Australia Dairy and Products Annual 2008

Australian production of fluid milk for 2008/09 is forecast to increase by approximately two percent to 9,700 TMT, reports USDA, Foreign Agricultural Service. A link to the full report is also provided. The full report includes all the tabular data which we have omitted from this article.Report Highlights:

Improved seasonal conditions and fodder and grain supplies are likely to allow the Australian dairy herd to expand by four percent. Despite recent improvements, irrigation water allocations are expected to remain at historically low levels and this is expected to constrain larger increases in production. Post has increased its forecast for production of cheese, butter and milk powders in line with forecast increases in fluid milk production. Exports of these commodities are also expected to increase.

Situation and Outlook

Summary

Seasonal conditions experienced in the first quarter of 2008/09 represent a marked improvement over those experienced in the same period for the previous year. Widespread rain through south eastern Australia has seen the production conditions for dairy improve markedly. At the time of writing this report, pasture conditions for key dairy areas range from average to above average and post anticipates good conditions for fodder production over the up coming summer.

Winter cereal crop production is forecast to improve markedly compared to last year with wheat production forecast to reach its highest level in three years and follows a record sorghum harvest. Cotton and oilseed production is also forecast to improve significantly likely causing an increase in production of vital byproducts for use in feed rations.

Post expects the Australian dairy herd to expand somewhat during 2008/09 although this expansion will be constrained by the availability of suitable livestock, following years of drought and herd reduction. Prices paid for dairy cows have recently reached record levels according to rural media reports and this is seen as evidence that the industry is expanding.

Post advises that any increase in production will be incremental and sees a sharp increase in production as highly unlikely. Continued low levels of irrigation water allocations and other residual effects of severe and long running drought will likely require a number of years before production will reach levels experienced prior to the drought which began in CY 2002.

A recent ABARE report stated that dairy returns are likely to improve over 2008/09. However, commodity prices have since fallen sharply due to the current economic uncertainty being experienced around the world. Post advises that the value of the Australian dollar has declined sharply also, and this has largely insulated Australia from the fall in commodity prices. Similar falls in fuel and fertilizer prices (farm gate) would also improve farm returns, although this remains to be seen.

Narrative on Supply and Demand, Policy & Marketing

Fluid Milk Production

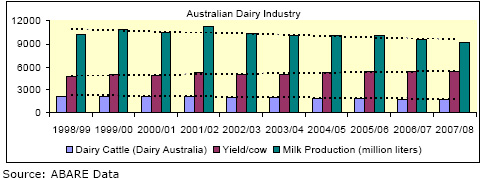

Fluid milk production for 2008/09 is forecast at 9,700 TMT, or around 9.42 billion liters using a conversion factor of 1.03. This forecast increase in production represents a two percent increase over the previous year. Despite this forecast increase however, production of this level, if achieved, would remain well below the levels prior to the commencement of the drought in 2002/03. The record for Australian dairy production remains at 11,600 TMT (11.27 billion liters) achieved in 2001/02.

A forecast four percent increase in cow numbers for 2008/09 is the primary driver for increased fluid milk production in 2008/09. Reports suggest prices paid for dairy cows have reached record or near-record levels and post sees this as evidence the industry is beginning to expand following years of drought and high feed prices.

Post has allowed for a small decline in yield per cow for 2008/09 due to the influx of younger cows. Post advises that above average seasonal conditions, if experienced, could see yield per cow improve somewhat.

Going forward, irrigation water supplies are likely to remain at historically low levels in most parts of the nation, despite recent increases in allocations. Recent travel throughout the Snowy Mountains, one of the most important irrigation water catchments in south eastern Australia, revealed a long term and fundamental decline in irrigation water reserves. Some sources believe that it may take more than a decade for these storages to fully recharge following the longest running and most severe drought in Australia’s recorded history.

In making these forecasts, post has assumed average seasonal conditions for the remainder of 2008/09. Above average rainfall would likely see yield per cow improve beyond posts expectations, while below average rainfall would likely constrain an increase in cow numbers.

Cheese

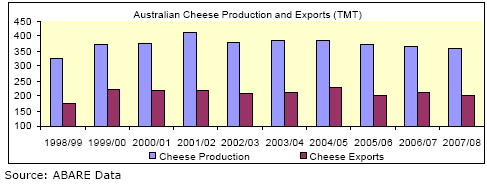

Cheese production for 2008/09 is forecast to increase around two percent to 350 TMT. This level of production would be considered to be slightly below average according to ABARE’s historic data.

The forecast increase in cheese production is largely in line with the forecast increase in fluid milk production. Post has assumed no change in butterfat production and has assumed average seasonal weather conditions.

Exports of cheese for 2008/09 are forecast at 206 TMT. This forecast represents an increase of around two percent which is largely in line with forecast increases in production. Post acknowledges the recent sharp fall in world dairy prices but also advises that these have been largely offset by a sharp decline in the value of the Australian dollar.

Total cheese imports are forecast to remain at historically high levels at 70 TMT, unchanged from the estimate for the previous year. Imports of cheese from the United States are forecast to decline somewhat due to the devaluation of the Australian dollar and increased in domestic production. Inquiry by post has revealed that the majority of US imports are used as “shredding cheese” in the food service sector.

Imports of cheese from the United States are a recent development for Australia. According to World Trade Atlas (WTA) data, Australia imported 6,718 MT of cheese from the US in 2007/08, up from just 51 MT in the previous year, making the US Australia’s second largest supplier of imported cheese. Despite this rapid increase, monthly data shows imports beginning to decline, and post believes that recent currency fluctuations and increased domestic production will likely constrain imports from the US to lower levels in 2008/09.

Butter

Total butter production for 2008/09 is forecast at 113 TMT, up around two percent on production for the previous year. Forecast increased supplies of fluid milk are likely to push production higher.

Monthly industry data shows butter production has strengthened in recent times and post believes this may signal an end to the long term decline of butter production vis-à-vis cheese production. Post has included butter oil as butter and advises that demand for this oil has been strengthened by demand for oils more general over the past few years.

Butter exports are forecast to also increase around two percent to 61 TMT, in line with increased production.

Whole Milk Powder

Production of whole milk powder for 2008/09 is forecast to increase to 128 TMT, up from the 125 TMT estimated for the previous year. Exports of whole milk powder are forecast at 113 TMT, up in line with production.

Skim Milk Powder

Production of Skim Milk Powder is forecast to increase to 181 TMT, in line with the forecast increase in fluid milk production. Exports are also forecast to increase to 123 TMT.

Further Reading

| - | You can view the full report by clicking here. |

List of Articles in this series

To view our complete list of Dairy and Products Annual, and Semi-Annual reports, please click hereNovember 2008