November Indicator Shows Irish Price Problem and Persisting Lower Imports

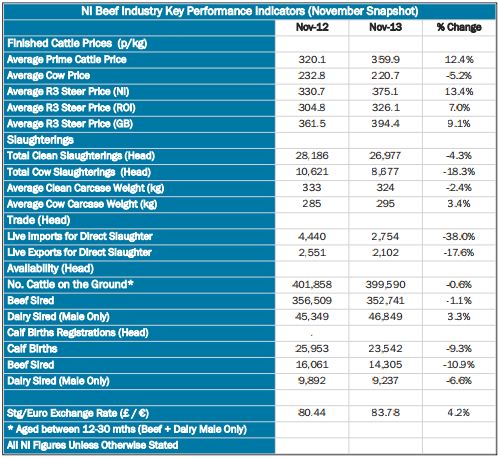

UK - The price differential between Ireland and neighbouring Great Britain and Northern Ireland, has grown through the autumn, according to market analysts at the Livestock and Meat Commission (LMC).The average prime cattle price in NI during November 2013 was 359.9p/kg, write LMC analysts.

This is 40p/kg higher than November 2012 when the average prime cattle price was 320.1p/kg.

This increase accounts for a 12.4 per cent rise in average prime cattle prices between the two periods. The R3 steer price in NI during November 2013 averaged 375.1p/kg, a 44.4p/kg increase on the 330.7p/kg paid during November 2012.

This represents a 13.4 per cent increase in the price paid between the two periods. Meanwhile in GB prices also recorded an increase year on year, but not to the same degree as recorded in NI. During November 2013 the R3 steer price in GB was 394.4p/kg, an increase of 32.9p/kg on the 361.5p/kg paid during November 2012.

This accounts for a 9.1 per cent increase year on year. These changes in the prices paid for R3 steers in both NI and GB have resulted in the differential between the two regions narrowing. In November 2012 R3 steer prices in GB were 30.8p/kg higher than NI prices and during November 2013 the differential has narrowed to 19.3p/kg as indicated in Figure 1.

In ROI during November 2013 the R3 steer price was the equivalent of 326.1p/kg, an increase of 21.3p/kg on the 304.8p/kg paid during November 2012. This increase has been driven by a strengthening in the value of euro against sterling as indicated in Table 1. In euro terms the price paid for R3 steers was up 10.3c/kg between the two periods (+2.7per cent).

While the price differential between NI and GB has narrowed between November 2012 and November 2013 the differential between NI and ROI for R3 steers has widened as indicated in Figure 1. In sterling terms the differential has widened from 26p/kg in November 2012 to 49p/kg in November 2013.

This widening in the differential between prices paid for R3 steers in ROI and NI, while the differential between NI and GB has narrowed would indicate that NI prices are now more closely following GB prices and are not being influenced to the same degree by the beef trade in ROI as they would have been in previous years. The tightening of retailer specifications and a preference for UK origin beef over ROI beef have been key drivers in this trend.

The stronger supplies of beef in ROI has also added to this differential. The NI processors have reported a steady supply of cattle in recent weeks to meet demand with a total of 26,977 prime cattle slaughtered during November 2013.

This is 4.3 per cent lower than the 28,186 head slaughtered during November 2012. This drop in throughput combined with a 9kg reduction in average prime cattle carcase weights has resulted in total beef production from prime cattle to be down by seven per cent year on year.

Cow throughput during November 2013 totalled 8,677 head compared to 10,621 cows the previous November. This accounts for an 18.3 per cent decline year on year. While a 10kg increase in cow carcase weights to 295kg in November 2013 has offset some of the decline in cow beef production it was still back 15 per cent year on year.

The average cow price in NI during November 2013 was 220.7p/kg, back 12.1p/kg from the 232.8p/kg in November 2012. Imports of cattle for direct slaughter in NI plants has also shown a decline year on year.

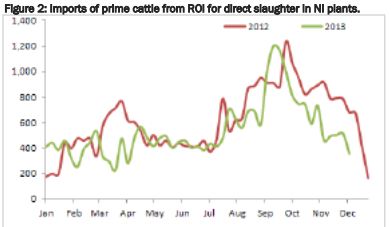

During November 2013 2,754 cattle were imported for direct slaughter compared to 4,440 imported in November 2012. This accounts for a 38 per cent decline between the two periods. Figure 2 outlines the number of prime cattle imported from ROI for direct slaughter in NI plants.

Imports for the period April to August 2013 were broadly similar to the corresponding period in 2012. In September 2013 imports of prime cattle for direct slaughter were higher than recorded in September the previous year. However as autumn 2013 progressed the number of prime cattle

imported has been consistently below the levels recorded in the same period in 2012.

Exports of cattle out of NI for direct slaughter during November 2013 totalled 2,102 head compared to 2,551 head during November 2012. This is a reduction by 17.6 per cent year on year. A total of 922 head were exported to ROI during November 2013 for direct slaughter, almost entirely made up of cows.

An additional 500 cows have been exported to ROI during 2013 to date when compared to the same period in 2012. The majority of these may be non-FQAS animals. Meanwhile exports of cattle to GB for direct slaughter totalled 1,180 head during November 2013 and consisted of 886 prime cattle and 294 cows.

The number of beef cattle on the ground (beef sired and dairy males) between 12 and 30 months in November 2013 was 399,590 head. This is slightly down on November 2012 when 401,858 beef cattle were recorded. The number of beef sired cattle on the ground was back one per cent to 352,741 head in November 2013 while the number of dairy sired males increased by three per cent to 46,849 head.

Calf registrations have also recorded a decline year on year. In November 2013 14,305 beef sired calves and 9,237 male dairy calves were registered compared to 16,061 beef sired calves and 9,892 male dairy calves in November 2012. The combination of these account for a nine per cent reduction in calf registrations year on year which will have a knock on effect on beef supplies in the future.

TheCattleSite News Desk

.JPG)