Strong April for US Beef Exports

US - April exports of US pork, beef and lamb were sharply higher than a year ago in both volume and value, according to data released by USDA and compiled by USMEF.

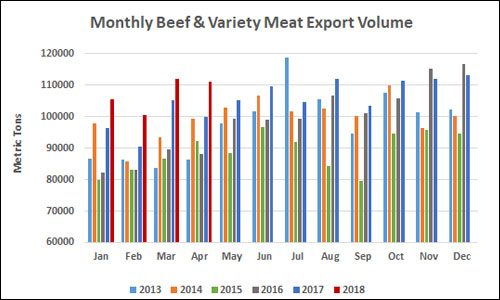

Beef export volume was 111,213 mt in April, up 11 per cent year-over-year. Export value was $676.7 million, up 23 per cent and the fourth-highest on record. Through the first four months of 2018, exports were up 10 per cent in volume to 429,286 mt. Export value was $2.59 billion, 20 per cent above last year’s record pace.

Exports accounted for 14.1 per cent of total beef production in April, up from 13.6 per cent a year ago. For muscle cuts only, the percentage exported was 11.3 per cent, up from 10.6 per cent. For January through April, exports accounted for 13.4 per cent of total production and 10.8 per cent for muscle cuts, each up about half a percentage point from last year.

Beef export value averaged $328.46 per head of fed slaughter in April, up 16 per cent from a year ago. Through April, per-head export value averaged $318.91, up 17 per cent.

Even with growth in red meat production, both pork and beef exports have accounted for a larger share and contributed more dollars per head, indicating strong international demand.

Asian markets and Mexico highlight strong April for beef exports

Japan maintained its position as the leading volume and value market for US beef, with April exports totaling 25,650 mt (up 9 per cent from a year ago) valued at $166.6 million (up 16 per cent). Through April, exports to Japan were steady with last year’s volume at 98,090 mt while value increased 10 per cent to $626.1 million. This included a 4 per cent increase in chilled beef to 47,322 mt, valued at $375 million (up 17 per cent). Frozen shipments have regained momentum now that the 50 per cent safeguard duty rate has expired. But with a 38.5 per cent rate in place for both chilled and frozen beef, the US remains at a large disadvantage compared to its top competitor, Australia.

US beef continues to build tremendous momentum in South Korea, where April exports were up 62 per cent from a year ago in volume (19,185 mt) and 72 per cent in value ($134.8 million). For January through April, exports to Korea climbed 31 per cent to 71,094 mt, valued at $501 million (up 45 per cent). Chilled exports totaled 15,480 mt (up 29 per cent) valued at $148 million (up 40 per cent). In contrast to Japan, US beef has a slight tariff advantage versus Australia, as KORUS was implemented earlier than the Korea-Australia Free Trade Agreement.

"The enthusiasm for US beef in these markets may be at the highest level I’ve ever seen," USMEF President and CEO Dan Halstrom said. "In nearly every segment of the retail and restaurant sectors, US beef is attracting new customers with a wider range of cuts and menu items. It’s an exciting trend that’s not just limited to Japan and Korea, with US beef’s popularity also strengthening in other Asian markets and in the Western Hemisphere."

For January through April, other highlights for US beef include:

- In Mexico, exports were 5 per cent ahead of last year’s pace in volume (78,435 mt) and 16 per cent higher in value ($342.4 million). Demand was especially strong in April, as exports totaled 21,396 mt (up 22 per cent and the largest since August), while value increased 33 per cent to $92.1 million.

- Exports to China/Hong Kong increased 23 per cent in volume (46,043 mt) and surged 51 per cent in value to $352.4 million. China still accounts for a small portion of these exports, as shipments to China were 2,299 mt valued at $21.3 million. China reopened to US beef in June of last year. While US beef is not yet subject to retaliatory duties in China, it remains on the proposed retaliation list with a possible additional tariff of 25 per cent.

- Taiwan continues to display a growing appetite for US beef, especially for chilled cuts. Exports to Taiwan were 30 per cent above last year’s pace in volume (17,500 mt) and 42 per cent higher in value ($168.7 million). Chilled exports were up 43 per cent in volume (7,605 mt) and value ($96 million), as US beef captured 74 per cent of Taiwan’s chilled beef market.

- Steady growth in the Philippines and a tripling of exports to Indonesia pushed exports to the ASEAN region 35 per cent above last year’s pace in volume (14,865 mt) and 37 per cent higher in value ($82 million).

- Exports to South America were up 14 per cent in volume (8,971 mt) and 28 per cent in value ($43.5 million), with the main destinations being Chile, Peru and Colombia. Leading market Chile was up 20 per cent in volume (4,137 mt) and 14 per cent in value ($22.5 million), though shipments slowed in March and April following a strong start to the year.

TheCattleSite News Desk