Global beef markets: Lower demand in most regions & diverging prices to affect exports

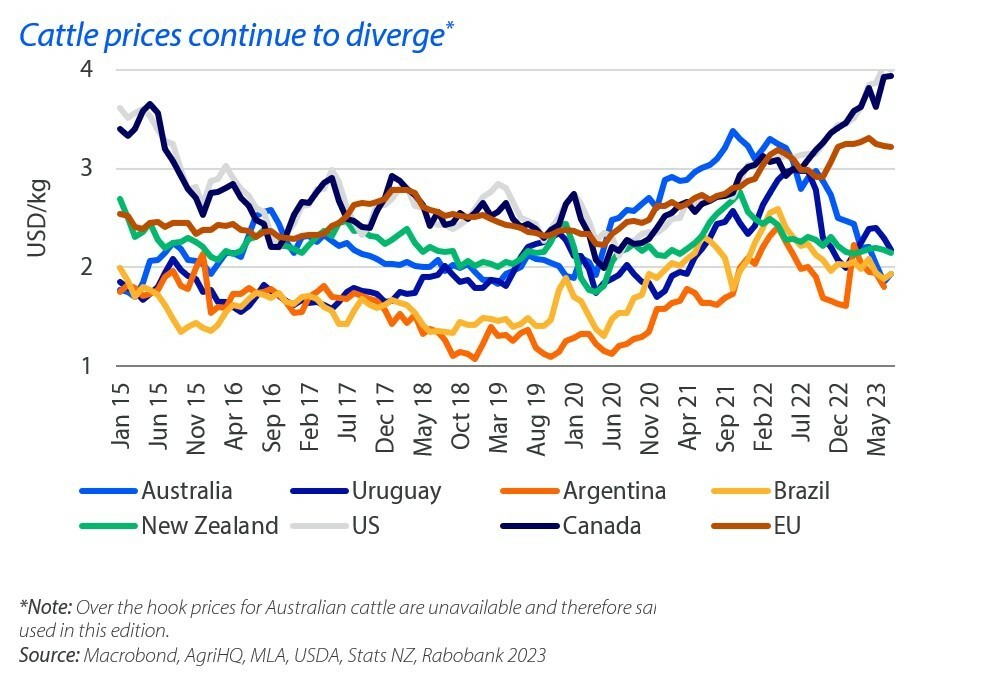

Sustainability agenda expandsAccording to a new report from Rabobank, most beef markets – other than the US – are seeing softer consumer demand. Global cattle prices have split into two distinct groups: those in North America and Europe and those in the rest of the world. In the US, declining supply and strong consumer demand are driving cattle prices higher, while in most other regions, softer consumer demand and/or increasing supply have caused prices to soften.

Diverging prices will affect beef exports

Compared to 12 months ago, US cattle prices have increased almost 30%, whereas Australian cattle prices have dropped by more than 30%.

“This price split is the largest we have seen in the last ten years,” says Angus Gidley-Baird, Senior Analyst – Animal Protein at Rabobank. “Such a separation in prices will have consequences for beef exporters’ competitiveness, and we expect to see some shift in trade volumes as a result.”

Rabobank expects total production of the six countries/regions monitored to decline slightly (-1% YOY) in Q3 this year before returning to levels similar to 2022 in Q4 and Q1 2024. Drops in New Zealand, and the US will outweigh the growth in Australia, Brazil and China in Q3 2023.

Demand is lower almost everywhere and supply chains are full

A consistent theme across most markets – other than the US – is softer consumer demand and full supply chains. In a number of regions, particularly in Asian countries, beef purchases made through 2022 and into 2023 in anticipation of recovery from Covid have not been consumed. These are now part of growing stock levels that also include other proteins.

“Softer consumer demand is making it harder to move these volumes through the system,” explains Gidley-Baird.

An added challenge is that global beef prices have dropped through this period and some of these stocks would have been purchased when prices were higher.

Beef's sustainability agenda is expanding with nature and biodiversity in focus

For some time, the sustainability discussion around beef has focused mainly on greenhouse gas emissions. Over the past year, nature and biodiversity have become more prominent issues in beef sustainability discussions, and these topics will be even more relevant over the coming year.

According to Gidley-Baird, fewer companies in the beef supply chain have made voluntary commitments around nature and biodiversity than those that have made emissions reduction commitments. But the set of drivers for both issues is similar, which can create synergies in how beef supply chain participants respond to both issues and reinforce the action being taken.

Forces driving the new focus on nature and biodiversity include intergovernmental agreements and regulation, financial services undertakings, and voluntary commitments from the supply chain.

Rabobank clients can read the full report.