Republic of Korea Livestock and Products Sem-Annual 2008

This article provides the cattle industry data from the USDA FAS Livestock and Products Semi-Annual 2008 report for the Republic of Korea. A link to the full report is also provided. The full report includes all the tabular data, which we have omitted from this article.Report Highlights:

Imports of beef are projected to remain stable in 2008 at 310,000 metric tons. Increases in domestic inventory will alleviate some of the unmet demand for animal protein. Lower international pork prices in the United States and increasinly lower tariffs for Chilean pork will make imported pork and pork products more price competitive this year. Total imports of pork are forecast at 452,000 tons, an increase of 2.5 percent from 2007. The domestic livestock industry is facing higher feed prices this year and will likely increase slaughter rates from those initially forecasted.

Situation and Outlook

The political landscape in Korea is changing. On February 25, a new conservative president, Lee Myung-bak, was sworn into office after 10 years of liberal rule. During his campaign the new president made a “747” jumbo election pledge to revive Korea's economy by achieving seven percent annual growth, per-capita national income of $40,000 and making Korea the world’s seventh largest economy in 10 years. Currently, exports are still strong, but the world economy is slowing and Korea may begin to feel the effects in the second half of this year. Imports are forecast to rise considerably this year due to high oil, grain and raw material prices. As a result, the economic forecast for 2008 is expected to be just under five percent.

With a new president, comes a new government. The new Minister for Food, Agriculture, Forestry & Fisheries (MIFAFF),, Jung Un-chun (also spelled Chung Woon-chun) has stated that “the country’s agriculture policy should no longer be passive and protective, but instead should be proactive and aggressive.” As a result, Jung’s nomination drew mixed reviews from rank-and-file farmers. The new Minister is likely to deal with the beef issue, while at the same time explore ways to provide additional debt relief to farmers in order to gain their support for the Korea-U.S. free trade agreement.

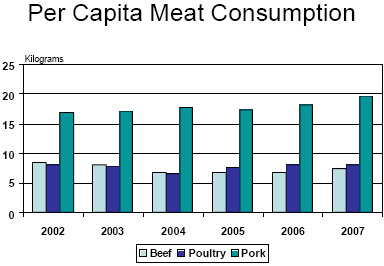

Imports of beef are projected to rema in stable in 2008; although the forecast was dropped slightly on account of higher slaughter rates. This increase in domestic production will result in a 5 percent increase in consumption compared to last year. The unmet demand for beef in Korea is quite high given that per capita consumption in 2007 (7.5 kg) is still below the 2003 level (8.1 kg) and well below the level in the United States (about 30.5 kg).

Increased swine slaughter in 2008 resulting in higher expected domestic production is the main reason that the forecast for pork imports was lowered. Imports of pork will increase year on year due to lower international prices. Increased U.S. swine production and the steady decline in tariff rates for Chilean pork will make imported pork more price competitive this year. The demand for pork, even though it is at record levels (19.7 kg), probably still has room for growth.

Domestic prices for live cattle and swine depend on slaughter rates. Higher prices for imported corn and soybeans, ingredients used locally in compound livestock feeds, will increase costs for the farmer. Judging by past history, farmers are likely to sell off their cattle at higher rates if their costs increase. Higher slaughter rates will result in lower live animal prices and lower wholesale prices for beef and pork; however, this does not necessarily translate into lower retail prices for the consumer. Retail prices tend to remain stable, changing only when external pressures force retailers to lower their prices. Absent U.S beef, the price of imported beef will increase as the higher costs of production in exporting countries are passed on to buyers.

Beef and Beef Products

Production

Inventory levels are expected to remain high regardless of whether or not U.S. beef returns to the market in 2008. Korea's total cow beginning stock levels in 2008 are five percent higher than those compared to this same time last year. High cow numbers will permit farmers to increase their herd sizes in 2008. In addition, 595,000 head of Hanwoo were artificially inseminated in the second half of 2007, an increase of 19.7 percent from the same period in 2006. With such high insemination rates and beginning stock levels, the total inventory is not expected to come down until at least 2009.

The conclusion of the KORUS FTA negotiations in early April 2007 and the brief resumption of U.S. beef imports that began in April 2007 after the bone chip issue was partially resolved had a huge impact on domestic beef prices. Live cow prices dropped over four percent from an average of 4,960,000 won (about $5,221, at an exchange rate of US$1=950 won) per head in April 2007 to 4,786,000 won (about $5,038) in May 2007, after the arrival of the first beef shipment on April 23, 2007. This decline continued until U.S. beef was shut off again on October 5, 2007. Since then, however, prices have begun to move upward again.

The price drop provoked farmers to sell off their stock and send cattle to slaughter. During the four month period (May-August) after U.S. beef imports resumed and prior to the Korean Thanksgiving Holidays (October), beef cattle slaughter jumped 6.7 percent in 2007 compared to the same period in 2006. The cow-steer slaughter ratio jumped to 45.9:54.1 during this four-month period, compared to 44.7:55.3 during the same period in 2006 and the 2006 annual average ratio of 43.3:56.7. Despite the short-term panic, Korea still maintains a very high level of Hanwoo inventory; however increased feed grain prices will have a direct effect on production costs and in the long run will cause less competitive farmers to stop producing cattle.

Korea was recognized by the World Organization for Animal Health (OIE) as being free from Foot & Mouth Disease (FMD) in 2002. Korea has requested that other countries, including the United States recognize its OIE status.

Korea’s beef self-sufficiency ratio has increased from 36.1 percent in 2003 to 46.9 percent in 2007; however, this is not because of an increase in production but rather a drop in consumption. The high price of beef in Korea has resulted in decreased demand for all beef, domestic and imported. When U.S. beef enters the market, as seen in 2007, the effect is more competition, more choice and lower prices for consumers resulting in increased demand that may actually be beneficial to the domestic industry. Increased availability of beef does not replace current suppliers, it expands the whole market. There is a market for Hanwoo beef that will remain even if U.S. beef is present; but not all consumers can eat Hanwoo beef given the cost. After the market was liberalized in 2000, Hanwoo production did not go away and even in 2007, with some U.S. beef available, Hanwoo sales actually increased and production grew.

Source: U.S. Meat Export Federation/Korea and the National Agric ultural Cooperative Federation

Consumption

Beef consumption is projected to continue to increase in 2008 as it did in 2007 due to higher domestic production. Prices dropped slightly in 2007 due to the availability of U.S. beef from May to October and this contributed to an increase in consumption of beef from all origins.

Korean consumers are still concerned about the safety of U.S. beef. The chart of U.S. beef retail sales shows that with each finding of backbone, sales dropped. According to a recent survey, 85.5 percent of consumers stated that they worry about the safety of U.S. beef.

According to the Ministry of Agriculture and Forestry (MAF), Korean consumers purchased beef 1.59 times per month in 2007 (up from 1.53 times per month in 2006) and spent an average of 36,100 Korean won per purchase (up from 27,980 Korean won in 2006). Consumers seem to be willing to spend more to purchase beef than they are to purchase pork or poultry. In addition, MAF is providing support to livestock producers to develop brands that provide consumers with more information about the meat they are buying. The awareness of brands is growing. In 2007, 34.5 percent of consumers said they were aware of beef brands, a marginal increase from 34.4 percent in 2006. In a recent survey, over half stated that they were willing to pay an additional 5-10 percent more for a branded meat product.

Source: U.S. Meat Export Federation/Korea

Very little beef is consumed in the form of processed meat in Korea and virtually all beef is purchased for direct cooking, either in the form of Korean barbeque, soup, and other Korean dishes. Only 600 tons of imported beef rounds from Australian and New Zealand are processed into beef jerky by a domestic company.

The most popular cuts of beef are bone-in short ribs, loins and chuck rolls. Short ribs are consumed mainly for Korean barbeque or kalbi. Loins are also used for Korean barbeque while chuck roll is used for making bulgoki, shaboo shaboo and steak. As Koreans like to barbeque their beef, well marbled beef receives higher prices over lean meat. Also, as consumers are accustomed to grainfed beef, they prefer such beef over grass-fed. Thus, Australia which used to supply grass-fed beef is now switching to grain-fed beef. Grass-fed beef is often marinated in order to cover the grass flavor that Koreans do not like. There is also a preference for fresh chilled beef rather than frozen beef. During the period when U.S. beef was banned, not only did the total amount of short rib imports drop, but Australian clod replaced chuck rolls for bulgoki.

Source: U.S. Meat Export Federation/Korea

Trade

Total imports of beef and beef products in 2008 are forecast at 310,000 metric tons (carcass weight equivalent). Since a commercially viable protocol for U.S. beef currently does not exist, this report makes no projection regarding imports of U.S. beef. Therefore, imports of beef from current sources are projected to remain stable from last year. The current 2008 forecast is down from the previous 2008 forecast when it was expected that a small amount of U.S. boneless beef would be imported.

The total beef import market has never really returned to the level prior to the ban on U.S. beef at the end of December 2003. Despite aggressive marketing of grain fed beef by Australia, total beef imports are still far below the 2003 level.

U.S. Beef Imports

Before the BSE ban was imposed at the end of 2003, beef was the top U.S. agricultural export to Korea and Korea was the third largest beef market for the United States. A beef protocol for deboned skeletal muscle meat was established in January 2006 and after an audit of all 36 plants eligible to export by the Korean quarantine authorities, the market was theoretically opened in September 2006. After three successive shipments, each one rejected due to bone fragment findings; Korea published slightly less onerous inspection procedures in March 2007. The new procedures indicated that all shipments would be subject to 100% inspections with x-ray machines, but that the rejections will only be limited to the box and not the entire shipment. These new inspection procedures enticed U.S. exporters to begin shipping boneless U.S. beef. On August 1, a vertebral column finding, a bone that Korea considered specified risk material (SRM) resulted in a quarantine inspection suspension for one month. This suspension was lifted on August 24; however, it was reinstated on October 5 when another vertebral column was found. This latest suspension is anticipated to remain until a bone-in protocol is negotiated. There is about 5,000 tons of beef that is in the bonded area; this beef has arrived, but has not been inspected.

Beef Tariffs and the Korea-U.S. Free Trade Agreement

The Korea-U.S. free trade agreement was concluded on April 1, 2007; however, neither the Korean National Assembly nor the U.S. Congress has ratified the agreement. Although the continued quarantine inspection suspension limits the ability of the United States to ratify this agreement, it does have some significant benefits for U.S. red meat exporters.

Korean tariffs on imports of beef muscle meats will decline to zero from the current 40 percent tariff in 15 equal annual reductions. A trade level similar to Korea's average imports from 2001 to 2003 of 182,800 metric tons of U.S. muscle meats valued at $569 million; implementation of the Korea-U.S. free trade agreement translates into a tariff savings of $15 million in year one of the agreement. Once tariffs are completely phased out, the annual tariff savings will be an estimated $1,300 per ton.

The agreement does includes a quantity safeguard of 270,000 tons for beef muscle meats, growing at a compound 2-percent annual rate to a final safeguard level of 354,000 tons in 15 years. In year 16 and beyond, safeguards will no longer apply. In 2003, the United States exported a record 224,000 metric tons of beef to Korea. This amount is still far below the trigger level in year one.

Korean tariffs on beef offal also decline in 15 equal annual reductions from their current 18- or 17-percent levels.

Further Reading

| - | You can view the full report by clicking here. |

List of Articles in this series

To view our complete list of Livestock and Products Annual, and Semi-Annual reports, please click hereFebruary 2008