Russian Federation - Dairy and Products Annual 2007

By USDA, Foreign Agricultural Service - This article provides the dairy industry data from the USDA FAS Livestock and Products Annual 2007 report for the Voluntary Annual Report from the Russian federation. A link to the full report is also provided. The full report includes all the tabular data which we have omitted from this article.Report Highlights:

Milk production is forecast to increase 2.8 percent in 2007, reaching 32 million metric tons (MMT) compared to the previous year. However, domestic milk output remains well below the target outlined in Russia’s National Priority Project (NPP) for Agriculture. Milk production is expected to rise slightly in 2008 as dairy operations continue to replace low-yielding domestic cows with imported pedigree animals. Rising grain prices are hurting producers’ profits as feed becomes more expensive. The prices for milk and dairy products increased 12 percent since the beginning of 2007 and are expected to continue to rise in 2008. The Russian government pressured domestic producers and food retailers into freezing prices for some products in addition to liberalizing trade with regional neighbors in an attempt to stabilize skyrocketing food prices. Demand for pedigree cattle and bovine genetics remains strong in Russia as dairy operations look to increase productivity by using better genetic stock.

Executive Summary

Milk production is forecast to increase 2.8 percent in 2007, reaching 32 million metric tons (MMT) compared to the previous year. However, domestic milk output remains well below the target outlined in Russia’s National Priority Project (NPP) for Agriculture. Milk production is expected to rise slightly in 2008 as dairy operations continue to replace low-yielding domestic cows with imported pedigree animals and genetics. Rising grain prices are taking a bite our of producers’ profits as production costs increase. Prices for milk and dairy products increased 12 percent since the beginning of 2007 and are expected to continue increasing in 2008. The Russian government is pressuring domestic producers and food retailers to freeze prices for some products in addition to liberalizing trade with regional neighbors in an attempt to combat skyrocketing food prices.Ministry of Agriculture officials now admit that investments in dairy cattle breeding are not likely to produce positive returns for a minimum of five years – not 2 years as was previously stated. Nevertheless, demand for pedigree cattle and bovine genetics remains strong in Russia as dairy operations look to increase productivity by using better genetic stock.

Imports of cheese, buttermilk, and yogurt increased substantially during the first 6 months of 2007 compared to the same period in 2006. Imports are expected to grow even higher in 2008 as Russia begins to lift import restrictions on neighboring countries and lowers dairy import duties.

Production

Milk production is forecast to increase 2.8 percent in 2007, reaching 32 million metric tons (MMT) compared to the previous year. Russian Minister of Agriculture Aleksey Gordeyev has publically expressed concern that domestic milk production is substantially lower than the 4.5 percent increase envisioned in Russia’s National Priority Project (NPP) for Agriculture (see RS 7020). Market analysts attribute the lag in domestic milk production to general underperformance of the dairy cattle sector in Russia in addition to growing feed prices.Milk production is expected to rise slightly in 2008 reaching 32.1 MMT as dairy operations continue to replace low-yielding domestic cows with imported pedigree animals and genetics. Dairy prices are also expected to increase in 2008, leading to better profits for the larger dairy producers, many of which are vertically integrated and already producing their own feed.

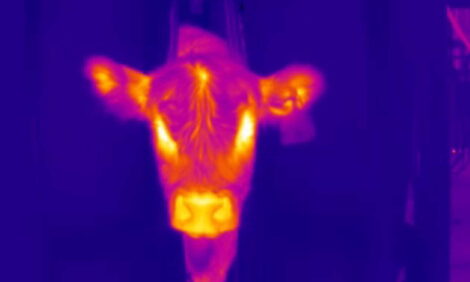

Russia currently has approximately 9.9 million milk cows. One-third of domestic Russian milk is produced in 7 provinces,1 evidence that, in contrast to the Soviet policy of producing a little of everything everywhere, production of dairy products is gravitating to the milksheds of major population centers or areas with some sort of relative advantage in dairying. Ag Minister Gordeyev predicted in 2005 that the national herd milk-yield average would be increased to 5,000 to 5,500 kilograms per cow. Expert dairymen in Russia estimate the genetic potential of the current indigenous dairy herd is already five to six thousand kilograms per year if the animals are properly nourished and cared for. While well below the world-class standards of eight to ten thousand kilograms per lactation seen in the U.S., Japan, and Israel, this still leaves room for considerable growth in Russia's per-cow productivity merely through introduction of better nutrition, herd health practices, and herd management.

Growing investments in Russian dairy processing operations increased production capacity but strong consumer demand and rising feed costs are maintaining an upward pressure on prices and diminishing any disinflationary effects on price levels gained from increased supplies. Prices for milk and dairy products increased 12 percent in 2007 and are expected to go up even higher in 2008. The Russian government recently pressured large dairy operations and food retailers to freeze prices for staple products such as milk and cheese until the end of January 2008. Over half of Russia’s milk is produced on private subsidiary plots. In 2006, the last year for which complete data are available, out of 31.4 MMT of milk produced in Russia, 14.1 MMT was produced in the commercial dairy sector. As the aging rural population dies out, and is not replaced, room for expansion by profitable commercial dairy farms will unfold. In general, commercial dairy farms showing gross profitability of 40 percent or greater tend to stay in business and even to expand; dairy farms with lower than 40 percent gross profitability continue to go out of business. This ongoing shakeout of dairy producers (both private subsidiary plots and unprofitable commercial operations) is leading to higher aggregate profitability and improved herd averages, and over time will result in a more economically healthy dairy sector.

Consumption

Domestic production capacity, import volumes, and prices all influence dairy consumption in Russia. Butter and cheese consumption is increasing as investments in the dairy industry raises the production capacity of Russian dairy producers and processors. Cheese consumption will increase further as Russia allows more imports from regional neighbors.Domestic consumption of fluid milk is slowing although the growing milk processing sector is beginning to demand higher volumes of fluid milk.

Trade

During the first 6 months of 2007, Russian imports of cheese, buttermilk, and yogurt increased substantially over the same period in 2006. Imports are forecast to grow even higher in 2008 as the Russian government takes active measures to combat rising prices. For example, Russia recently lifted a ban on Ukrainian dairy products after Russian veterinarians inspected numerous dairy operations. In addition, Russia recently announced that it would postpone restrictions on Belarussian dairy products originating from facilities that had not been inspected by Russian veterinarians by March 1, 2008. At the end of October 2007, the Russian veterinary service announced that 3 Bulgarian dairy processors would be permitted to export to Russia after joint inspections took place.According to Canadian Alta Exports International (AEI), in 2007 Canadian cattle breeders delivered their biggest shipment of breeding stock to Russia since the discovery of Bovine Spongiform Encephalopathy (BSE) in Alberta, Canada four years earlier. The shipment included 2,217 head of purebred Canadian Angus, Holstein and Hereford cattle worth almost $4 million. AEI sourced the breeding stock from over 400 farms in six provinces, including 800 Holstein heifers and 17 Holstein bulls (see GAIN RS7031).

According to a press release from the Canadian Beef Breeds Council, since 2004 Canadian officials have participated in several trade missions to Russia to help clear the path for exports of cattle, semen and embryos. Export Development Canada provided financial services for the shipment. AEI has successfully exported 5,700 head of breeding stock to Russia and Kazakhstan to date.

Live dairy cattle are imported under the National Priority Project and financed by the government agricultural leasing agency, Rosagroleasing (http://eng.rosagroleasing.ru/). Semen and embryos are being imported from distant Australia and Canada since supplies of live animals in Western Europe have been largely exhausted. Imports of live dairy cattle and embryos from the United States remain in abeyance pending agreement on veterinary protocols.

Policy

To the surprise of many observers, dairying was largely ignored in the government program of support for agriculture announced in July 2007 (see GAIN report RS7051). This reflected more the outcome of a battle between the Ministry of Finance, seeking to avoid new, costly programs, and the Ministry of Agriculture, seeking to expand support for agriculture to a new basis prior to completing negotiations on accession to the WTO. Dairy supports were also omitted from the Law on Agricultural Development and Market Regulation passed at the end of 2006 (see GAIN report RS7005).Russian Prime Minister Viktor Zubkov recently signed a directive reducing import duties on milk and dairy products from 15 percent to 5 percent for six months in an attempt to stabilize prices on the Russian market (see GAIN RS7071). The new import duties took effect October 17, 2007, and apply to milk, cheese and curd. Market analysts predict the directive lowering import duties on dairy products will have little if any effect on rising dairy prices as consumer demand continues to grow rapidly.

Exchange prices for milk increased three-fold in the past six months, and Russian dairy processors are requesting imposition of export quotas for dry milk. Vladimir Labinov, Executive Director of the Russian Union of Dairy Companies, said Russian producers cannot remain on the sidelines of growing global demand for milk and dairy products.

The Russian government recently announced that the new 2008 budget will allocate one billion rubles to subsidize interest rates on working capital loans for milk processors to acquire raw materials. However, companies applying for the subsidized loans must agree to maintain price controls for a certain period. Minister of Economic Development and Trade Elvira Nabiullina has proposed implementing an export duty on dry milk. No details have emerged yet about this proposal.

Prices

The Russian Statistics Agency (Rosstat) reported last month that consumer prices in Russia increased 7.5 percent from January to September 2007 and 0.8 percent alone in the month of September making it the highest single-month increase since 2000. Increasing dairy prices are a large contributor to inflationary pressures in Russia. According to Rosstat, food prices in Russia increased by as much as 30 percent in September 2007 for nine out of every ten food products, including staple commodities such as vegetable oil, pasteurized milk, yogurt products and cottage cheeses. Prices for milk and dairy products increased 7.2 percent in September 2007 and 12 percent since the beginning of 2007. The cost of butter increased 9.4 percent in the month of September 2007 alone.Market analysts believe that dairy prices are rising in Russia due in part to changes in European Union (EU) farm polic ies, rising grain prices and changing trade patterns among Russia’s regional neighbors. Cheese and butter prices increased in July 2007 after the EU eliminated dairy export subsidies. Imported European milk is relatively expensive though of much higher quality than domestic . Less than one-third of all raw milk produced in Russia meets the EU’s high quality standards. Strong demand for quality raw milk increased the market price to 15 RUR/kg. Higher global grain prices in 2007 increased feed costs for dairy cows, and by extension, consumer prices for raw milk. Feed prices almost doubled over the summer, according to reports from the Ministry of Agriculture, reflecting higher global grain prices, although Russian grain production was up over 2006 levels. In an effort to reduce inflationary pressures on the Russian economy, on October 10, 2007, Minister of Agriculture Aleksey Gordeyev announced a 30-percent export tariff on barley and 10-percent export tariff on wheat would be imposed in November (see GAIN RS7065, RS7068 and RS7070). Shifts in regional trading patterns also contributed to price growth in Russia, as traditional suppliers in Belarus and Ukraine have begun shipping dry milk to Europe, Asia, and Africa.

The Fight is on Against Skyrocketing Food Prices

In October 2007, Ag Minister Gordeyev headed a closed-door meeting attended by government officials and major retailers and producers to discuss concerns with growing food prices. At that meeting, representatives from large retail chains such as Metro, Perekryostok and Mosmart and major dairy operations such as Wimm-Bill-Dann and Unimilk agreed to freeze prices at October 15 levels on staple foodstuffs until the January 31, 2008. Specific varieties of bread, cheese, milk, eggs and vegetable oil are some of the products considered to be of social significance that will be affected by price freeze. According to Ministry of Agriculture officials, a formal agreement was signed on October 24, 2007. Since then, Wimm-Bill-Dann Chairman David Yakobashvili has stated the price freeze could potentially remain in effect until after the March 2008 presidential elections.To date, no list has been published of products for which prices are frozen at the October 15 level. A representative of one of the largest dairy operations stated earlier that it would freeze prices of milk with a fat content of 2.5 percent, sour cream, low-fat kefir and butter. Another producer said it will freeze prices on milk with a fat content of 2.5 percent, kefir with a fat content ranging from 1.5-2.5 percent, and sour cream with a fat content of 15 percent.

High level Russian government officials, including Prime Minister Zubkov, have ordered the Federal Antimonopoly Service to work with regional leaders to ensure producers and food retailers are observing antimonopoly legislation, with special attention to be paid to dairy products. However, market analysts are unsure of how the Russian government will protect economically vulnerable groups if dairy prices increase after January 31, 2008 once price controls are removed. Some in the dairy industry have stated that federal and regional government officials should consider special subsidies for raw milk production to protect lowwage earners from rising dairy prices.

Dairy Stocks

Stocks of dairy products and raw dairy material decreased in 2007 due to several reasons including rising production costs from higher grain prices, higher prices for dairy products from Europe, and lower import volumes from Ukraine and Belarus.

Feed Stocks

Feed stocks are lower in 2007 compared to the previous year because of drought conditions during the first half of the harvesting season. Lower feed stocks have hindered milk production and contributed to higher dairy prices.

Foreign Investment in the Russian Dairy Sector

Major Italian dairy operation Parmalat plans to spend at least 600 million Euros on acquisitions in emerging markets, including Russia, by the end of 2007. Parmalat is researching countries showing growing demand for value-added dairy products, such as nutritional baby products and milk. There is a considerable gap in dairy consumption rates between Western Europe and Russia, and investors anticipate higher returns in Russia where approximately 10 million tons of dairy products are consumed annually. Russian urban markets for processed dairy products are dominated by large consolidated firms . Foreign companies wishing to enter the Russian dairy market have to make acquisitions or acquire shares of existing firms.

A Dutch dairy operation is planning to construct 10 dairy farms each with 1,000 head in the Omsk region, according to the Omsk regional government. An agreement is expected to be signed in December.

Russian Livestock Improvement Regulations

Russia is prioritizing the development of its livestock sector through the National Priority Project (NPP) for Agriculture, known as “Agro-industrial Complex Development”. The Russian government has stated that rapid development of the imploding livestock sector is crucial to alleviating high rates of unemployment and poverty in Russia’s rural areas. Russia is implementing a livestock improvement program to increase the size and genetic potential of its herds. Some of the efforts include importing semen and embryos from high quality livestock, and establishing a genetic conservation fund for endangered livestock breeds useful for breeding.

Currently, Russia has about 588,000 head of purebred cows at breeding farms, which is less than seven percent of Russia’s total herd and half the level required for sustainable reproduction. Russia risks a large deficit of domestic brood stock if it fails to substantially increase the size of its breeding herd.

Footnotes

1 Moscow, Leningrad and Novosibirsk oblasts, Krasnodar and Altay krays, Tatarstan and Bashkortostan.

Further Reading

|

|

- You can view the full report, including tables, by clicking here. |

List of Articles in this series

To view our complete list of 2007 Dairy and Products Annual reports, please click hereDecember 2007