India Livestock and Products Annual 2008

By USDA, Foreign Agricultural Service - This article provides the livestock industry data from the USDA FAS Livestock and Products Annual 2008 report for the Voluntary Annual Report from India. A link to the full report is also provided. The full report includes all the tabular data which we have omitted from this article.Report Highlights:

Post forecasts CY 2009 beef (buffalo meat) production to increase by 4.5 percent to 2.7 million tons. The buffalo meat export forecast for CY 2009 is increased to 850,000 MT (Carcass Weight Equivalent), up from CY 2008 by 40,000 tons on account of growing international demand and the cost competitiveness of Indian buffalo meat. Current GOI sanitary conditions effectively prohibit imports of poultry, swine meat and meat products from many countries, including the United States. Imports of beef products are banned in India.

Section I: Situation and Outlook

Production

The cattle1 population for CY 2009 is forecast at 281.4 million head, continuing the multiyear declining trend. However, the decline is specific to the cow population only and not to buffalo population. Tractors are increasingly replacing bullocks (male cattle) in field operations and dairy farmers are replacing low producing native breeds of cows with a smaller number of high milk-yielding crossbreds and buffalos. Higher milk yield, which is considered as a premium for high-fat milk, and a ready market for male and unproductive buffaloes in the meat sector are the major reasons behind the decline in the cow population. Post forecasts the CY beef2 production up by 4.5 percent to 2.7 million tons as it is cheapest compared to all other meats. Demand for Indian buffalo meat is gradually growing in export markets due to its cost competitiveness, perceived organic nature and proportion of less fat. Indian exporters have been able to meet international demand by utilizing modern integrated abattoir and meat processing facilities thereby working to improve the quality of Indian product. Among the categories of meat, poultry meat is the fastest growing animal protein consumed in India with an estimated year-to-year cumulative average growth rate of 13 percent. Meanwhile, the growth rate for buffalo meat production is also impressive at around five percent. Sheep and goat meat production has remained relatively stagnant and supply has failed to keep pace with increasing demand. As a result, goat and sheep meat is the most costly meat among all categories.

The animal husbandry and fisheries sector provides employment to 23.68 million people. According to the Central Statistical Organization of the Government of India (CSO), the value of output (at current prices) from the livestock and fisheries sector was around $62 billion during the Indian Financial Year (IFY) 2006/07. The livestock and fisheries sectors together contribute 31.7 percent to India’s agriculture production value (value of output) and are the major sources of income for small and marginal farmers. Additionally, the livestock and fisheries sector had a share of 5.26 percent in the total GDP during 2006-07. India has the world’s largest livestock population. However, India’s share in the world meat trade is minimal (except beef) and meat processing levels are below other major meat producing countries.

Animal slaughtering for domestic consumption is mainly carried out in slaughterhouses approved by the municipal corporation (a local regulatory body) and small corner shops. According to the Animal Husbandry Statistical Database of the Department of Animal Husbandry, Dairying and Fisheries (DADF), there are a total of 5,520 recognized and 4,707 unorganized slaughterhouses in the country as of 2006. Livestock trading in India is done in livestock markets, which are regulated by state governments. Nonetheless, supervising direct operation of the markets is the responsibility of local authorities such as municipal corporations. There are also some privately owned markets and the model Agricultural Produce Marketing Act (APMC) has a provision for running private livestock markets.

Buffaloes can be used for milk production, meat, and also as a work animal for small and marginal farmers. Small and marginal farmers in India mainly rear cows and buffaloes as this ensures a sustained means of income during the year. The milk obtained from buffaloes is high in fat and therefore attracts a premium in the Indian market, as consumers prefer high fat milk. Animal maintenance costs are also lower for buffaloes as compared to dairy cows. India has the famous Murrah variety of buffalo, which has a high milk yield, is a hardy breed that easily withstands diverse weather conditions, and easily gains body weight on readily available green fodder. The buffalo carcass has less fat and bone and a higher proportion of muscle than an Indian cow carcass. Additionally, buffalo meat, unlike cow and pig meat, has no religious taboos attached to it and is therefore freely consumed in the domestic market among meat-eating consumers. Meanwhile, indigenous breeds of nondescript cows have lower milk yields and cow slaughter is not legally permitted in many states with the exception of Kerala, West Bengal and some Northeastern states. For these reasons, the buffalo population has been growing faster than the cow population over the past several years.

Animal husbandry, like other agricultural sectors, is a state subject and therefore each state has its own set of rules and regulations. Some state municipal corporations either prohibit street slaughter or have imposed standards for meat marketing, hygiene and registration. However, much effort is still required to ensure complete implementation of the rules to further organize the meat industry.

Indian Meat Production (Category-Wise Share)

Note: The data is derived from meat production estimates from the recognized (official) sector and trade flows.

Impact of Rising Feed Prices on the Livestock Industry

The feed and fodder requirement for dairy animals is primarily met by green fodder and home made mixtures. According to industry estimates, 60 percent of the cattle feed requirement is met through deoiled cakes and green fodder, 28 percent by home -made mixes and only 12 percent by manufactured compound feed. Out of the total production of coarse grains (maize, bajra, sorghum and millets etc) about 10 percent is currently used for livestock feeds. Therefore, the rise in beef prices is not as abrupt as in the case of poultry (see the table on ‘Retail prices of meat categories’ on page 7). Dairy cooperatives in India supply low cost compound feed to farmer members while private feed manufacturers mainly cater to the requirements of farmers with independent operations and the buffalo meat industry. The price of full cream milk was revised to Rs 25/kilogram recently compared to Rs. 22 / kilogram at the start of the current year in the Delhi market. Prices of compound feed for dairy animals have increased due to high oilmeal prices, which have increased significantly on account of reduced domestic availability resulting from increased exports. According to the Solvent Extractors Association of India, oilmeal exports from October 2007 through June 2008 were a record 5.4 million tons, up by 23 percent over the corresponding period of last year. Peanut and soy meal exports were also higher by 77 and 36 percent respectively due the competitive pricing of Indian meal.

Additionally, the increasing feed ingredient prices have affected the profit margins of the poultry industry which is largely vertically integrated, as poultry industries have established good marketing networks and have developed backward linkages with farmers. Rising costs of the key poultry feed ingredients (corn and soybean meal) has greatly increased the cost of production of poultry products. According to the industry estimates, feed costs account for about 60-70 percent of the total cost of the poultry production. The National Egg Coordination committee (NECC) records show that egg and broiler production costs have increased significantly in the last 12 months from Rs 0.9/Rs 1 to Rs 1.80/Rs 1.90 per egg and from Rs 27-28 per kg to Rs 40-41/kg for broilers. Furthermore, the increase in feed ingredient costs has adversely affected the profitability of poultry operations as producers are mostly unable to pass on the higher costs due to the price sensitivity of Indian consumers.

On July 3, 2008, the GOI imposed a ban on maize exports from India until October 15, 2008. The complete text of the notification can be seen at: http://dgft.delhi.nic.in/ . The move was undertaken to address repeated requests from the poultry industry to ensure availability of corn in the domestic market and to check further price increases of this essential poultry feed ingredient. Maize prices increased significantly by 30 percent earlier this year from Rs. 7,100/MT in January to Rs. 9,260/MT in June in one of the major markets in Karnataka despite of good crop harvest in 2007/08. Maize prices have not been depressed by the GOI’s export ban as spot prices for maize in some of the major markets of Karnataka were noted to be at a record high of Rs. 11,000/MT in the month of August because of strong domestic demand. According to price data compiled by the Solvent Extractors Association, soymeal prices registered a 38 percent increase from Rs. 15,232 / MT in January to Rs. 21,000/MT in August. The poultry industry has also approached the government to request a ban on oilmeal exports but the government has not acted on the request to date.

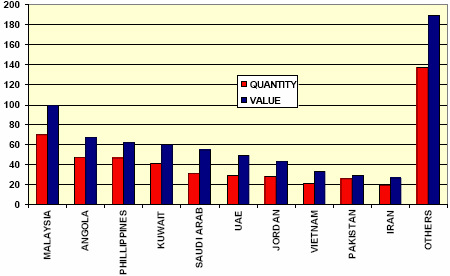

Livestock, poultry and related products accounted for export earnings of $1.3 billion during 2006-07. Beef (buffalo meat) is the largest meat segme nt exported out of India and international demand for buffalo meat is growing. India is cost competitive in buffalo meat but further improvement is needed in India’s cold chain infrastructure in order to increase competitiveness. The beef export and consumption estimates for CY 2007 and 2008 have been revised to reflect government trade statistics. The buffalo meat share in total meat exports from India is more than 90 percent (in value terms) followed by a three percent share of sheep and goat meat. Exports of pork, poultry meat and processed meat are negligible. According to trade sources, the majority of buffalo meat exports (90 percent) are boneless and the balance is shipped as carcasses. Malaysia and Jordan are the major markets for specialty and Halal buffalo meat whereas some South East Asian countries have growing institutional demand for processed buffalo meat products such as sausages and salami.

Indian Bovine Meat Exports - IFY 2006/07 ('000 Tons, $ million)

The export of meat and meat products is handled by 15 export-oriented modern combined slaughter houses and meat processing plants registered with the Agricultural Processed Food Export Development Agency (APEDA), Ministry of Commerce. Additionally, there are about 35 meat processing and packaging units (out of which 12 are registered with APEDA), which source dressed carcasses from the government approved municipal slaughter houses for export. The GOI has proposed a financial outlay of $250 million to fund the program ‘Salvaging and Rearing of Male Buffalo Calves’ for the purpose of increasing meat production during the 11th five year plan (2007-12).

Footnotes

1 Cattle population includes buffalo

2 Beef refers to buffalo meat

Further Reading

| - | You can view the full report by clicking here. |

List of Articles in this series

To view our complete list of Livestock and Products Annual, and Semi-Annual reports, please click hereSeptember 2008