China Livestock and Products Semi Annual Report 2009

China’s 2009 beef production is expected to decline two per cent to six MMT, as low beef producer returns dampen growth, according to the USDA Foreign Agricultural Service.Executive Summary

China maintains a ban on U.S. bovine products, including beef and live cattle due to BSE-related restrictions. Post expects China’s 2009 breeding cattle imports to increase by seven per cent to 16,000 head as a result of China’s stepped up efforts to improve dairy genetics. Post forecasts 2009 Chinese direct imports of beef will decrease by 10 per cent to 9,000 MT, primarily due to slow sales of highend products. Significantly higher quantities of imp orted beef will continue to move through gray channels. Post believes China’s live cattle and beef exports in 2009 to decline by nine and 12 per cent to 30,000 head and 52,000 tonnes respectively due to an impact of world-wide financial crisis.

Post forecasts China’s pork production in 2009 will rise by four per cent to 48.7 MMT (CWE). Lower pork prices will fuel higher consumer pork demand compared to 2008 levels. China’s breeding swine imports are expected to decline 25 per cent from last year’s record imports to 9,000 head as lower prices hinder growth in piglet and fattening swine placement. Post forecasts China’s 2009 live swine exports to rise three per cent to 1.7 million head. Post forecasts China’s 2009 pork exports to decrease by six per cent to 210,000 tonnes due to weak demand from export markets impacted by the world financial crisis.

In January 2009, seven Chinese government agencies announced a swine price alert system and subsidy program designed to ensure pork producers earn sufficient returns as prices fall and/or input costs rise. This is the first time government agencies have joined forces to monitor pork producer returns and ensure farm-level incentives are maintained, underscoring the importance the government is placing on providing stable and sufficient pork supplies.

Beef Production to Decrease

Post forecasts China’s beef production in 2009 to slide two per cent to 6 MMT, carcass weight equivalence (CWE) from estimated 6.3 MMT (CWE) in 2008.

FAS Beijing (Post) revised China’s 2009 beef cow beginning stocks downward two per cent to 48.5 million, continuing a two per cent decline in the previous year. The sluggish production is a result of farmers’ reluctance to raise beef cows because of shrinking profit. According to the Chinese meat industry, producers have been discouraged by rising input costs and uncertain returns due to the long time frame from birth to slaughter. In 2007, fattened beef cattle could generate over RMB1,500 ($219). In 2008, production costs increased considerably, with prices for fattened cattle approaching RMB6,615 ($965.7). Subtracting the estimated costs of buying cattle for fattening at RMB4000 ($538.9), and total feeding costs at RMB2,340 ($341.6), including feed, labor, water, and electricity, a beef cow could only generate RMB274 ($40). As a result of low returns, beef inventory has been decreasing over the year. Post believes that profits can only be found among cattle collectors and slaughter/processing plants. Given that beef production does not enjoy government subsidies like dairy cows, the low returns have pushed many of the backyard and small – scale operators, which account for most shipments, into hog production and other farm work.

Post believes that some cattle slaughter and processing plants operate far below production capability due to insufficient cattle supplies. This will most likely keep beef prices high through 2009.

Decreasing Beef Consumption

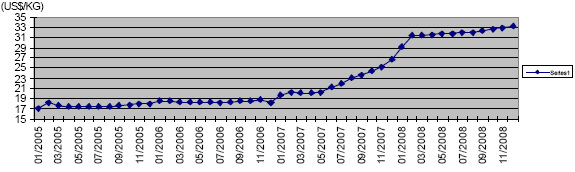

Post forecasts China’s 2009 beef consumption will continue to decline, falling to 5.9 MMT (CWE), mainly due to high prices compared to other meats. Since 2006, beef price increases nearly doubled, well more than the price increases for alternative meats (pork and chicken). In December 2008, average retail beef prices were over $33.25 per kilogram, compared to $20.34 for pork and $13.87 for broiler meat. This is up from $18.61, $14.40, and $11.64 for beef, pork, and chicken, respectively, in December 2006.

Post believes declining tourism in China, (foreign tourist arrivals are down by as much as 20 per cent) due to the world financial crisis will dampen consumption of high-priced loin cuts and other high-end products. However, sales of lower-priced variety meats (offals) should fare comparatively better due to a long history of beef offal consumption in China and high prices encouraging a shift toward cheaper beef products.

Increasing Breeding Cattle and Genetic Material Imports

Post forecast of China’s live cattle imports is now estimated to rise 7 per cent to 16,000 head due to an urgent need for improved genetics in the dairy herd, as China rebuilds the dairy industry following the nationwide melamine crisis in 2008. Producers seem less pricesensitive, with a greater focus on the quality of dairy genetic stocks and materials. In 2008, China’s dairy cow imports grew despite an increase in average import prices of 15 per cent. The government’s subsidy of RMB500 ($73) per cow for MOA (Ministry of Agriculture) certified high-quality dairy heifers beginning in 2008 will encourage imports of both high quality breeding cows and frozen bovine semen. This will benefit U.S. frozen bovine semen exports to China since the United States is China’s largest supplier, followed by Canada. Quality is vital for this market.

Beef Imports to Decline, While Live Cattle Imports to Increase

Post forecasts China’s direct beef imports in 2009 will decline 10 per cent to 9,000 tonnes. Reduced beef demand in high-end hotels and other restaurants, caused by a reduction in foreign tourists, will account for most of the decline. However, according to traders, significantly larger volumes of beef imports are entering China through gray channels, primarily through Vietnam. 2008 U.S. beef exports to Vietnam rose from 1,959 tonnes in 2006 to 39,654 tonnes in 2008, and traders report the great majority of these shipments were transshipped to China, encouraged by high Chinese beef prices. Maintaining product quality is a significant challenge in this channel due to uncertain cold chain capabilities. Whether China lifts its official ban on U.S. beef due to BSE is a key factor in future beef import levels, as this will likely result in significantly higher overall shipments of U.S. beef.

Australia is the predominant supplier of China’s direct beef imports (over 60 per cent of total imports) and this is expected to continue. In 2009, sales of re-exported beef from Hong Kong may pick up, encouraged by an increase in tariffs to their original level, effective January 1, 2009 (from six to 12 per cent).

Decreasing Live Cattle and Beef Exports

Post forecasts China’s live cattle exports in 2009 to decrease 12 per cent to 30,000, while beef exports are expected to decline to 52,000 tonnes, primarily due to reduced demand as a result of the world financial crisis. Given expected reduced domestic beef supplies in 2009, export prices will remain relatively high, reducing competitiveness of Chinese beef products. China’s historical price advantage compared to imported beef has nearly evaporated, down to $10 per ton on average in 2008.

Further Reading

| - | You can view the full report by clicking here. |

List of Articles in this series

To view our complete list of Livestock and Products Annual, and Semi-Annual reports, please click hereMarch 2009