Tyson Foods rejects blame for rising meat price conclusions drawn by White House

Tyson Foods categorically rejects the conclusions drawn earlier today by the Secretary of Agriculture and the Director of the National Economic Council in a White House press briefing, according to a September 8, 2021 Tyson press release.The USDA recently published a report detailing the drivers of consumer inflation in the food sector, none of which are related to industry consolidation or scale. The report can be found by clicking here.

Increase in Beef Prices due to Unprecedented Market Conditions

As we have explained in great detail to the U.S. Senate Committee on the Judiciary, in testimony provided in August 2021, which can be accessed by clicking here, the increase in the price of beef, in particular, is due to unprecedented market conditions.

Multiple, unprecedented market shocks, including a global pandemic and severe weather conditions, led to an unexpected and drastic drop in meat processors’ abilities to operate at full capacity. This led to an oversupply of live cattle and an undersupply of beef, while demand for beef products was at an all-time high. So, as a result, the price for cattle fell, while the price for beef rose. Today, prices paid to cattle producers are rising.

Labor shortages – the inability of the industry to adequately staff its plants – has exacerbated the situation. Labor shortages are also affecting the nation’s pork and poultry supply.

Tyson Foods today pays its frontline workers an average of $22 per hour, including full medical benefits; we recently announced additional paid sick leave and vacation benefits starting in 2022. The company is also piloting childcare programs and providing access to vaccinations for all of its U.S. workers.

Inaccurate Claims of Consolidation Impact

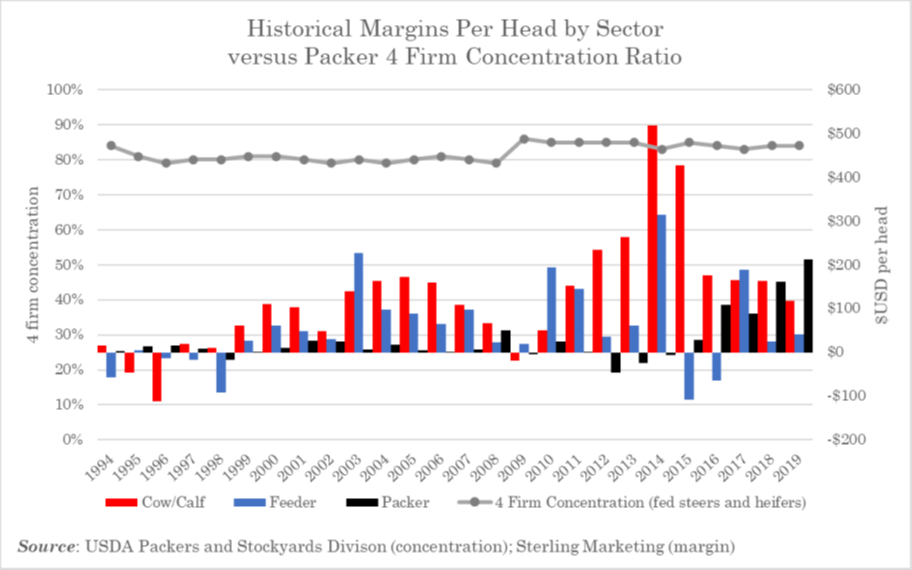

It is inaccurate to suggest that consolidation in the meat processing industry is leading to higher prices for consumers. In fact, evidence of healthy competition can also be found by looking at historical outcomes. For example, we have seen a rise in availability and quality of beef, while the price has become more affordable over the past quarter-century: data shows that while the concentration of the industry has remained relatively constant for close to 30 years, quality has significantly improved.

Furthermore, as the U.S. Department of Agriculture table below clearly illustrates, the historical ratios of margins of cow and calf producers and feeders versus processors, including Tyson, show that cow and calf and feeder margins outpace processor margins in almost every year except the most recent.

Table: USDA Data - historical ratios of margins of cow and calf producers and feeders versus processors, including Tyson

Scale Allows for Efficiency, Leading to Lower Prices for American Families

Tyson’s scale allows it to operate efficiently, which keeps costs down for consumers. At Tyson, we rely on independent farmers and want them to succeed, because without a steady pipeline of livestock, we can’t run our business. In rural communities across America, every year, we invest more than $15 billion with 11,000 independent farms supplying us with cattle, hogs and chickens.

Tyson Foods is committed to working with the Administration, the U.S. Congress and others to find ways to better feed this growing country – and keep consumer prices affordable. We welcome a deeper discussion on all of the issues raised today.