Canada Livestock and Products Semi Annual Report 2008

This article provides the cattle industry data from the USDA FAS Livestock and Products Semi-Annual 2008 report for Canada. A link to the full report is also provided. The full report includes all the tabular data, which we have omitted from this article.Report Highlights:

Canadian production of beef and pork is forecast to be lower during 2008. Livestock inventories are in decline reflecting high feed costs and low market prices. Canadian imports of beef and pork are increasing, bought on partially by a strengthening in the Canadian dollar to levels not seen in decades. Canadian red meat exports, on the other hand are forecast to struggle to reach last year’s levels given lower slaughter output and the competitive challenges in international markets related to the Canadian dollar’s rise.

Executive Summary

This report does not contain official USDA data

Note: The forecasts in this report are made under the policies in effect at the time of writing. U.S. Country of Origin Labeling (COOL) is scheduled to come into effect in September 2008. However, the USDA regulations associated with COOL are not yet known. COOL regulatory provisions may impact on U.S./Canadian trade in livestock and livestock products but analysis of the potential impact cannot be made in absence of the final COOL regulations, the basis on which U.S. packers and feeders may adjust their purchases of live livestock and meat from Canada.

- After peaking in mid-2005, Canada’s cattle inventory began 2008 with its third consecutive annual decline. According to Statistics Canada, cattle farmers reported 13.9 million head on their farms on January 1, 2008, down by 210,000 head, or 1.5%, from January 1, 2007. The level was only slightly more than the 13.5 million head cattle inventory at the beginning of 2003 before Canada’s initial detection of BSE.

- Lower beef production is forecast for 2008. Presently, post predicts the annual decline in total Canadian beef and veal output during 2008 to range between 6.0-7.0%.

- During 2007, U.S. exports of fresh and frozen beef and veal to Canada reached 75,880 MT (product weight) surpassing their pre-BSE level of 67,565 MT. Strong demand for U.S. beef in Canada is related to lower Canadian fed slaughter and a stronger Canadian dollar.

- Canadian beef exports have not recovered to their pre-BSE level. Fresh and frozen Canadian beef and veal exports have fallen annually since 2004 even as international market access began to improve after trading partners lifted, or partially lifted, BSE-related import control measures.

- Canadian hog inventories plunged during 2007 as a strong Canadian dollar and high feed costs challenged producers. According to the January 2008 Livestock Survey by Statistics Canada, there were 14.0 million hogs on farms 897,000 fewer than on the same date in 2007. This is down 6.0% from 2006 and is 2.4% lower than October 1, 2007.

- Given the poor profitability prospects for 2008, many industry analysts anticipate a continued reduction in the Canadian swine herd throughout 2008 and the exit from the industry of many smaller producers. In late February 2008, the Canadian government announced a C$50 million program to encourage producers to cull the national sow herd by 10%, or about 150,000 head.

- Pork production will fall in 2008 and Canadian pork exports are likely to struggle to maintain the levels of recent years. Ironically, as the profitability fortunes of Canadian hog producers decline, increased foodservice and retail demand for certain cuts of U.S. pork and the strong Canadian dollar has resulted in record imports of U.S. pork

- Canadian live hog exports to the United States reached 10.0 million head during 2007, a 14% increase from the previous year. Prospects for even stronger feed prices in 2008 combined with the outlook for continued weak hog market prices in Canada are expected to propel live hog exports to the United States to a new record level in 2008.

Cattle and Beef

Cattle Herd Continues Decline

After peaking in mid-2005, Canada’s cattle inventory began 2008 with its third consecutive annual decline. According to Statistics Canada, cattle farmers reported 13.9 million head on their farms on January 1, 2008, down by 210,000 head, or 1.5%, from January 1, 2007.The level was only slightly more than the 13.5 million head cattle inventory at the beginning of 2003 before Canada’s initial detection of BSE. The inventory soared after the discovery of the May 2003 BSE case reflecting lost access to international markets for cattle and beef but it has since dropped by almost 1.0 million head.

Beef Outlook

Lower beef production is forecast for 2008. Cattle on feeding operations as of January 1, 2008 fell 8.6% from a year earlier according to Statistics Canada and accounted for most of the year-to-year decline in total cattle numbers. By comparison, total beef cow numbers slipped less than 1.0% in the year ending January 1, 2008. The resulting reduction in the number of slaughter type animals combined with increased access to U.S. live cattle markets is expected to keep downward pressure on 2008 beef production in Canada. On November 19, 2007 the U.S. re-opened the border to Canadian cattle born after March 1, 1999 with the implementation of Minimal Risk Rule 2.

Presently, post predicts the annual decline in total Canadian beef and veal output during 2008 to range between 6.0-7.0%.

Consumption

Per Capita

The Canadian per capita consumption of beef and veal has remained flat over the past ten years. The 32.80 kg per person (carcass weight equivalent) during 2006 (the most recent official data by StatCan), is virtually unchanged from the 32.83 kg reported in 1997. Swings in per capita consumption over the ten year period have been relatively minor. Even though per capita beef and veal consumption has shown zero growth in 10 years, the good news for the Canadian beef industry is that per capita consumption remained relatively strong during a period when exports showed a BSE-related decline.

Cattle Market Prices

Alberta fed steer prices slipped moderately in January 2008 but many observers predict price strengthening related to a lower cattle inventory and steady demand from the domestic market. Prices are forecast to increase to the mid-$80.00 per hundredweight range by midyear.

Trade

Beef and Veal Imports

During 2007, U.S. exports of fresh and frozen beef and veal to Canada reached 75,880 MT (product weight) surpassing their pre-BSE level (67,565 MT). The development is significant in that it occurred during a period of near-record cattle slaughter in Canada due to the BSE-related backlog in Canadian cattle numbers. Strong demand for U.S. beef in Canada is related to the changes in the slaughter and beef marketing pattern in Canada that was profoundly disrupted by BSE and the strengthening Canadian dollar versus the U.S. dollar. Also, fed slaughter in Canada has trended lower and the increased purchasing power in Canada’s HRI sector, which prefers high quality U.S. beef (especially the higher end restaurant and hotels in Ontario), has resulted in increased purchases of U.S beef. As well, there is anecdotal evidence that the major foodservice companies are importing more U.S. beef. The trend is expected to continue throughout 2008.

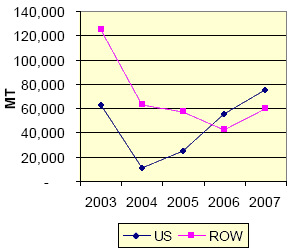

Following the detection of BSE in Alberta in 2003, the GOC moved to restrict the issuances of supplementary beef imports form non-NAFTA suppliers. The chart below illustrates Canadian beef imports for the five year period ending 2007. The recent spike from other suppliers in 2007 mostly reflects product imported from Uruguay.

Beef and Veal Exports

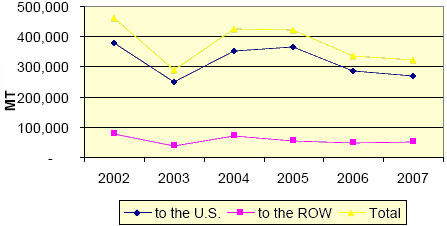

Canadian beef exports have not recovered to their pre-BSE level. As shown in the graph below, fresh and frozen Canadian beef and veal exports have fallen annually since 2004 even as international market access began to improve as trading partners lifted, or partially lifted, BSE-related import control measures. Total Canadian fresh and frozen beef and veal exports during 2007 slipped to 323,704 MT (product weight), 4.2% below the year earlier level and 30% below the 2002 level, the full calendar year prior to Canada’s detection of BSE in May 2003.

Outlook

With all of Canada’s major markets accepting or partially accepting Canadian beef under their BSE import measures, it would appear that any Canadian successes at lifting BSE-related restrictions in other markets would have only minor impact on total beef exports. For 2008, prospects do exist under MRR2 to export additional beef from older animals to the United States, but this prospective development could be significantly hindered by the increase in the value of the Canadian dollar, resulting in Canadian beef being less competitive in all markets. Present Post analysis is that total beef exports in 2008 will again fall below year earlier levels.

Policy

New Program Proposals for Livestock Farmers

On February 25, 2008 The Honourable Gerry Ritz, Minister of Agriculture and Agri-food introduced proposed amendments to the Agricultural Marketing Products Act (AMPA) which will give Canadian producers better access to cash advances. Proposed changes to the Advance Payments Program (APP) through the amendments to AMPA would provide Canadian producers access up to C$400,000 (up to C$100,000 interest-free) in repayable advances. Cash advances under the APP help producers with cash flow by giving them the flexibility to keep their products and sell them when market conditions are favorable. The collaboration of all political parties will be required in Parliament for passage of the AMPA amendments. The proposed changes to the APP will provide easier access to immediate cash flow by:

- Removing the requirement for livestock producers to use a Business Risk Management program such as AgriStability as security for a cash advance and allowing producers to use inventory as security. This brings the treatment of livestock more in line with other produced commodities.

- Adding "severe economic hardship" as a condition to offer emergency advances, on the recommendation of the Minister of Agriculture and Agri-Food and the Minister of Finance.

- Revising the security requirements for emergency advances and increasing the emergency advance available to producers from a maximum of $25,000 to $400,000 in conditions of severe economic hardship.

"We welcome this change as it will provide much needed cash flow to producers at a time when the current crisis across the country has reached a critical point," said Hugh Lynch- Staunton, President of the Canadian Cattlemen’s Association (CCA). "This improvement to the APA is consistent with (our) recommendation and will improve Canadian producers' ability to deal with their liquidity crisis.

Advances to hog producers will be based on the number of animals they expect to raise for sale for a 12 month period. The repayment period will start one year after the producer has received the advance and must be repaid within the production period to be determined under the Advance Payments Program. According to AAFC, when these program changes are implemented, producers will have access to C$3.3 billion in repayable advances. Taken together, program improvements made in December and proposed changes to AMPA represent significant changes to advance payments. If all livestock producers take full advantage of the program, an estimated $3.3 billion in repayable advances will be available. AAFC also announced a new C$50 million initiative with the Canadian Pork Council to deliver a sow cull program that will help restructure the industry to bring it in line with market realities (see Policy in Pork Section of this report). AAFC will review meat inspection user fees to assess their impact on competitiveness of the livestock sector. The government will work to reduce costs and increase competitiveness under Canada’s enhanced feed ban. This complements the federal government’s last year’s commitment of C$80 million to help the industry adjust to new feed standards.

U.S. Country of Origin Labeling (COOL)

Canada’s beef and pork industries are deeply concerned about U.S. Country of Origin Labeling legislation a provision of the U.S. Farm Bill which was postponed twice before but which is now scheduled to become effective by September 2008. Last year, Canada’s beef and pork industries formed the Canadian Livestock Producers Against COOL and issued a press release calling on the Canadian government to convince the US to repeal or substantially revise the mandatory COOL provisions of the U.S. Farm Bill. Beef and pork producers in Canada are concerned that the COOL provisions could cause U.S. packers and purveyors of meat to be required to segregate Canadian meat in the U.S. market resulting in a strong disincentive to import Canadian slaughter animals and meat. They believe that significant trade disruption could result in substantial economic loss for the Canadian livestock and meat industry and claim that Canada would be justified challenging COOL in its present form at the WTO and under NAFTA.

Market recovery post-BSE

Canada continues its attempts to regain access to world markets that were lost after the BSE case in may 2003. In May 2007, the World Organization for Animal Health, or commonly referred to as the OIE (for its French language acronym), granted Canada (and the U.S.) a “controlled” risk status for bovine spongiform encephalopathy (BSE). Hugh Lynch-Staunton, president of the Canadian Cattlemen's Association, told the Canadian Press that the Canadian cattle industry is hopeful that the OIE’s second-highest safety designation will translate into more (Canadian beef) exports. "It's a very significant step," said Lynch-Staunton. "It gives an independent, scientific assessment of the BSE situation in Canada," he said.

On February 25, 2008 Gerry Ritz, Minister of Agriculture and Agri-Food announced that Mexico will allow the resumption of the importation of Canadian breeding cattle, dairy or beef, under 30 months of age. Mexico banned imports of live Canadian cattle in May 2003 after the initial detection of BSE in Alberta. Mexico reopened the market for most Canadian beef that same summer, but has kept the border closed to Canadian cattle. Canadian products now approved for export to Mexico include beef derived from animals under 30 months of age and dairy and beef breeding cattle. At the same time, the Minister also said that Barbados, which had already opened its market to Canadian beef, would now accept a full range of breeding cattle.

Canada Confirms 12th BSE Case With Detection In Alberta

On February 26, 2008, the Canadian Food Inspection Agency (CFIA) confirmed bovine spongiform encephalopathy (BSE) in a six-year-old dairy cow from Alberta. The animal's carcass is under CFIA control, and no part of it entered the human food or animal feed systems. According to the CFIA, the age and location of the infected animal are consistent with previous cases detected in Canada and the new case will not affect Canada’s Controlled Risk country status, as recognized by the World Organization for Animal Health (OIE). Based on science, the CFIA says that it does not expect that the finding should impact access to any of Canada’s current international markets for cattle and beef. The CFIA reiterated that as Canada progresses toward the eradication of BSE, the periodic detection of a small number of cases is fully expected. It said that its BSE surveillance program, which targets the highest risk animals and regions, continues to benefit from very strong producer participation and that Canada’s animal and human health safeguards prevent potentially harmful cattle tissues from entering the human food and animal feed systems. The CFIA will conduct an epidemiological investigation directed by international guidelines to identify the animal’s herdmates at the time of birth and potential pathways by which it might have become infected. Once completed, a report on the investigation will be publicly released. Canada’s last case of BSE was detected in December, 2007.

Further Reading

| - | You can view the full report, including tables, by clicking here. |

List of Articles in this series

To view our complete list of Livestock and Products Annual, and Semi-Annual reports, please click hereFebruary 2008