Global Supply Issues Lead to 34 per cent Jump in SMP Year-on-Year

GLOBAL - Supply contraction and strong demand in key export and import regions is strengthening the global dairy market, a Rabobank report has highlighted.The report states that weak US and EU demand is being offset by extremely strong Chinese purchasing on the global market.

Global dairy prices as tracked by Bord Bia show Dutch SMP and WMP for the week ending 20th March some 34 per cent and 17 per cent higher at €2,560 and €3,100 per tonne respectively, compared to the corresponding week last year.

Since the start of the year though, prices have increased more steadily, with SMP and WMP 24 per cent and 6 per cent higher, respectively.

Similarly on the French market, strong double digit growth is evident for SMP. In New Zealand, prices at the latest Fonterra GDT auction reached their highest level since June 2011.

The GDT index is now up almost 20 per cent so far this year, with the price of WMP in particular performing well.

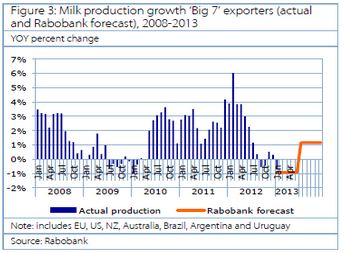

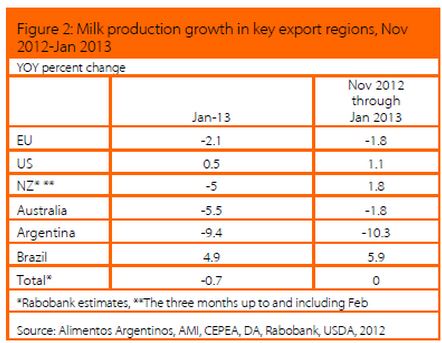

The latest projections from Rabobank suggest that the on-going supply contraction in key surplus regions and incremental demand for product in import regions should result in a tight international market for the coming months.

Rabobank expect EU and US supplies to back by almost 0.7 per cent and 0.4 per cent , respectively, in the 1st half of 2013.

The impact of drought conditions in the North Island of New Zealand where around 61 per cent of milk is produced are expected to become evident as we approach quarter three with Rabobank projections suggesting a drop of 15-20 per cent , as farmers dry cows off earlier than normal.

Drought is also expected to have some downward pressure on Australian production for 2013, although the latest evidence suggests that 1st half of 2013 will be 0.7 per cent higher.

Elsewhere, Brazilian output is forecast to increase by 1 per cent to 2 per cent in the first half of 2013 on the back of a small milk price rise, softening feed costs, and more favourable weather conditions.

There are no signs a recovery in Argentinean milk supplies with production in the first two months of 2013 down 10 per cent . Rabobank expect this trend to continue throughout 2013, given on-going cost issues and the failure of expected investment in drying capacity to materialise.

TheCattleSite News Desk