 2009

New Year's always marks an accounting of the previous year's events. Subsequently it also ushers in a look ahead for the next twelve months, writes Nevil Speer, Professor, Animal Science, Western Kentucky University - published by the Ohio State University Extension Beef Team.Accordingly, last year I outlined three key factors for the beef complex in 2008: consumers, corn, and capacity. The coming year will likely prove to be largely the "same..but different" - 2009 will be marked by variations on those themes. Namely, it will be year defined by revenue, volatility and policy.

To begin, none of us need to be reminded about the current economic slowdown. It's THE story of 2008 and certainly present at the forefront of everyone's mind. What makes this recession different, though, is its convergence on the consumer. Interestingly enough, Gallup reported a year ago that nearly 75% of Americans intended to reduce debt in '08. And indeed they've made good on those intentions; the Federal Reserve reported (December) that aggregate household debt had declined as of September 30 - the first such decline ever recorded by the Fed. Most importantly, that response indicates a spending slowdown across the consumer front. And as noted last month, the spending trough may prove to be deep and enduring as consumers retrench while undergoing fundamental transformation relative to their purchasing habits.

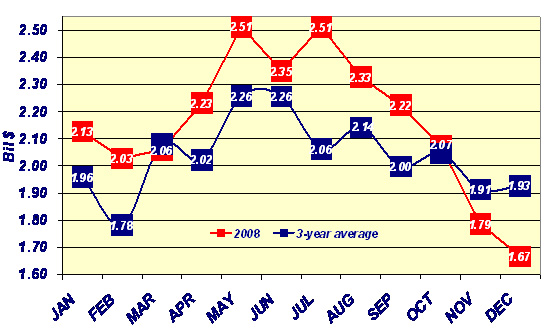

Consumer behavior is especially important as it relates to food expenditures. The beef complex is not immune to that effect from both perspectives: volume (less beef being purchased) and value (trading down when purchasing). That's an important influence (both domestically and globally) because it means less overall revenue available to the industry. The first illustration below represents monthly revenue available to the feedyard sector; a function of total marketings and average fed price. Note that since the economic stimulus effect ran its course the beef complex has experienced a sharp decline in net sales. That's a troubling trend and portends an industry which will have to contract. At the very least, less revenue coupled with tightened cattle supply will further tighten the noose around the feeding and packing sectors already burdened by overcapacity.

Second, the corn market's influence isn't going away anytime soon. Granted the market has moved sharply lower from previous highs established earlier in the year. Simultaneously, though, the market has rebounded from early-December lows. Much of the market's ebb and flow is dictated by the ethanol industry: ethanol production has steadily climbed higher and now represents 38% of the nation's domestic corn use. Comparatively, livestock feed represents approximately 50% of the nation's total usage (down from 75% back in 2002).

Regardless of the market's overall level, end-users need to prepare themselves for continued volatility. In the period between 1997 and 2006 the maximum weekly fluctuation in the corn market (basis Omaha) was generally 20-to-25 cents during any given year. That ratcheted up to 50 cents in 2007 and broached $1.00 in 2008. And despite some recent proclamations of decoupling, corn no longer operates within its own market fundamentals (please see January's AgSight for additional perspective). Moreover, increased demand places the complex in an ever-more tenuous position in terms of annual carryover.

The end result is continued turbulence. Furthermore, economic recovery won't be a smooth transition. It will occur in fits and starts. That means oil prices will continue their ups and downs pulling corn and all other commodities along for the ride, not to mention changing capital structure and subsequent liquidity within the industry. All considered those have especially important ramifications for cattle feeders. Careful decision-making and risk management has never been more critical - a wrong decision on any given week could prove very costly!

Lastly, the beef complex now faces a myriad of issues going forward that will influence business operations. To begin, the JBS purchase of National Beef will become increasingly contentious and drawn out - it's a sentinel case reflecting sharply divergent views on the industry's shape and how business operations should operate in the United States. Meanwhile, formal complaints with the World Trade Organization from our two largest customers, Canada and Mexico, regarding mandatory COOL adds to the mix and represents another issue not likely to be resolved any time soon. Lastly, 2009 will witness phasing in of President-elect Obama's administration; there'll be lots of uncertainty about implementation of new policy priorities.

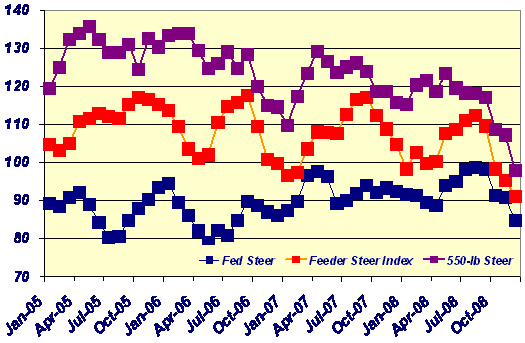

What's the bottom-line? 2008 ended on somewhat of a sour note; market trends were in a negative direction (see graph below) and 2009 will probably include some tough days ahead. But then again that's nothing new. Repeatedly over the years, somehow, someway the beef complex has risen to the occasion and proven itself to be remarkably durable and resilient!

Aggregate Monthly Feedyard Revenue (bil $)

Based on 1250 lb Steer/Heifer

Monthly Average Cattle Prices ($/cwt)

Price Summary

| Item | Week Ending: | ||||

|---|---|---|---|---|---|

| 1/2/09 | 12/26/08 | 12/19/08 | 12/12/08 | 12/5/08 | |

| Slaughter Steers ($/cwt) | NT | 84.76 | 82.73 | 84.89 | 86.30 |

| Choice Cutout ($/cwt) | 143.49 | 144.21 | 143.08 | 143.13 | 148.18 |

| Select Cutout ($/cwt) | 135.55 | 134.93 | 134.82 | 133.57 | 138.65 |

| Hide and Offall ($/cwt) | 6.35 | 6.19 | 5.99 | 6.06 | 6.96 |

| USDA Slaughter Weights (lb) | 1306 | 1307 | 1306 | 1306 | 1303 |

| USDA Steer Carcass Weights (lb) | 851 | 852 | 856 | 855 | 850 |

| CME Feeder Cattle Index ($/cwt) | 92.92 | 91.30 | 91.31 | 89.65 | 91.17 |

| Cow Cutout ($/cwt) | 108.10 | 101.53 | 98.46 | 98.65 | 100.96 |

| Corn (basis Omaha: $/Bu) | 4.00 | 3.86 | 3.68 | 3.63 | 3.23 |

| Cattle Harvest (000 head) | 507 | 450 | 595 | 607 | 621 |

| Beef Production (million lb) | 396.1 | 352.8 | 466.2 | 474.8 | 484.2 |

January 2009