The Stumbling Steps of a Brazilian Beef Giant

Two years ago, the Brazilian beef giant had asserted its market dominance worldwide. In spite of mounting concern it seemed destined to crush struggling industries on its Westbound path, but then the unthinkable happened, writes Adam Anson, reporting for TheCattleSite.On Wednesday the 30th of January 2008, EU Health Commissioner, Markos Kyprianou, imposed a temporary ban on almost all Brazilian beef imports. The ban was announced due to controversy over where exactly the beef was being sourced, believed by many to have leaked from areas ravaged by Foot and Mouth Disease.

After an agressive campaign led by the Irish Farmers Association, the EU Commission said that it was necessary to increase the restrictions on Brazilian beef imports in order to maintain a high level of protection for animal health in the EU. Although avoiding an outright ban, the restrictions stopped imports from an estimated 97 per cent of Brazilian beef units. Whatever the intention of lobbyists, Europe had successfully strangled the South American threat.

Now, over a year later, the repercussions of this ban are shaking the Brazilian giant at its foundations. Added to which, comes the market force of the global recession, drastically affecting liquidity in the financial markets. If it hasn't fallen yet, the Brazilian beef giant is certainly beginning to buckle.

As the saying goes - the larger they are, the harder they fall. Recently Independência - the third largest meat processor in the country - filed for protection from creditors under the local equivalent of the US Chapter 11 bankruptcy law. According to local Brazilian reports, the company has halted slaughtering operations at all 11 of its plants.

The company announced that the global reduction in liquidity had seen financial deals cancelled. It has also been hit by a reduction in short term financing to 30 days and an increase in financing costs, whilst a devaluation of the Brazilian Real increased debt. But Independência are not alone in this tragedy. Their downfall merely serves as an indication of the wider problems that are affecting the whole industry.

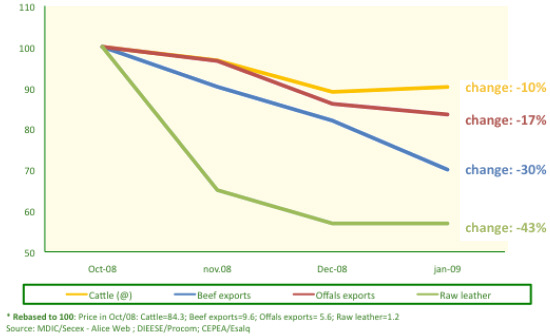

Price Evolution (R$/Kg)

An Independência report showed how the shifting new market shaped a disatrous climax for Brazilian processors. Cattle prices peaked in October and November of 2008 resulting in a super valued inventory. By December the volumes in the domestic market had increased, but the traditional increase of prices did not take place. Meanwhile, an increase of domestic beef supply was verified, due to a reduction of export opportunity. This resulted with beef prices falling more than cattle prices.

"In January, export prices and volumes decreased disastrously", says the report. "Due to the cattle prices level, the exports income was negative, even with the Brazilian Real devaluation." The strong competition between the exporting slaughterhouses in the local market then pressured down the in-bone beef prices in supermarkets, not covering the costs of production.

The problems behind this situation arose because the export volumes dropped by almost three times the reduction in slaughter volume - by 34 per cent compared to 12 per cent. The massive pre-contracted oversupply of beef was then allowed to flood the poorly valued domestic market.

Not only were European markets closed to Brazilian beef throughout this time, but the remaining markets also began to shut. Between September 2008 and January 2009, Brazilian beef exports to Russia - where 37 per cent of overall Brazilian beef exports were destined - dropped from 50.3 thousand tonnes to 16.3, signifying a minus 68 per cent growth. Over the same period, Brazilian beef exports to Iran were at minus 59 per cent, Israel; minus 64 per cent and Ukraine; minus 95 per cent.

The Independência report also examined the impacts of the global financial crisis, which have led to a reduction of liquidity and pressure on the working capital. The report attributed falling liquidity on a lack of external line offers; cancellation of some limits coupled with the none renewal of existing ones; the consolidation of banks and a reduction of limits due to the BR Real devaluation. Reduced payment periods led to a concentration of maturities every month and increased pressure over renewal negotiations. Debt increased as the Real fell. Subsequently impacting the debt service and operational flow, resulting in the cancellation of refinancing transactions.

Late January 2009, the Brazilian Beef Industry and Exporters Association (Abiec) announced that Brazilian beef exports dropped to US$ 255.68 million for that month - 45 per cent less than in January 2008. In terms of volume, sales in January totalled 81,810 tonnes, a reduction of 34 per cent.

Yet despite the negative result, the Abiec director pointed out the return to purchases by some important clients. According to Meat and Livestock Australia (MLA), the Brazilian industry is expecting a positive outcome of the EU veterinary inspection performed recently on the Brazilian Cattle Traceability System (SISBOV).

A final report is expected to be released during March, but the EU Directorate of Animal Health said that no major flaws in the system were found. In addition, the directorate expects an average of 100 Brazilian farms to be approved by authorities on a monthly basis during 2009. Brazil currently has around 1,000 establishments approved by the EU, which represent roughly 200,000 animals of the total 970,000 head registered in SISBOV.

Whilst it is not expected that Brazil will be able to return to pre ban volumes to the EU in 2009, there is great hope for the future. The National Agriculture Confederation aims to increase the number of states approved to the EU (Brazil’s highest value market) from 8 to 16 – all of which are recognised by the World Organisation for Animal Health as foot and mouth disease free with vaccination.

Meanwhile Farming UK reported that the Brazilian beef industry has developed a new micro chip that will be implanted into calves at birth, giving the full history and trace-ability from birth to point of slaughter. The revolutionary device that was developed by Ceitic Semiconductor Systems, along with the Ministry of Science and Technology of Brazil, will be placed into one million calves this year.

Whilst the industry has certainly stumbled on recent, unforseen events, it seems that it is beginning to find its feet once more. With such huge potential for cheap quality products its eventual recovery can never really be in doubt. The question that really beckons for the rest of the global industry is how big Brazilian beef will be on its return, and how far its shadow will fall.

March 2009