Domestic and Foreign Demand - Foreign Demand for US Beef Continues to Grow

By Shane Ellis, Iowa Farm Outlook. Domestic pork supplies will be at record highs in the fourth quarter of this year, while beef production will be down from a year ago.As detailed in the ISU Hog and Pig report summary a few weeks ago, there will be a tide of hogs going to slaughter now through the first of next year. Cattle on feed numbers, however, are down considerably from the fall of last year. Expectations are that September placements were up considerably from last year, marketing lower, while the inventory remains several percentage points lower than a year ago.

Domestic Demand Outlook

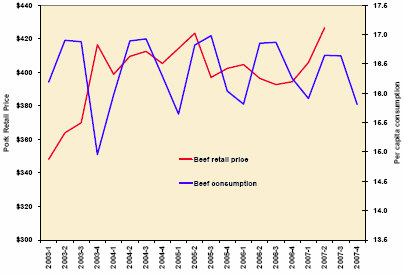

US consumers have not been demanding beef quite like they used to. Although “high protein, low-carb” diets are still widely utilized, their popularity has dissipated somewhat. Figure 1 compares quarterly beef prices with consumption. There has been a general tightening in the margin of consumption throughout the year. Consumers are eating beef on a more regular basis, while still responding to increases in price. In the fourth quarter, and the first quarter of next year, consumption will trend downward. With beef supplies fairly steady in the market, demand will be the key source of market support and variability. Retail beef prices for the rest of the year will follow the usual seasonality, but consumption is expected to be down considerably in 2008.

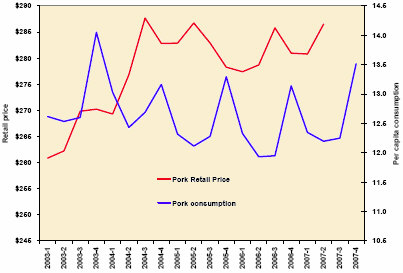

The pork market, on the other hand, is dealing more with steady demand and increased supply. Pork retail prices may reach a three year low as extra supplies come available. Consumption, in turn, is expected to reach a three year high. Competing meat prices, beef and poultry, are considerably higher than they were a year ago. So a sign of softening pork prices should draw the attention of consumers. Figure 2 demonstrates the pork price and consumption behavior since 2003. Pork prices have been on a new plateau since 2004. Beginning this quarter, that plateau will shift lower as pork supplies catch up with demand. On an added note, hog packers may have an upper hand on negotiated hog prices, adding to the expectation that live hog prices will be lower in the fourth quarter.

Foreign Demand for US Beef Continues to Grow

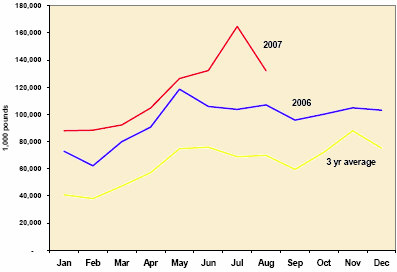

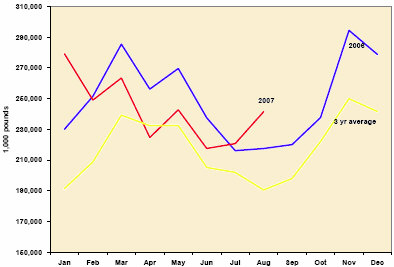

Beef exports are up 25% from last year. The largest growth in beef exports has been in Japan and South Korea, as when a quantity goes from nothing to something it is a significant increase. Exports to Canada have increased 38% from last year, which is to be expected, with 21% more Canadian feeder cattle being finished here in the US. On the other hand Mexico, our largest beef customer, took in 12% fewer beef and sent us 19% fewer feeder cattle. Figures 3 and 4 compare current beef and pork exports with the volumes of the past year and three years. Pork exports so far this year are actually 1.3% lower than in 2006, with a 38% percent decrease in exports to Mexico being the main reason for the drop in pork exports. Most other pork exports are steady to slightly higher. In short, foreign demand is fairly strong and will continue to grow as the global economy grows and foreign currencies gain buying power against the dollar.

October 2007