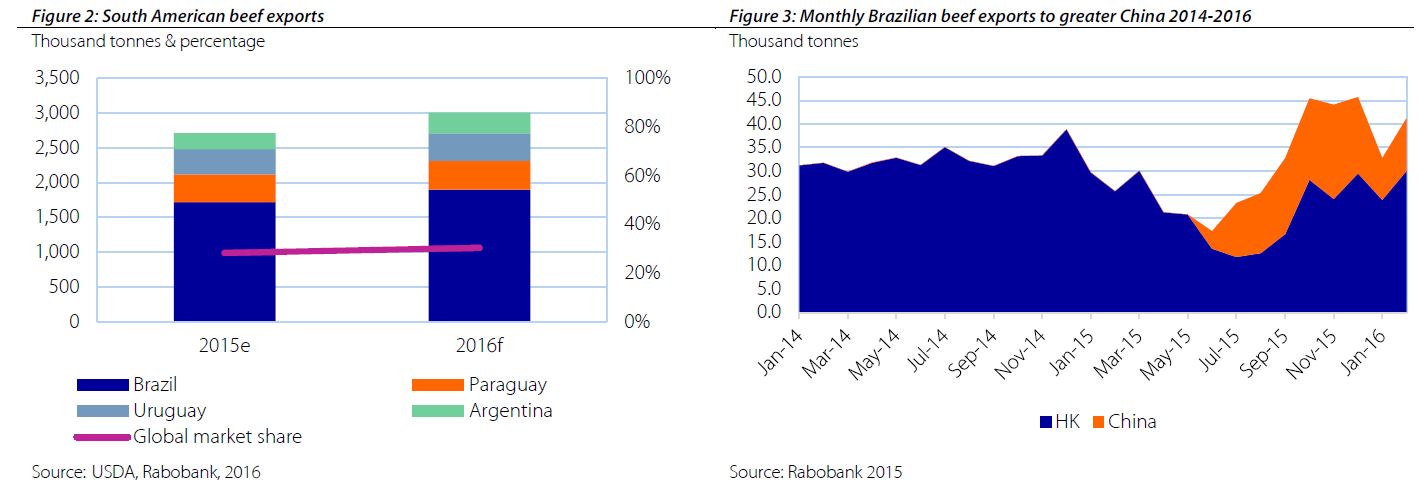

Brazil's Beef Exports to Rise as China Doubles Volume

ANALYSIS – Despite domestic challenges, South America's beef exporters are set to increase exports by an estimated 11 per cent in 2016, according to the Rabobank global beef quarterly report. This increase is due to favourable currency conditions, better access to importing countries and more beef.

This increase is due to favourable currency conditions, better access to importing countries and more beef.

While Brazilian consumers are seeing their purchasing power decline, local beef prices remain high and local consumption is expected to falter.

On the supply side, cattle producers have been encouraged to maintain cows in their herd rather than sending them to slaughter — a result of high calf prices driven by low calf availability.

This is expected to bring about improvement in calf and feeder cattle availability in the second half of 2016, but beef supplies are expected to improve until 2017.

Meanwhile, the weaker currency has made Brazilian beef very competitive on international markets, and strong global demand has pushed local market prices higher.

The resulting high domestic beef prices have pushed consumers towards cheaper competing proteins, such as poultry, freeing up additional beef for exports.

The Chinese market is also opening up to Brazil, with five more plants opening access recently which bring the total approved plants to 16. Brazil is expected to double their export volume in 2016 to China, shipping about 200,000 tonnes. This increase would rank Brazil as the top beef exporter to China in 2016.

"The existing Hong Kong market is expected to maintain beef imports from Brazil above 2015 levels. As a result, Brazilian beef exports are forecast to grow by 10 per cent during the first half of 2016," said Justin Sherrard, Rabobank Strategist, Animal Protein Global Sector Team, in the report.

"Meanwhile, the possible first fresh beef shipment to the US during the first half of 2016 is likely to support an even higher growth rate for Brazilian beef exports in the second half of 2016."

Other regional highlights from Rabobank's Beef Quarterly report:

- Despite a slowing economy, official Chinese imports of beef continue to increase. China’s official beef imports surged by 60 per cent YOY in 2015, reaching 473,000 tonnes.

- Supplies are drying up as Australian beef production is expected to remain low in the first half of 2016.

- The USDA’s outlook report released on February 25th forecast that US imports of beef and veal will drop by 24 per cent to 900,000 tonnes.