CME: Smaller Feedlots Back in the Game

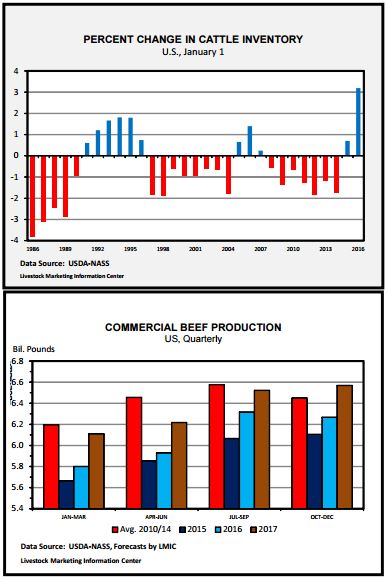

US - The recent USDA Cattle report showed total US inventory of all cattle and calves (beef-type and dairy), both on farms/ranchers and in feedlots as of January 1, 2016 totalled 92.0 million head, up 3 per cent year-over-year.Importantly, USDA lowered their prior estimates including dropping the size of the 2014 calf crop. The US cattle herd, beef cow count, and the number of heifers being retained for breeding purposes all grew significantly.

One of the aspects of the report is that it provides the best survey-based assessment of the total number of cattle on-feed in the US. Remember, the monthly Cattle on Feed report includes only feedlots that have 1000 head or more capacity.

The monthly report showed as of January 1, 2016 that there were 10.6 million head in those surveyed feedlots, slightly fewer animals than a year ago (down 0.5 per cent). In contrast, the annual Cattle report gave a total feedlot inventory of 13.2 million head, 1.2 per cent above 2015’s.

The implication is that the smaller feedlots (those under 1000 head capacity and often referred to as “farmer feeders”) after tending to become less-and-less interested in feeding cattle during most recent years jumped back into the game during 2015.

The proportion of animals in the larger feedlots actually was below 2015’s as of January 1st of this year, cattle on-feed in 1000 head and larger capacity lots as of January 1, 2016 was 80.2 per cent of all animals on-feed, down about 1 per cent from a year ago.

Factors that likely contributed to renewed interest by farmer feeders included lower corn prices and growing trend in urban areas for sourcing locally raised food.

Based on recent cattle industry reports from USDA-NASS, what does the balance of 2016 and 2017 seem to hold in terms of US beef production?

A larger calf crop was produced in 2015 (up 780,000 head or 2.3 per cent above 2014’s and the largest since 2011). An even larger calf crop will be produced in 2016.

Those numbers suggest that steer and heifer slaughter numbers will clearly be posting year-over-year increases, with the largest percentage increases during 2016 occurring in the second half of the calendar year.

Besides steers and heifers processed into beef, an important source for US beef tonnage comes from cull cows slaughtered. The Livestock Marketing Information Center (LMIC) forecasts year-over-year increases in US Federally Inspected cow slaughter in both 2016 and 2017.

However, levels of cow slaughter are forecast to remain below the drought-induced huge levels posted annually from 2007 into 2014.

So, without another severe US drought, the increase in beef produced from steers and heifer slaughter is expected to be much larger than beef from cows.

For example, in 2016, steer and heifer slaughter could increase 3 per cent to 4 per cent compared to 2015’s, while the number of cows processed rises by 2 per cent to 3 per cent.

Given the biological time lags between calf crops and increases in beef production, forecast cow slaughter levels, and forecast dressed weights; US beef production in 2016 is estimated to be 2 per cent to 4 per cent above 2015’s.

In 2017, output could grow in the range of another 4 per cent to 5 per cent year-over-year. Still, LMIC expects US beef production in 2017 to be at to slightly below 2013’s. That is important context.

TheCattleSite News Desk