UK's dairy retail year in review

Slow growth is expected for 2022According to a special report on the retail dairy market in 2021, published by the UK's Agriculture and Horticulture Development Board (AHDB) , easing COVID-19 restrictions allowed a return to the eating-out market for some consumers, which meant 2021 grocery sales were unable to retain the volumes seen during the height of the pandemic. However, due to price inflation, the market value remained stable at -0.1%, according to data fro Kantar.

The story for animal dairy is in line with total grocery, said the AHDB report. Unsurprising, as 77% of consumers say dairy is a vital part of their everyday food, making it a staple in the shopping basket, and reflected in that 99.5% of households shopped the category every month in 2021.

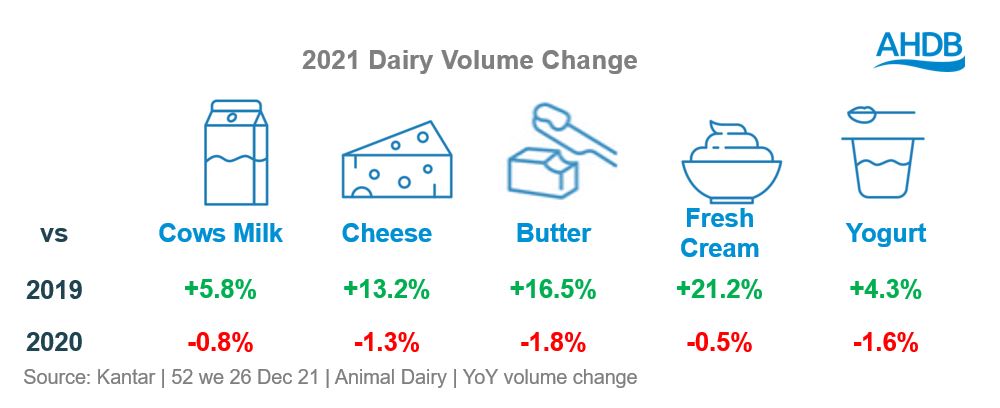

Spend in retail is flat year-on-year, while volumes are down -1.2%. When comparing back to pre-pandemic levels (2019), so a more normal time, animal dairy remains significantly elevated at +11.3% in value and +6.3% in volume. The biggest driver of this is existing shoppers buying more per trip to cater for the increased need for in-home food occasions.

As a comparison, dairy alternatives are seeing year-on-year volume growth and increases of 37% versus 2019. However, the market remains small at only 5% of total dairy volumes.

According to AHDB, dairy will continue to do well in 2022. However, as 2020 was such an extraordinary year for grocery, growth throughout 2021 has slowed overall as restrictions have eased. Despite this, the dairy category remains elevated versus 2019 in retail and AHDB predicts this will be the same for 2022. A continuation of more in-home occasions will drive this. However, changed financial situations, coupled with high price inflation, means the category should focus on value for money. As well as this, the dairy industry should aim to address health and sustainability concerns, as according to IGD, the dairy category over indexes versus total grocery on purchase drivers such as healthier options, environmentally friendly packaging and being ethically produced (Category Benchmarks 2021).