Another Look at the Feedlot Sector…

US - Last month the USDA released the March Cattle on Feed report. The only real surprise in the report was that February placements were estimated to be lower than anticipated, writes Glynn T. Tonsor, Associate Professor, Department of Agricultural Economics, Kansas State University.It is critical to not lose sight of the widely accepted notion that feeder cattle supplies are “drying up” and how this influences placements. Perhaps the pre-report estimates simply underestimated this point.

That being said, given an available feeder cattle supply economists generally view feedlot operators as forward-looking (assessing expected profit and expected variability of profit) decision makers that examine the situation of potential placements before making final decisions.

It is also prudent to take note of recent experiences in how profitability expectations may have not been met as these experiences could spillover into more current placement decisions as reflected in Friday’s report.

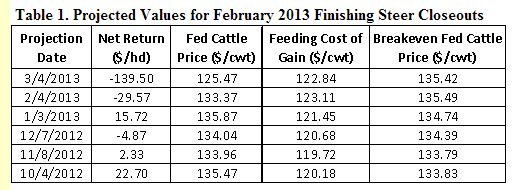

To provide context on this recent divergence in expectations and realized profit outcomes one can compare projections Dr. Kevin Dhuyvetter and I have been posting for February 2013 closeouts over the past several months (see table 1).[1] The projected returns for steers sold in February were first made on October 4, 2012. At that time, projected positive returns ($22.70/hd) reflected expected fed cattle prices of $135.47/cwt and a $120.18/cwt cost of gain.

As shown in table 1, some key projected values have changed over the past six months leading to significantly less profitable closeout values. Specifically, fed cattle prices projected for February closeouts fell by $10/cwt since the October 4th assessment.

The observation of breakeven fed cattle prices being relatively constant over these six months reflects feeder cattle prices being set at placement and limited cost of gain adjustments. This highlights that the decline in expected and realized fed cattle prices is largely responsible for the reduced returns.

This decline corresponds with well noted concerns about beef demand strength and industry frustrations regarding the inability to realize and sustain higher boxed beef values.

While these projections best serve as a barometer of profitability and do not narrowly reflect the situation of any given operation, they do illustrate important points. This is yet another example of projections inherently being imprecise forecasts of future realized values.

While many stakeholders understandably desire more narrowly accurate forecasts, this reminder of the inherent variability in commodity prices and hence “less than perfect” nature of forecasts should be appreciated.

It is likely the worse than expected recent returns realized by feedyards has spilled over into less aggressive interest in placing additional cattle in February. The related question many industry analysts are asking is if these adjustments in placement interest are complete or if similar behavior will underlie next month’s Cattle on Feed report.

This is only one of multiple aspects of underlying structural changes at play in the feedlot sector. Given the direct relevance for feedlot operations and implications for stakeholders throughout the industry upcoming observations of feedlot placements will be continue to be closely watched.

Ultimately, diversity in the views and willingness to accept the underlying variability highlighted here will in large part drive the expand, maintain status quo, change focus, or exit decisions of individual operations at each industry level.

TheCattleSite News Desk