The Tricks to Defining Beef Demand

US - Beef demand across consumers is a complex issue with perish-ability, income and availability of other meats dictating possible values, according to John Michael Riley, Asst. Extension Professor Department of Agricultural Economics, Mississippi State University.To take you back to Economics 10, two primary forces affect price: supply and demand. Last week, Dr. Anderson highlighted the adjustments to beef and competing meat supplies from the recent supply and demand report. So much discussion lately has revolved around shrinking beef and cattle supplies.

Even with the increased beef production there is little doubt the supplies have shrunk and will likely continue to shrink moving forward. These tight supplies would translate to higher prices if everything else remained unchanged.

We economists like to sound fancy by using the Latin phrase “ceteris paribus”, which translates to “with other things the same.” Scientists are able to create this environment with trials and therefore can isolate the effect of, say, inputs A or B on output. There are so many moving parts in an economy that pinpointing the cause of price movements with precision is extremely difficult.

A great example of this phenomenon is the start of 2013. As the authors of this publication and others have pointed out “all else” has not remained the same and beef demand has been under pressure. This is a fairly recent outcome given that demand did show strength in 2011 and 2012. Therefore, it is appropriate to highlight the factors currently shaping beef demand but first to discuss what beef demand is not (using an updated adaptation of remarks from Schroeder, Marsh and Mintert.

First, beef demand IS NOT simply consumption (or per capita consumption). Beef is a perishable product. Given the long production lag for cattle, each year the production, i.e. production, of beef is fixed. Outside of some minor shifts in frozen supplies of beef or beef leaving and coming into the United States (which have been roughly equal since 2010), each year the amount of beef consumed is roughly equal to the amount of beef produced. Therefore, the reports that show shrinking consumption per person are completely acceptable since the total available supply of beef has been declining and the population is growing.

Beef demand IS NOT the percentage of beef consumed relative to other competing meats like pork or poultry. These products are perishable too and thus their proportion of total meat consumption will fluctuate as their supplies increase or decrease. For example, if one billion pounds of beef, pork, and poultry are produced this year then the ‘average’ person will consume 33.3 per cent of each product.

If poultry production were to increase to 1.5 billion pounds and beef and pork remained at one billion, then the average individual’s meat consumption would consist of 43 per cent poultry and 29 per cent each to beef and pork. This does not indicate that beef and pork demand declined from 33.3 per cent to 29 per cent nor did poultry demand increase from 33.3 per cent to 43 per cent, it is simply a case where more poultry was available.

Finally, beef demand IS NOT the percentage of income that consumers devote to beef purchases. This concept is a bit trickier since income does affect demand, but the proportion of consumer spending for products is not directly indicative of demand changes. On the other hand, if a consumer’s income were to increase 10 per cent, which resulted in an increase of purchases for beef, then demand for beef has gone up.

So, what are the leading culprits to the recent decline in beef prices? The predominant factor is the loss of the income tax break for social security (6.2 per cent of pay is now being deducted compared to 4.2 per cent last year). Using the median household income in 2011 of $50,054 as a gauge for current levels, this results in a $1,001 decrease from the family budget or about $83 per month.

While this may not sound like a substantial decrease when carried across all households it does add up. A second factor is that the costs of other items in the family budget are increasing. Gasoline prices, for example, increased 7 per cent in the first month of 2013. Most families cannot make sweeping changes to their driving habits, while they can more easily alter their purchases at the meat case. Finally, the flu epidemic in the U.S. and the brutal winter storm in the Northeast impeded beef consumption.

In the strictest economic definition, only the drop in take-home pay is a true decrease in beef demand. The increase in fuel and other necessary products and the flu issue have resulted in potential lost beef consumption. To be more specific, similar to the short-term impact of hurricane Sandy in October and November of last year, displaced consumption has caused a short-term build up of current supplies. This will likely be reflected in upcoming Cold Storage reports.

Still, this lowers prices in the short term since suppliers cut prices in an attempt to move their inventory. The decrease in take-home pay is a longer-term issue and is directly attributable to decreased beef demand.

The price of beef coming into 2013 left some consumers priced out of the market. Since, as noted earlier, the amount of beef produced must equal the amount consumed given that beef is perishable this has forced the price of beef lower via a decrease in beef demand.

In the Markets

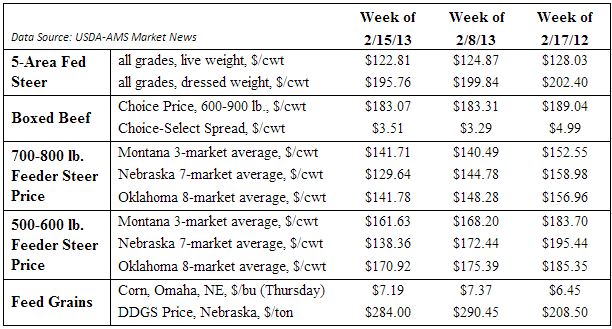

Cash fed prices were lower this week. Prices on a live basis were down about $2 per hundredweight across the major feeding regions and dressed prices were reported lower by $2 per hundredweight in Nebraska.

Wholesale boxed beef prices were marginally lower this week with Choice carcasses finishing with a weekly average of $183.07 per hundredweight, down $0.24.

Oklahoma feeder steers were $4-$8 per hundredweight lower and steer calves were $3-$7 lower.

Corn prices held mostly steady losing 3 cents per bushel to close at $7.40 in Omaha.

TheCattleSite News Desk