Kiwi Beef Returns Higher Than Lamb

NEW ZEALAND - Over the first nine months of this season, beef and veal returns and volumes have been higher than lamb and mutton, according to levy board Beef and Lamb New Zealand.Because of the significant size of the market, changes in Chinese demand – specifically, less lamb and mutton and more beef – impacted across all categories of New Zealand meat exports, say market analysts.

Meanwhile, the USD / NZD exchange rate averaged 0.76 in the first nine months of the current season, compared with 0.84 over the same period last season – a 10 per cent drop. This NZD weakness contributed significantly to this season's higher average export values across all products.

Lamb Exports

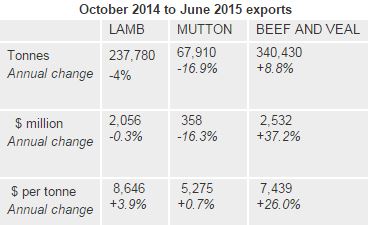

Despite more lambs being processed, New Zealand lamb exports decreased 4.0 per cent to 237,780 tonnes shipped weight in the nine months to June 2015, compared with the same period in the previous season. This was led by a fall in demand from China.

After increasing year-on-year since 2009-10, lamb exports to China fell 12 per cent in the first nine months of the season compared with the previous season. New Zealand lamb cut exports to China held over the period, but lower value exports, like carcases, dropped.

Lamb exports to the European Union were up 4.7 per cent. This reflected higher export tonnages to Germany, Netherlands and Belgium, offset by lower exports to Great Britain, the largest market for New Zealand lamb. Due to dry conditions early in the summer, New Zealand lambs were finished and exported to Great Britain a little earlier than normally. This coincided with an increased production in Great Britain and lower exports due to a strong GBP, which put pressure on prices.

Lamb exports to North America and the Middle East were up in volume and value terms.

Over the first nine months of the season, lamb exports averaged $8,646 per tonne, up 3.9 per cent. The total value of lamb exports remained relatively stable at $2.06 billion (-0.3 per cent).

Mutton Exports

In the nine months to June 2015, New Zealand mutton exports decreased by 17 per cent to 67,910 tonnes shipped weight, reflecting lower mutton production and lower demand from China, the largest export market for mutton.

New Zealand mutton exports to China fell 32 per cent to 39,840 tonnes shipped weight in the first nine months of the 2014-15 season, compared with the previous season. In addition, the average value of mutton exports to China decreased 6.7 per cent.

Beef and Veal Exports

Strong demand for beef, a weaker New Zealand dollar against the US dollar and high New Zealand beef production resulted in a 37 per cent rise in beef and veal export revenue over the first nine months of the season, compared with the previous season.

Dry conditions early in the summer and low milk prices led to an earlier and extended dairy cow cull than previous years. From October 2014 to June 2015, New Zealand beef and veal exports reached 340,430 tonnes shipped weight – up 8.8 per cent on the corresponding period last season.

The strongest demand for New Zealand beef and veal in 2014-15 came from the United States, which took 57 per cent of total shipments, and China, which took 12 per cent. Export tonnages to the United States and China increased by 23 per cent and 38 per cent respectively. For the first time, beef and veal exports to China overtook mutton exports in terms of volume.

Strong demand and a weaker New Zealand dollar against the US dollar pushed the average per tonne value of beef and veal exports up by 26 per cent, to $7,440 per tonne, compared with $5,900 in the corresponding period last season. Beef and veal export returns reached a record high of $2.53 billion – up $686 million on the corresponding period last season.

TheCattleSite News Desk

.JPG)