US beef exports continue on their upward trajectory

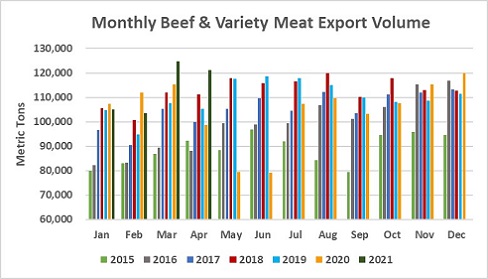

Newly-released data from the US Meat Export Federation (USMEF) shows that April's beef exports continued to build momentum after breaking records in March 2021.

April exports of US beef set another new value record at $808.3 million, up 35% from a year ago, with export volume reaching 121,050 metric tonnes (MT) – up 23% year-over-year and the fifth largest on record. For beef muscle cuts, exports were the third largest ever at 94,656 MT (up 21%), valued at a record $726.7 million (up 36%). For January through April, beef exports moved 5% ahead of last year’s pace at 454,398 MT, with value up 10% to $2.93 billion. Beef muscle cut exports were up 8% to 357,570 MT, valued at $2.63 billion (up 12%).

“Looking back at April 2020, it was a difficult month for red meat exports as we began to see COVID-related supply chain interruptions and foodservice demand took a major hit in many key markets,” said USMEF President and CEO Dan Halstrom. “While it is no surprise that exports performed much better in April 2021, we are pleased to see that global demand continued to build on the broad-based growth achieved in March.”

Halstrom cautioned, however, that the COVID-19 pandemic is still a major concern for the US meat industry, adding uncertainty to the business climate in many export destinations. Logistical challenges, including container shortages and ongoing vessel congestion at many US ports, also present significant obstacles for red meat exports.

“While conditions are improving in many key markets, the COVID impact is the most intense it has ever been in Taiwan and heightened countermeasures are also in place in Japan and other Asian countries,” he explained. “But foodservice activity is climbing back in our Latin American markets and retail demand – both in traditional settings and in e-commerce – has been outstanding and USMEF continues to find innovative ways for the US industry to capitalize on these opportunities. We are also working with ag industry partners and regulatory agencies to find ways to improve the flow of outbound cargo, which is essential to maintaining export growth.”

Beef exports set second consecutive value record; per-head value also highest ever

In addition to the overall value record, beef export value per head of fed slaughter also reached a new high in April at $367.45, up 1% from a year ago. Through April, per-head value averaged $343.70, up 5% from the same period last year. April exports accounted for 15% of total beef production and 12.6% for muscle cuts, each up about one full percentage point from a year ago. Through April, exports accounted for 14.4% of total beef production (steady with last year) and 12.1% for muscle cuts (up from 11.9%).

April beef exports to South Korea increased 21% from a year ago to 23,482 MT, and just missed setting a new value record at $182.7 million (up 36% and slightly below the August 2020 high). Through April, exports to Korea were up 11% in volume (92,478 MT) and 15% in value ($686.7 million). Exports were also well ahead of the record pace of 2019, when full-year export value to Korea reached $1.84 billion.

Beef exports to China continued to soar in April, reaching a record 17,233 MT (up from just 1,367 MT a year ago). Export value to China was $130.6 million – up from $11.5 million. Through April, beef exports increased more than 1,300% in both volume (48,291 MT) and value ($364.6 million). These are new annual records, already exceeding the full-year totals posted in 2020.

While Japan remains the leading volume destination for US beef, April exports definitely felt the impact of Japan’s safeguard tariff, which was in effect from mid-March to mid-April. During this time, US beef cuts entering Japan were tariffed at 38.5%, well above the rates imposed on major competitors. The rate for US beef dropped to 25% on 17 April, which is level with other major suppliers. US trade officials are in consultations with their Japanese counterparts on the safeguard threshold, which USMEF expects to be exceeded every year unless it is increased. April exports to Japan were down 19% from a year ago at 25,293 MT, valued at $170.7 million (down 15%). Through April, exports were down 12% to 100,702 MT, valued at $655.9 million (down 9%).

Other January-April highlights for US beef exports include

- April beef exports to Mexico far exceeded last year’s low totals at 17,190 MT (up 70%) valued at $79.3 million (up 128%). Through April, exports were still down 2% from a year ago in both volume (68,721 MT) and value ($324.4 million), but demand is trending upward with the gradual recovery of foodservice and tourism activity in Mexico.

- Led by strong growth in Colombia and Chile, January-April exports to South America increased 13% from a year ago to 9,478 MT, with value up 30% to $47.8 million. While total exports to Peru were up only slightly, beef variety meat shipments increased 5% to 2,281 MT, with value climbing an impressive 41% to $3.4 million.

- With January-April shipments on a record pace to Guatemala, Honduras, El Salvador, Costa Rica and Nicaragua, beef exports to Central America increased 42% from a year ago to 7,139 MT, valued at $42.2 million (up 49%). Nicaragua is emerging as a strong destination for beef variety meat, with exports through April reaching 332 MT (up 261%) valued at nearly $300,000 (up 176%).

- April was the first month of 2021 in which beef exports to Taiwan were higher than a year ago in both volume (5,311 MT, up %) and value ($51.5 million, up %). This pushed January-April exports to 17,854 MT (down 14%) valued at $169.8 million (down 7%), but exports in May and June may be impacted by COVID containment measures, including a current suspension of dine-in restaurant service.

TheCattleSite News Desk