November Beef Exports Trail 2018

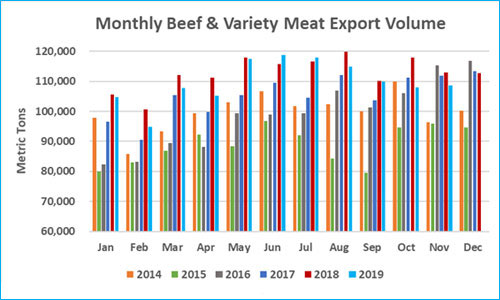

US - November exports of US beef were below the previous year’s large totals, according to data released by USDA and compiled by the USMEF.

November beef exports totaled 108,662 mt, down 4 percent from a year ago, valued at $658.1 million (down 7 percent). For January through November, beef exports trailed 2018’s record pace by 3 percent in both volume (1.21 million mt) and value ($7.4 billion). However, 2019 is already the second-highest year for beef export value, trailing only the 2018 record of $8.33 billion.

Beef export value per head of fed slaughter was $307.55 in November, down 15 percent from a year ago. Through November, per-head export value averaged $308.74, down 4 percent. November exports accounted for 13.7 percent of total beef production and 11 percent for muscle cuts only, down from 14.1 percent and 11.8 percent, respectively, a year ago. For January through November, exports accounted for 14.1 percent of total beef production and 11.4 percent for muscle cuts, down from 14.5 percent and 12 percent, respectively, a year ago.

Beef exports to Korea, Taiwan headed for new records

Although November beef exports to South Korea were lower than a year ago in volume (19,116 mt, down 5 percent) and value ($139 million, down 11 percent), the market remained on pace to break the 2018 records.

Through November, exports to Korea were up 6 percent in both volume (234,310 mt) and value ($1.69 billion). US share of Korea’s chilled beef imports reached 62 percent, up from 58 percent in 2018.

US beef accounted for 51 percent of Korea’s total beef and beef variety meat imports and more than one-third of Korea’s total beef consumption.

Beef exports to Taiwan will be record-large for the fourth consecutive year in 2019. November exports were 4,869 mt (up 8 percent from a year ago) valued at $43 million (up 7 percent). This pushed January-November results 8 percent ahead of the previous year’s pace at 57,837 mt, valued at $513.3 million (up 4 percent).

The gains in Korea and Taiwan have been offset by a decline in Japan, which is still the largest destination for US beef exports but one in which the US industry has faced a steep tariff rate disadvantage compared to imports from Australia, New Zealand, Canada and Mexico.

Through November, exports to Japan were down 6 percent from a year ago in volume (287,090 mt) and dropped 7 percent in value ($1.8 billion). But on 1 January, US beef gained tariff relief in Japan that brings rates in line with key competitors, so the outlook is very positive for 2020.

"The Japanese market performed extremely well for US beef in 2018, even though we were already facing a tariff rate disadvantage versus Australia," USMEF President and CEO Dan Halstrom explained.

"More competitors saw tariff rate cuts in 2019 under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which further tilted the playing field against US beef. For example, Canada’s beef exports to Japan increased 57 percent last year.

"So the rate cuts Japan recently implemented for US beef are long overdue, and USMEF is working aggressively with US exporters and the Japanese trade to capitalize."

January-November highlights for US beef exports include:

- In Mexico, the third-largest market for US beef behind Japan and Korea, exports increased 4 percent from a year ago in value to just over $1 billion despite a 2 percent decline in volume (214,963 mt). This was largely due to a strong value increase for tripe, one of the top US beef variety meat export items to Mexico. Variety meat exports were up 2 percent year-over-year in volume (89,667 mt) but jumped an impressive 18 percent in value to $244.5 million. This included $88 million in tripe exports, up 28 percent.

- Led by strong demand in Indonesia and steady growth in the Philippines, beef exports to the ASEAN region increased 23 percent from a year ago in volume (55,583 mt) and were 7 percent higher in value ($270.6 million).

- Exports to the Dominican Republic already surpassed the 2018 record, increasing 24 percent in volume to 7,523 mt valued at $61.4 million (up 19 percent).

- In Central America, strong demand in Guatemala and Panama helped push exports 4 percent higher than a year ago in volume (14,044 mt) and 9 percent higher in value ($79.9 million). Export value to Guatemala and Panama jumped 9 percent and 25 percent, respectively.

- Mexico and Japan have led a very strong year for global exports of US beef variety meat, which were up 4 percent from a year ago in volume (295,527 mt) and 9 percent higher in value ($885.9 million). Exports to Japan, which largely consist of tongues and skirts, were up 20 percent from a year ago to 58,278 mt, valued at $355.5 million (up 13 percent). Egypt, the largest destination for US beef livers, saw a 4 percent increase in volume (59,203 mt) while export value climbed 17 percent to $69 million. Led by strong demand in Indonesia, variety meat exports to the ASEAN increased 39 percent in volume (16,595 mt) and 43 percent in value ($37.3 million). Strong growth in the Dominican Republic and Trinidad and Tobago pushed variety meat exports to the Caribbean 17 percent higher in volume (6,814 mt) while value surged 61 percent to $14.2 million.

TheCattleSite News Desk